SBA 3508S 2021-2025 free printable template

Show details

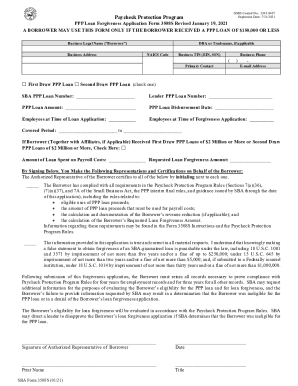

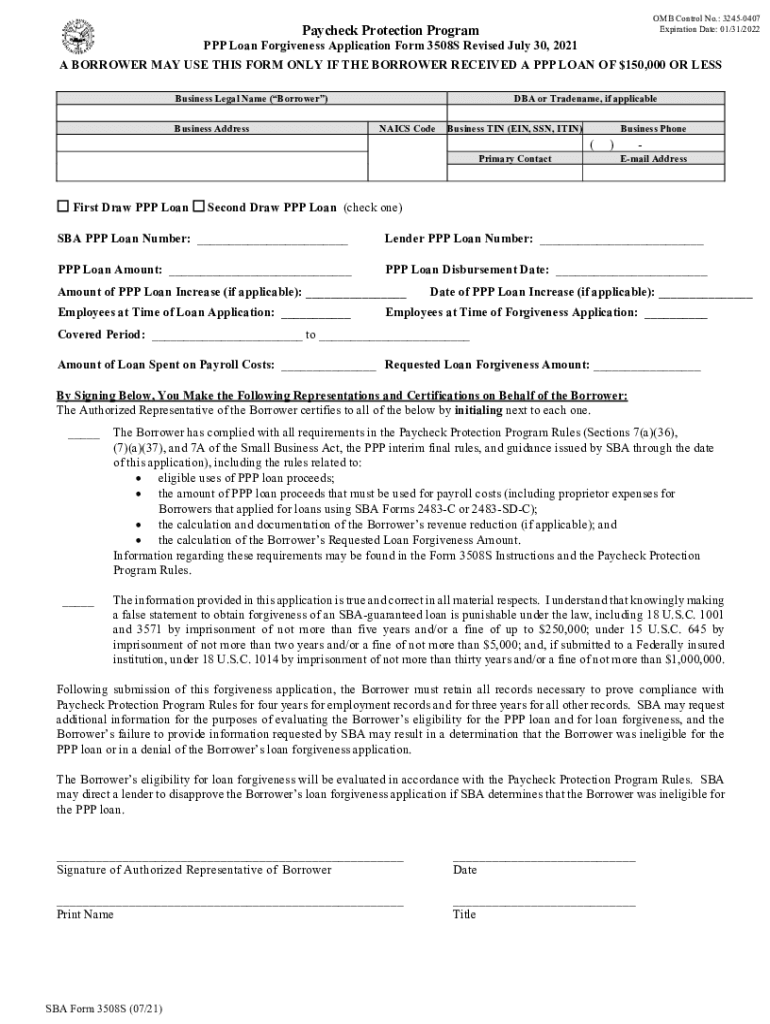

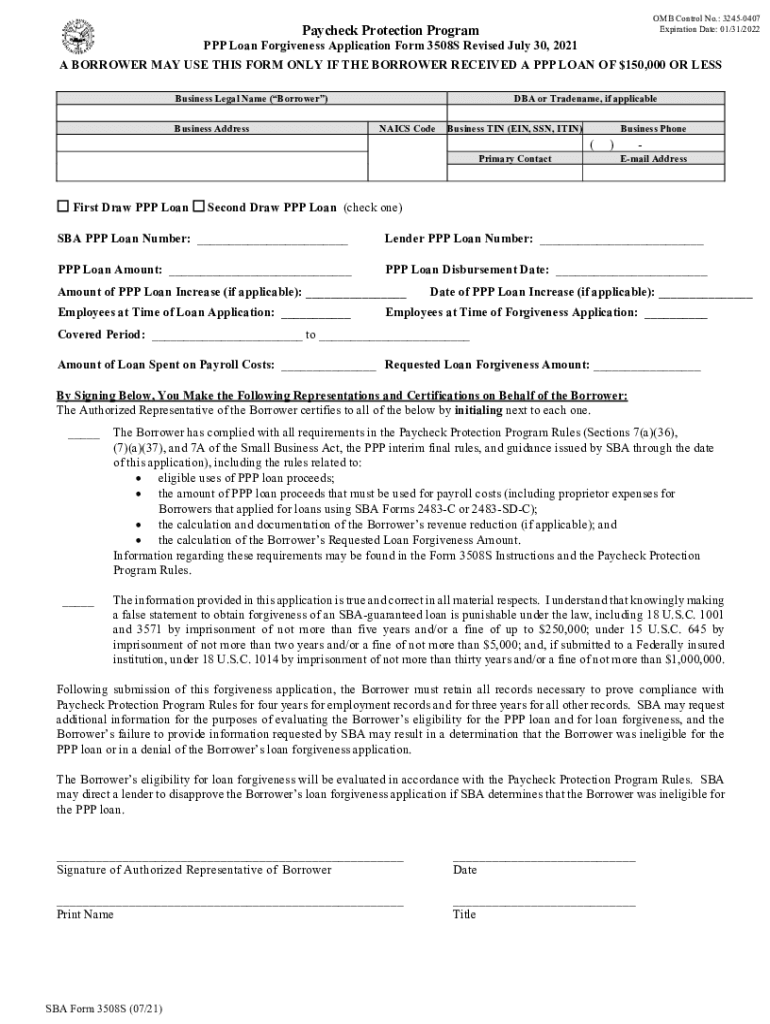

OMB Control No.: 32450407 Expiration Date: 01/31/2022Paycheck Protection Program PPP Loan Forgiveness Application Form 3508S Revised July 30, 2021, A BORROWER MAY USE THIS FORM ONLY IF THE BORROWER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ppp loan 3508s form

Edit your 3508s form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ppp forgiveness form 3508s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ppp forgiveness form 3508s online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ppp forgiveness form 3508s. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SBA 3508S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ppp forgiveness form 3508s

How to fill out SBA 3508S

01

Gather all relevant financial documents and information.

02

Complete the borrower information section with your business details.

03

Calculate your payroll costs by summing all eligible expenses.

04

Enter the total amount of the loan you received.

05

Fill in the covered period, which is typically 8 to 24 weeks after receiving the loan.

06

Provide information regarding any FTE (full-time equivalent) employees you retained.

07

Complete the sections related to non-payroll costs if applicable.

08

Review the form for accuracy and completeness before submission.

Who needs SBA 3508S?

01

Small businesses and certain non-profit organizations that received a Paycheck Protection Program (PPP) loan of $150,000 or less.

02

Businesses that are looking to apply for loan forgiveness under the PPP guidelines.

Fill

form

: Try Risk Free

People Also Ask about

What is a SBA Form 2483?

By signing SBA Form 2483, Borrower Information Form in connection with this application for an SBA-guaranteed loan, the Applicant certifies that it has read the Statements Required by Law and Executive Orders, which is attached to Form 2483.

Is PPP coming back?

Unfortunately, PPP loans in 2022 aren't happening –– eligibility for the program ended in May 2021 and there are no signs of it coming back. There are other options for securing small business funding besides PPP loans. Read on to learn about your options for how to get the funding you need.

Is there a public list of who received PPP loans?

If you're looking to check who's received EIDL grants, EIDL loans, or PPP loans, the SBA has made recipient data publicly available.

How do I fill out a PPP loan and get approved?

How to Complete Your PPP Loan Application Step 1: Access your PPP Application. Step 2: Add or Confirm Existing Business Information. Step 3: Add New Requirements for Business Information. Step 4: Enter or Confirm Ownership. Step 5: Enter or Confirm Additional Owner Info. Step 6: Upload or Confirm Documents.

How much money is left in the PPP program as of today 2021?

PPP Money – Nearly All Gone: Only $8 billion remains available. Source: CBS News, April 6, 2021.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ppp forgiveness form 3508s directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your ppp forgiveness form 3508s as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get ppp forgiveness form 3508s?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the ppp forgiveness form 3508s in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete ppp forgiveness form 3508s on an Android device?

On Android, use the pdfFiller mobile app to finish your ppp forgiveness form 3508s. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is SBA 3508S?

SBA 3508S is a simplified loan forgiveness application provided by the Small Business Administration for borrowers of the Paycheck Protection Program (PPP) who received loans of $150,000 or less.

Who is required to file SBA 3508S?

Borrowers with PPP loans of $150,000 or less are required to file SBA 3508S to apply for loan forgiveness.

How to fill out SBA 3508S?

To fill out SBA 3508S, borrowers need to complete the form with information regarding their PPP loan, total payroll costs incurred during the covered period, and other eligible expenses. Detailed instructions are provided with the form.

What is the purpose of SBA 3508S?

The purpose of SBA 3508S is to streamline the loan forgiveness application process for small businesses with minimal loan amounts, making it easier and faster to apply for forgiveness.

What information must be reported on SBA 3508S?

SBA 3508S requires reporting of the PPP loan amount, the amount of forgiveness being requested, and certification that the borrower used the funds according to PPP guidelines.

Fill out your ppp forgiveness form 3508s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ppp Forgiveness Form 3508s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.