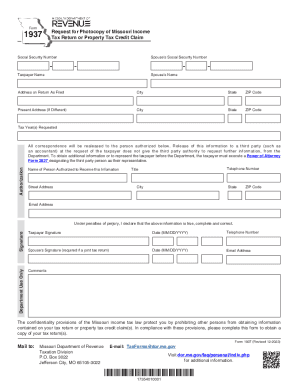

MO DoR 1937 2018 free printable template

Get, Create, Make and Sign MO DoR 1937

How to edit MO DoR 1937 online

Uncompromising security for your PDF editing and eSignature needs

MO DoR 1937 Form Versions

How to fill out MO DoR 1937

How to fill out MO DoR 1937

Who needs MO DoR 1937?

Instructions and Help about MO DoR 1937

Are you doing tell me pictures of us yeah now you should never throw one sec school shiny enough for you is very excited all right your driver's license Mr. Fleming rights you still ready no I have hey to Andrew Henderson here today I'm at the Minnesota Revenue building in about a minute here I'm going to walk in and purchase a marijuana tax now I did this about a year ago I did ask why you could purchase a tax stamp in Minnesota even though marijuana is illegal they didn't give me a real good answer on that now the reason that they give out the tax stamp with marijuana still being illegal in Minnesota it's, so they can prosecute dealers for tax evasion as well as selling drugs now if you decide to go do this for yourself you should know that on the form you do not have to give your name or address or any identifying information there are two ways to get your tax young either down here so where you can mail it in if you mail it in not identifying yourself is pretty much worthless so here we go class from thank you very much yes Oh a job take your game, and then she'll be right though Lori possible see that racially thank you very much they have the form do we need any more can more optional ingredients okay very cool thank you very much all right well that went pretty smooth no hassle last time they freaked out about my camera this time didn't seem to mind so kudos to them on that if you want to try this yourself I will include a link to the forum in the video description so go check it out and yeah good luck to you by an opponent you want to be upset you

People Also Ask about

Do I need to file a Missouri tax return?

Does Illinois require a federal return to be attached?

How much do you have to make to file state taxes in Missouri?

What is the minimum income to file taxes in 2022?

Can I see copy of my tax return online?

Do I need to send a copy of my federal return with my Missouri state return?

Who needs to file a Missouri state tax return?

Do you need to attach federal return to New York return?

Do you have to send a copy of your federal tax return with your state return in Illinois?

What forms do I need to send with my Missouri tax return?

What documents need to be included with my tax return?

Do you have to attach federal return to state return?

Does Missouri require state income tax?

Do you have to send a copy of your federal tax return with your state return in Wisconsin?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MO DoR 1937?

How do I fill out MO DoR 1937 using my mobile device?

How do I edit MO DoR 1937 on an Android device?

What is MO DoR 1937?

Who is required to file MO DoR 1937?

How to fill out MO DoR 1937?

What is the purpose of MO DoR 1937?

What information must be reported on MO DoR 1937?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.