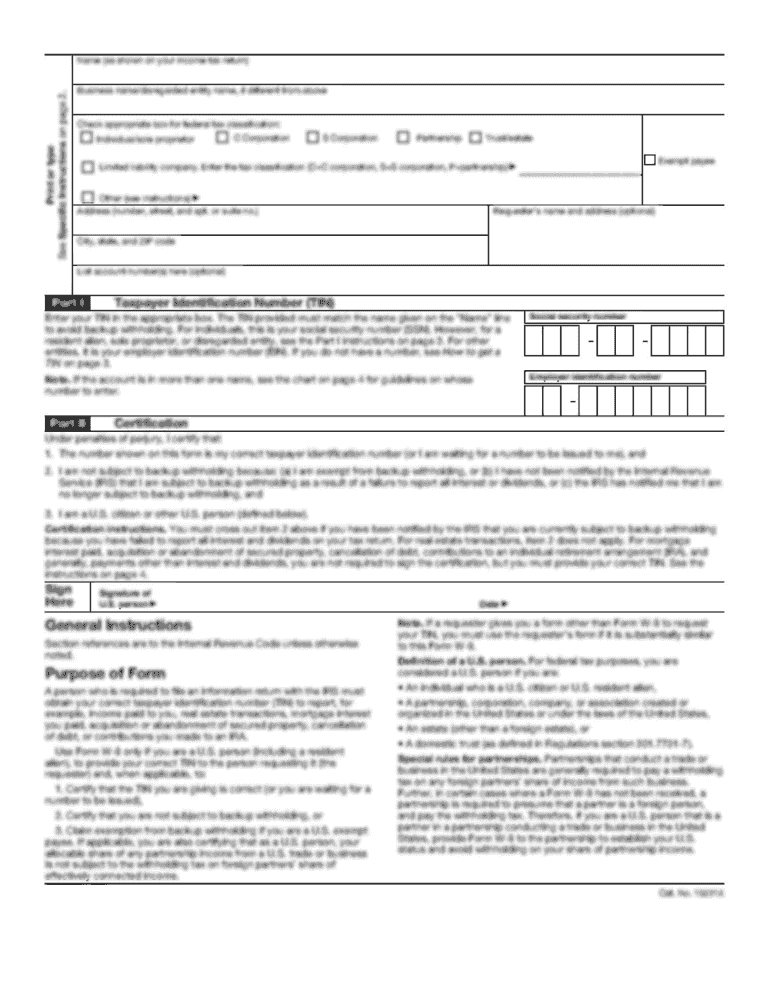

IRS 1040 - Schedule C 1992 free printable template

Instructions and Help about IRS 1040 - Schedule C

How to edit IRS 1040 - Schedule C

How to fill out IRS 1040 - Schedule C

About IRS 1040 - Schedule C 1992 previous version

What is IRS 1040 - Schedule C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule C

What should I do if I realize I made an error on my submitted 1992 form 1040 schedule?

If you discover an error after filing your 1992 form 1040 schedule, you should submit an amended return using Form 1040X. Ensure that you clearly indicate the changes and provide any necessary explanations to avoid further issues.

How can I check the status of my filed 1992 form 1040 schedule?

To verify the status of your filed 1992 form 1040 schedule, you can use the IRS's online tracking tool or contact them directly. Be prepared to provide your personal information for verification, including your Social Security number.

Are there any specific privacy considerations when filing a 1992 form 1040 schedule?

Yes, when filing your 1992 form 1040 schedule, be mindful of personal data security. Ensure that any information you submit is kept private and is only shared on secure platforms to protect against data breaches.

What common errors should I watch for when submitting my 1992 form 1040 schedule?

Common errors include incorrect Social Security numbers, mismatched names, and math mistakes. Double-check your entries and consider using tax preparation software to help reduce the chances of making these errors on your 1992 form 1040 schedule.

Can I use anything other than a computer to submit my 1992 form 1040 schedule electronically?

Yes, you can use mobile devices or tablets to e-file your 1992 form 1040 schedule, provided that the software or application supports mobile submissions and meets the IRS's technical requirements for e-filing.

See what our users say