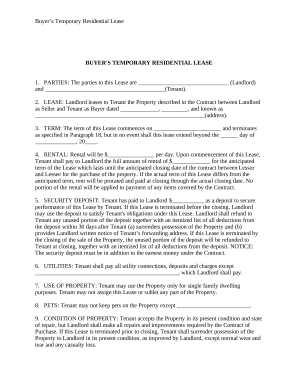

WI DoR W-RA 2021 free printable template

Show details

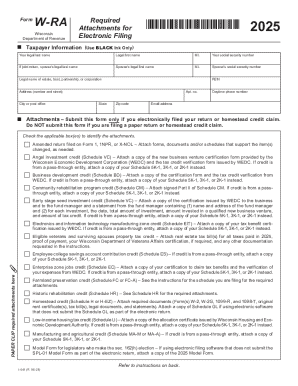

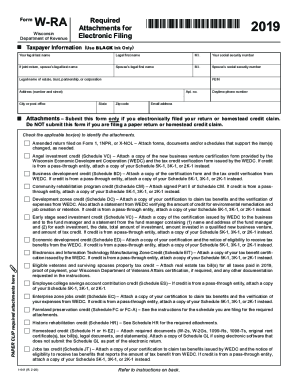

FormWRAWisconsin Department of RevenueRequired Attachments for Electronic Filing2021Taxpayer Information (Use BLACK Ink Only) Your legal last nameless first name. I. Your social security number joint

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR W-RA

Edit your WI DoR W-RA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR W-RA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR W-RA online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI DoR W-RA. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR W-RA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR W-RA

How to fill out WI DoR W-RA

01

Obtain the WI DoR W-RA form from the Wisconsin Department of Revenue website or your local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Provide your filing status by checking the appropriate box (e.g., single, married filing jointly, etc.).

04

Enter your income details in the designated section, including wages, interest, and other sources of income.

05

Report any deductions and exemptions you are claiming, following the guidelines provided on the form.

06

Calculate your tax liability based on the information you've provided.

07

Sign and date the form to certify that the information is accurate and complete.

08

Submit the completed form to the Wisconsin Department of Revenue either electronically or via mail.

Who needs WI DoR W-RA?

01

Individuals who need to report their income and calculate their tax liability in Wisconsin.

02

Taxpayers seeking to claim certain deductions or credits on their Wisconsin state taxes.

03

Anyone needing to update their tax information due to changes in income or personal circumstances.

Fill

form

: Try Risk Free

People Also Ask about

Can you file Wisconsin Homestead online?

If you have a Wisconsin income tax filing requirement, you may use WI e-file to electronically file your 2021 Wisconsin income tax return and homestead credit claim together. Select Form 1 on the WI e-file selection page and then select Schedule H.

How do I file for homestead exemption in Wisconsin?

You may download or request forms and instructions on the department's website. You may obtain a Wisconsin Homestead Credit booklet from any Department of Revenue office located throughout the state. Forms are also available at many libraries.

How much is homestead exemption in Wisconsin?

The Wisconsin homestead exemption allows a debtor to exempt as much as $75,000 of equity in a homestead that the debtor occupies. If a person owns a $275,000 homestead and has a $200,000 mortgage, then $75,000 of equity in the homestead is fully exempt.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What qualifies as a homestead in Wisconsin?

Your homestead is the Wisconsin home you occupy, whether you own it or rent it, and up to one acre of land adjoining it (or up to 120 acres of land if the homestead is part of a farm). For example, it may be a house, an apartment, a rented room, a mobile home, a farm, or a nursing home room.

What is Wisconsin Form W-RA?

Purpose of Form Use Form W-RA to submit supporting documentation when you electronically file an income or franchise tax return and claim any of the credits or items listed.

Who must file a Wisconsin income tax return?

Am I required to file a Wisconsin individual income tax return? Filing StatusAge as of the End of YearFull-Year ResidentsSingleUnder age 65$11,900 or moreSingleAge 65 or older$12,150 or moreMarried filing a joint returnBoth spouses under 65$22,130 or moreOne spouse 65 or older$22,380 or more5 more rows

Which form is required to file for the Wisconsin Homestead Credit?

For all electronically filed homestead credit claims, Form W-RA, Required Attachments for Electronic Filing, along with the required attachment(s), must be submitted (either electronically or by mail) to the department within 48 hours of receiving your Wisconsin acknowledgment.

Can I get tax forms at my local library?

Yes, library staff will print a specific form upon request but you will need to view instructions, tables, and schedules online.

How do I file my homestead credit in Wisconsin?

If you do qualify for a credit, you must submit a copy of your 2022 property tax bill (if you owned and occupied your home) or an original rent certificate signed by your landlord (if you rented your home) along with your Schedule H or H-EZ. The filing deadline for a 2022 claim is April 15, 2027, for most claimants.

Who qualifies for Wi homestead credit?

You occupied and owned or rented a home, apartment, or other dwelling that is subject to Wisconsin property taxes during 2021. You are a legal resident of Wisconsin for all of 2021. You are 18 years of age or older on December 31, 2021. Your household income was less than $24,680 for 2021.

Can I eFile a Wisconsin amended return?

Yes, you can electronically file an amended return using the department's Wisconsin e-file application or through an approved software vendor that supports amended returns.

Where can I pick up IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Can you write off property taxes in Wisconsin?

Wisconsin also has income tax credits designed to help offset property taxes. These credits are available for qualifying property owners when they complete their Wisconsin income tax return.

Where can I pick up paper IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How much do you get back for Homestead in WI?

The maximum credit allowed is $1,168. Household income includes all taxable and certain nontaxable income, less a deduction of $500 for each qualifying dependent. If household income is $24,680 or more, no credit is available. Property taxes are those levied for 2021, regardless of when they are paid.

Do I need to file a Wisconsin state tax return?

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete WI DoR W-RA online?

With pdfFiller, you may easily complete and sign WI DoR W-RA online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit WI DoR W-RA on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing WI DoR W-RA, you need to install and log in to the app.

How do I fill out the WI DoR W-RA form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign WI DoR W-RA and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is WI DoR W-RA?

WI DoR W-RA is a form used by the Wisconsin Department of Revenue for reporting certain income and withholding information related to tax purposes.

Who is required to file WI DoR W-RA?

Individuals or entities that have income subject to Wisconsin withholding are required to file WI DoR W-RA.

How to fill out WI DoR W-RA?

To fill out WI DoR W-RA, provide pertinent information such as taxpayer identification details, income amounts, and withholdings as specified in the instructions.

What is the purpose of WI DoR W-RA?

The purpose of WI DoR W-RA is to report withholding tax information to ensure proper record-keeping and compliance with state tax regulations.

What information must be reported on WI DoR W-RA?

Information that must be reported includes the taxpayer's identification number, total income earned, and the amount of withholding tax deducted.

Fill out your WI DoR W-RA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR W-RA is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.