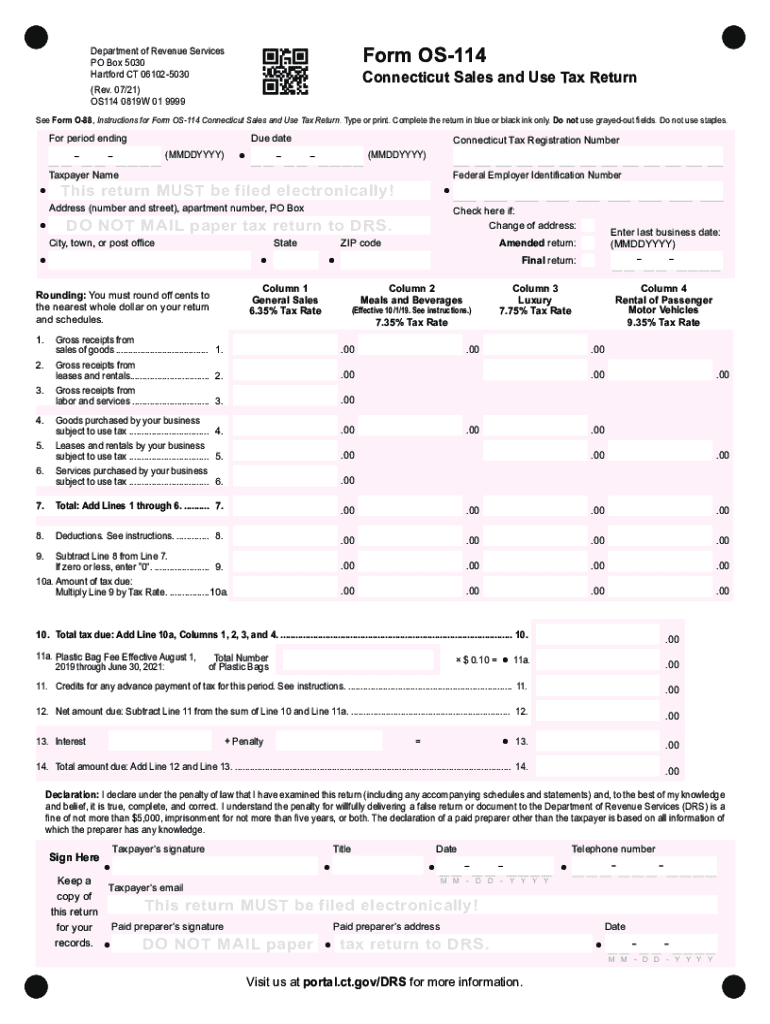

Who needs an OS-114 form?

Form CT DRS OS-114 or Sales and Use Tax Return is to be filed by all the entrepreneurs registered for sales and use taxes in the State of Connecticut.

What is the OS-114 tax form for?

This tax return is requested by the Department of Revenue Services. All individuals, business entities and organizations who made sales or provided services on the territory of the state have to report their taxable sales and should calculate penalty and interest monthly, quarterly and annually based on this form.

It can also be used as an amended return.

Is it accompanied by other forms?

Depending on the circumstances and qualifications of the filer, certain schedules and attachments can be required at the moment of submission of the OS-114 form. For details, check the instructions (form O-88).

When is the form due?

The State of Connecticut requires entrepreneurs to complete and file sales and use tax returns by the last day of the month following the end of the filing period. If the due date falls on a weekend or legal holiday, the deadline for submission is postponed until the next business day.

How do I fill out the form?

Make sure you put the correct Connecticut Tax Registration number, VEIN, name and full address of the entrepreneur in the top table of the first sheet. If this is an amended return, check the box on the right under the table. In the next table, enter the total exempt and taxable state sales and details of all due taxes. On the second page of the two-page form enter the appropriate deductions amount.

Where do I submit the Sales and Use Tax Return?

Send the form by mail to the Department of Revenue Services (DRS) in the State of Connecticut or file the return electronically on the DRS Taxpayer Service Center website.