UK HMRC VAT431C 2019 free printable template

Show details

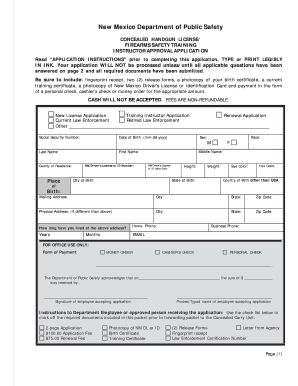

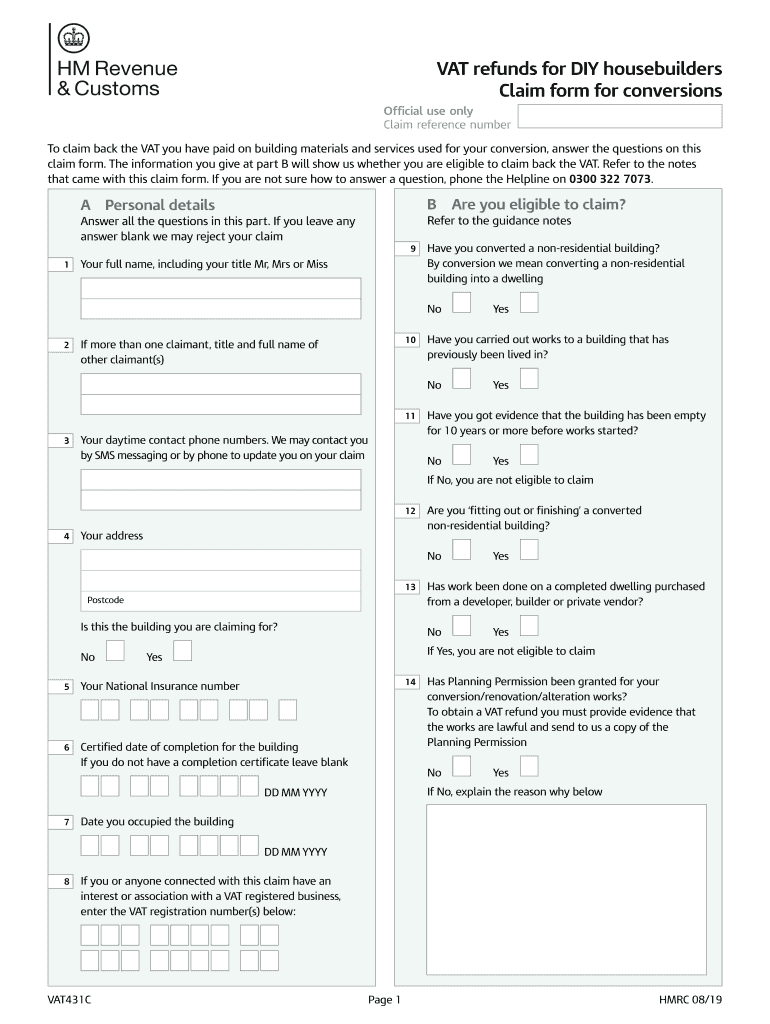

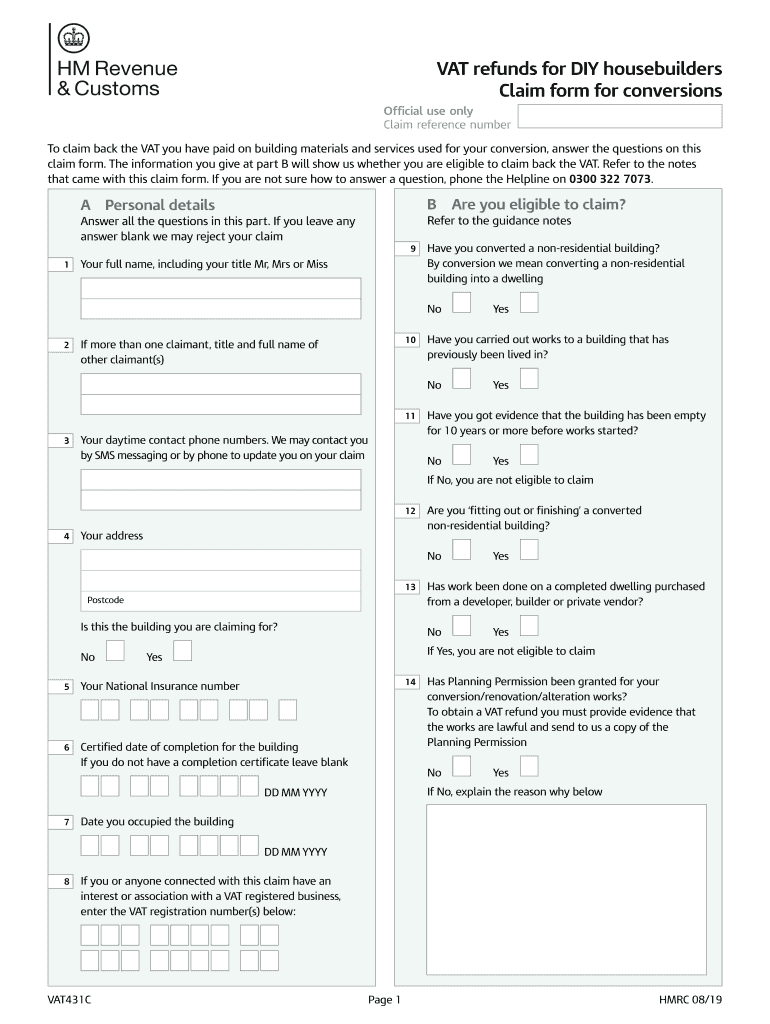

VATrefundsforDIYhousebuilders

Claimformforconversions

Officialuseonly

Claimreferencenumber

ToclaimbacktheVATyouhavepaidonbuildingmaterialsandservicesusedforyourconversion, answerthequestionsonthis

claim

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC VAT431C

Edit your UK HMRC VAT431C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC VAT431C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC VAT431C online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK HMRC VAT431C. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC VAT431C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC VAT431C

How to fill out UK HMRC VAT431C

01

Gather your financial records including total sales and purchases.

02

Access the HMRC online portal or obtain a paper form for VAT431C.

03

Fill in the VAT registration number at the top of the form.

04

Indicate the relevant accounting period for which you are submitting the form.

05

Enter the total sales and purchases figures in the appropriate sections.

06

Calculate the input and output VAT amounts based on your sales and purchases.

07

Complete any additional sections that apply, such as zero-rated sales or exports.

08

Review the completed form for accuracy before submission.

09

Submit the form electronically if using the online portal or send by post as required.

Who needs UK HMRC VAT431C?

01

Businesses in the UK that are registered for VAT and need to reclaim VAT paid on their purchases or report their VAT liability.

Fill

form

: Try Risk Free

People Also Ask about

Can I claim VAT back on a house extension?

Not all self-build projects are eligible for a VAT refund. You can only reclaim VAT if you're building a new home that's a dwelling in its own right — extensions or annexes to existing homes don't count.

What items can you claim VAT back on?

Examples may be office supplies, computers and equipment, travel and transport costs and services like accountancy. They can all have VAT reclaimed if they were bought for use only in business activities. For other expenses, such as mobile phone bills, part of the cost may have been incurred for non-business use.

What is non recoverable VAT UK?

Irrecoverable VAT refers to Value-Added Tax that cannot be recovered because the buyer purchased items for a non-business related activities. This includes but is not limited to: Gifts for customers, anything for private use.

What is the DIY housebuilders scheme?

The DIY Housebuilders scheme is designed to put private housebuilders in a similar position to residential property developers. It allows private persons to claim back VAT on the cost of building materials when constructing their own homes.

Can you claim VAT back on everything?

You cannot reclaim VAT for: anything that's only for personal use. goods and services your business uses to make VAT -exempt supplies.

Can you claim all VAT back?

If you're registered for VAT, you can claim that back. You do this by reporting how much VAT you paid during a period of time. HMRC balances the amount you've paid against the VAT you've collected to work out your refund or bill (learn more in working out your VAT).

Can you claim VAT back on residential property?

As far as residential lettings are concerned, they are always considered exempt from VAT and you will never see VAT added to residential rents. That means you can also never reclaim VAT on expenses incurred in conducting your property rental 'business'.

Can you claim VAT back on a washing machine?

You're restricted from recovering VAT on things like refrigerators, washing machines, dishwashers, and so on. In addition, the treatment of flooring is quite important. You're not entitled to recover VAT on carpets, but if you lay down a hardwood floor, that VAT is recoverable.

What VAT can you not reclaim?

What VAT can you not reclaim? You cannot reclaim VAT on the following costs even if you are registered for VAT and make only taxable supplies: food, drink or other personal services for yourself, your agents or employees. The exception being to the extent that they are part of a taxable supply of services.

Can I claim VAT back on goods?

You can only reclaim VAT on purchases for the business now registered for VAT . They must relate to your 'business purpose'. This means they must relate to VAT taxable goods or services that you supply.

How do I reclaim VAT on house renovation UK?

Fill in form 431NB to claim a VAT refund on a new build, or form 431C to claim for a conversion. You can only claim a VAT refund once. You must claim within 3 months of the building work being completed. Send your claim form to HM Revenue and Customs ( HMRC ).

How do I apply for reduced VAT on renovations?

In order to apply the 5% rate to building works, the supplier will need to obtain proof that they have applied the 5% rate correctly. In most cases, however, a certificate is not required, but in order to keep HMRC happy evidence to support the application of the lower rate is required.

Can you claim VAT back on a dishwasher?

No, it's quite clear, you cannot claim for the integrated appliances. As you have already pointed out you can claim the VAT back on the extractor.

Can you claim back VAT on house renovations?

How do I claim a VAT refund on building work? For VAT registered businesses, VAT refunds operate in the same way for building projects as they do for other business activities. For VAT refunds for self-build DIY projects, you need to return the appropriate form to HMRC within 3 months of completing the project.

What is the VAT rate for home improvements UK?

VAT for most work on houses and flats by builders and similar trades like plumbers, plasterers and carpenters is charged at the standard rate of 20% - but there are some exceptions.

Can you claim VAT back on house renovation UK?

Fill in form 431NB to claim a VAT refund on a new build, or form 431C to claim for a conversion. You can only claim a VAT refund once. You must claim within 3 months of the building work being completed. Send your claim form to HM Revenue and Customs ( HMRC ).

How do I claim VAT back on a new build in Northern Ireland?

Fill in form 431NB to claim a VAT refund on a new build, or form 431C to claim for a conversion. You can only claim a VAT refund once. You must claim within 3 months of the building work being completed. Send your claim form to HM Revenue and Customs ( HMRC ).

What is DIY scheme?

What is the DIY Housebuilder Scheme? The scheme puts DIY housebuilders in a similar VAT position to a person who buys a zero-rated house built by a property developer. It enables DIY housebuilders and converters to reclaim VAT in specific types of building projects.

What VAT can I claim back?

You can reclaim VAT paid on goods or services bought before you registered for VAT if you bought them within: 4 years for goods you still have or goods that were used to make other goods you still have. 6 months for services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get UK HMRC VAT431C?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the UK HMRC VAT431C in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in UK HMRC VAT431C?

With pdfFiller, the editing process is straightforward. Open your UK HMRC VAT431C in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit UK HMRC VAT431C on an Android device?

The pdfFiller app for Android allows you to edit PDF files like UK HMRC VAT431C. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is UK HMRC VAT431C?

UK HMRC VAT431C is a form used by businesses registered for Value Added Tax (VAT) to apply for a VAT refund from Customs.

Who is required to file UK HMRC VAT431C?

Businesses that are not established in the UK and are seeking to claim back VAT incurred on purchases made in the UK are required to file UK HMRC VAT431C.

How to fill out UK HMRC VAT431C?

To fill out UK HMRC VAT431C, businesses need to provide details such as their contact information, the VAT paid on purchases, and evidence of the taxable supplies received.

What is the purpose of UK HMRC VAT431C?

The purpose of UK HMRC VAT431C is to enable eligible businesses to claim a refund of the VAT they have paid on goods and services purchased in the UK.

What information must be reported on UK HMRC VAT431C?

Information that must be reported on UK HMRC VAT431C includes the business name, address, VAT registration number, details of the VAT claimed, and supporting documentation for the claim.

Fill out your UK HMRC VAT431C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC vat431c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.