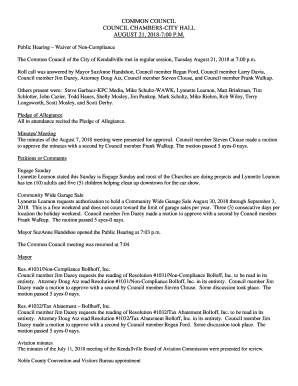

Get the free Small Scale Business Micro-Loan Application 2008 b Liberty Bancshares Florida Inc We...

Show details

Help Africans Help Africa SMALL SCALE BUSINESS MICROLOAN APPLICATION (RAMP) ARA CORP Florida 10151 University Blvd 109 Orlando, FL32817 Tel: (+1) 888688 3576 www.aracorporation.org ARA Corp. Cameroon

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small scale business micro-loan

Edit your small scale business micro-loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small scale business micro-loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small scale business micro-loan online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit small scale business micro-loan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small scale business micro-loan

How to fill out small scale business micro-loan:

01

Gather all necessary documents such as identification, business registration/license, financial statements, and collateral information.

02

Research and choose a lender that offers small scale business micro-loans.

03

Visit the lender's website or go to their physical branch and request an application form for a small scale business micro-loan.

04

Fill out the application form accurately, providing all the required information about your business and personal details.

05

Attach all the necessary documents to the application form, ensuring that they are complete and up-to-date.

06

Review the application form and attached documents to ensure there are no errors or missing information.

07

Submit the completed application form and documents to the lender through their preferred method (online submission, mail, or in-person).

08

Wait for the lender to review your application and make a decision on your small scale business micro-loan.

09

If your loan is approved, carefully review the terms and conditions proposed by the lender, including the interest rate, repayment schedule, and any additional fees.

10

If you agree to the terms, sign the loan agreement and return it to the lender.

11

Upon receiving the signed loan agreement, the lender will disburse the funds to your business account.

12

Start utilizing the micro-loan funds for your small scale business needs, whether it's purchasing inventory, equipment, or funding renovations.

Who needs small scale business micro-loan:

01

Small business owners who require financial assistance to start or expand their ventures.

02

Entrepreneurs who lack the necessary funds to invest in their business ideas.

03

Individuals who want to overcome financial challenges and stabilize their small scale businesses.

04

Businesses that do not meet the requirements of traditional bank loans but still have a viable business model.

05

Individuals facing unforeseen expenses or emergencies that may affect their small scale business operations and cash flow.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send small scale business micro-loan to be eSigned by others?

Once your small scale business micro-loan is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete small scale business micro-loan on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your small scale business micro-loan. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out small scale business micro-loan on an Android device?

Complete your small scale business micro-loan and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is small scale business micro-loan?

Small scale business micro-loan is a type of loan specifically designed for small businesses that require a small amount of funding to start or grow their operations.

Who is required to file small scale business micro-loan?

Small business owners who are in need of financial assistance to support their business activities are required to file for a small scale business micro-loan.

How to fill out small scale business micro-loan?

To fill out a small scale business micro-loan, applicants must provide detailed information about their business, financial statements, and a proposed plan for the use of funds.

What is the purpose of small scale business micro-loan?

The purpose of a small scale business micro-loan is to provide financial support to small businesses that may not qualify for traditional bank loans.

What information must be reported on small scale business micro-loan?

On a small scale business micro-loan application, applicants must report their business name, contact information, financial statements, and proposed use of funds.

Fill out your small scale business micro-loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Scale Business Micro-Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.