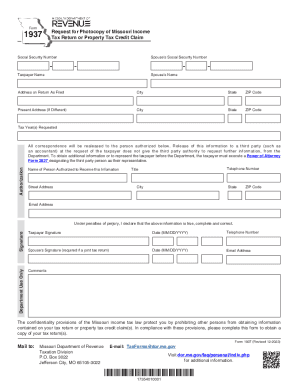

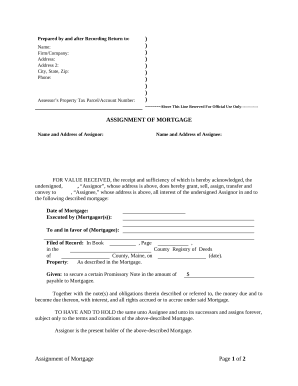

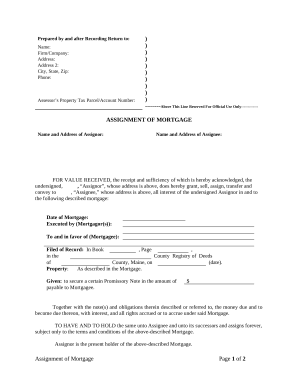

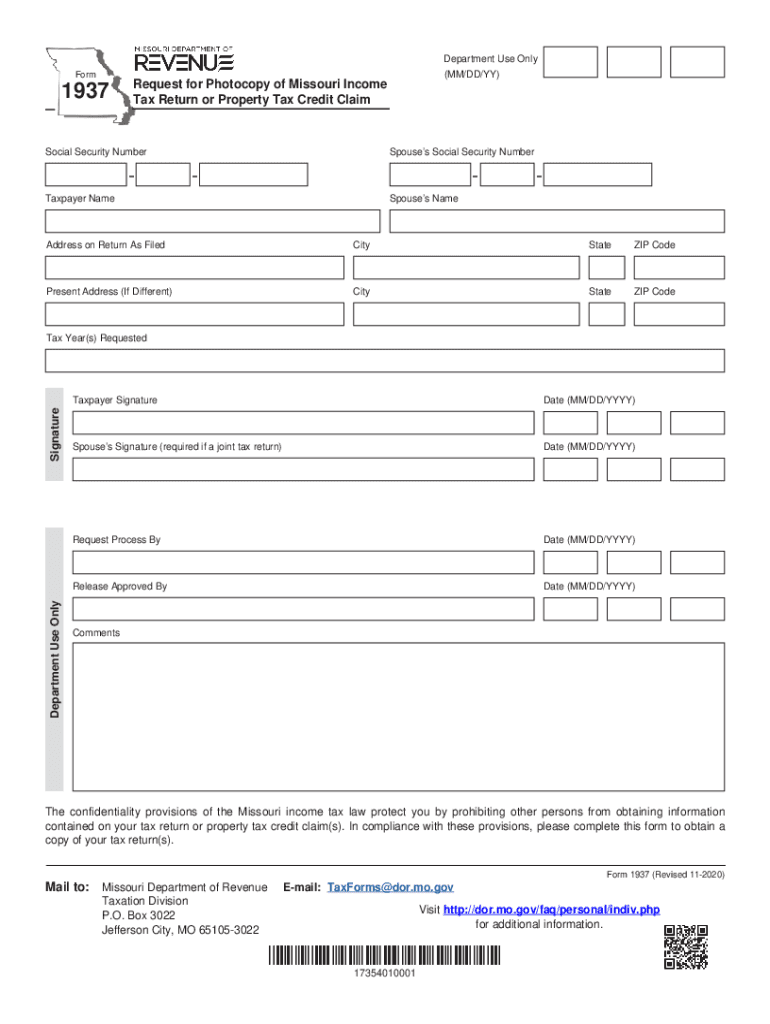

MO DoR 1937 2020 free printable template

Show details

Social Security Number Name of Spouse Taxpayer Name Address on Return As Filed City State Present Address If Different Zip Code Signature Tax Year Requested Date MM/DD/YYYY / / Spouse s Signature required if a joint tax return Request Processed By Release Approved By Department Use Only Comments Form 1937 Revised 08-2013 Mail to Missouri Department of Revenue Phone 573 751-5337 Taxation Division TTY 800 735-2966 P. Reset Form Form Print Form Missouri Department of Revenue Request for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR 1937

Edit your MO DoR 1937 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR 1937 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO DoR 1937 online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MO DoR 1937. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 1937 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR 1937

How to fill out MO DoR 1937

01

Begin by obtaining Form MO DoR 1937 from the official Missouri Department of Revenue website or your local revenue office.

02

Enter your personal information in the designated fields, including your name, address, and contact information.

03

Provide your Social Security Number or Business Identification Number as required.

04

Complete the financial sections, including details about your income, expenses, and any applicable deductions.

05

Review the instructions provided on the form for specific line item requirements.

06

Ensure all entries are accurate and legible to avoid processing delays.

07

Sign and date the form where indicated.

08

Attach any necessary supporting documents as specified in the form instructions.

09

Submit the completed form by mail or electronically, as directed, ensuring you keep copies for your records.

Who needs MO DoR 1937?

01

Individuals who are required to report Missouri income tax.

02

Business owners operating in Missouri who need to file income tax returns.

03

Anyone claiming specific deductions or credits associated with Missouri taxation.

Fill

form

: Try Risk Free

People Also Ask about

Can I download and print tax forms?

You can e-file directly to the IRS and download or print a copy of your tax return.

What is a MO ptc form?

To claim real estate taxes for a prior year, you must file a claim for that year. Example: If you paid your 2021 real estate tax in calendar year 2022, you must file a 2021 Property Tax Credit Claim (Form MO-PTC).

How far back can I file a MO PTC?

$29,200 if rented or owned less than full year; $34,000 if owned & occupied full year. The MO-PTC is generally filed with the income tax return, but may be filed at any time during the year for up to three years back. Example: In 2022 you may file for 2019, 2020 & 2021.

Where can I get tax forms in my area?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

How do I pay my Missouri sales tax online?

If you are a registered MyTax Missouri user, please log in to your account to file your return. If you are not a registered MyTax Missouri user, you can file and pay the following Business taxes online using a credit card or E-Check (electronic bank draft).

Does Missouri allow itemized deductions?

Missouri law requires a taxpayer to start with the federal itemized deductions reported on Schedule A of the federal return. If a taxpayer itemizes deductions on their federal return, they may itemize deductions for Missouri or take the standard deduction, whichever is to their advantage.

What tax form does a part year resident file in Mo?

Form MO-1040 is the only tax return that allows you to take a resident credit (Form MO-CR) or the Missouri income percentage (Form MO-NRI). Form MO-CR: Form MO-CR is used when a resident or part-year resident elects to take a credit (resident credit) for taxes paid to another state or political subdivision.

How do I pay my Missouri state taxes?

Paying Online The Missouri Department of Revenue accepts online payments — including extension and estimated tax payments — using a credit card or eCheck. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

What Missouri tax form do I use?

Missouri Form Mo-1040 Instructions.

How do I set up a Missouri Department of Revenue account?

Create a MyTax Missouri Account Please accept the MyTax Missouri usage terms to register for a portal account. You will need to provide your First and Last Name, Phone Number, and e-mail address to create a user ID for the Missouri Department of Revenue's MyTax Missouri.

How do I write a check to the Missouri Department of Revenue?

How Do I Make My Payment? Make your check or money order payable to the “Missouri Department of Reve nue.” Do not send cash (U.S. funds only). Do not postdate your check; it will be cashed upon receipt. The Department of Revenue may collect checks returned for insufficient or uncollected funds electronically.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MO DoR 1937?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the MO DoR 1937. Open it immediately and start altering it with sophisticated capabilities.

How do I execute MO DoR 1937 online?

pdfFiller makes it easy to finish and sign MO DoR 1937 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit MO DoR 1937 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing MO DoR 1937, you need to install and log in to the app.

What is MO DoR 1937?

MO DoR 1937 is a document or form used primarily for reporting certain financial or operational details as required by regulatory authorities in the state of Missouri.

Who is required to file MO DoR 1937?

Entities such as businesses, organizations, or individuals engaged in specific activities that require regulatory oversight in Missouri are required to file MO DoR 1937.

How to fill out MO DoR 1937?

To fill out MO DoR 1937, gather the required information and follow the guidelines provided by the regulatory authority. This typically includes entering your business details, financial data, and any relevant operational metrics.

What is the purpose of MO DoR 1937?

The purpose of MO DoR 1937 is to ensure compliance with state regulations and to provide necessary information for oversight by regulatory bodies in Missouri.

What information must be reported on MO DoR 1937?

The information that must be reported on MO DoR 1937 typically includes business identification details, financial statements, operational activities, and any other data required by the regulatory authority.

Fill out your MO DoR 1937 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR 1937 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.