Get the free Coronavirus Local Fiscal Recovery Fund - Request For Payment

Show details

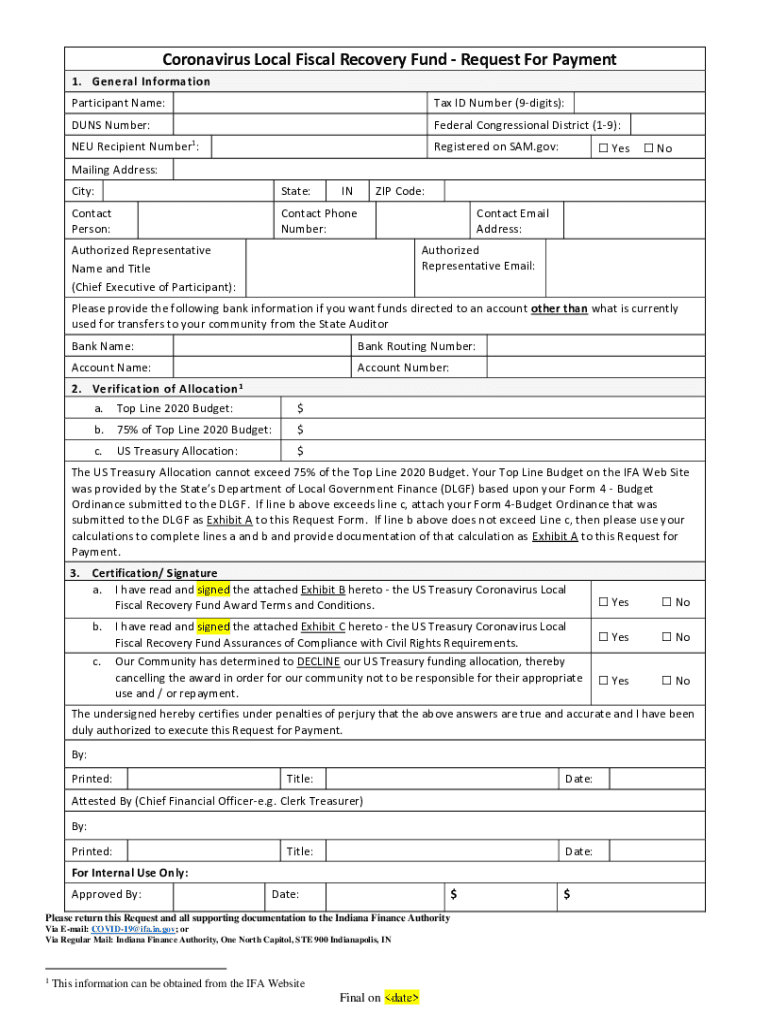

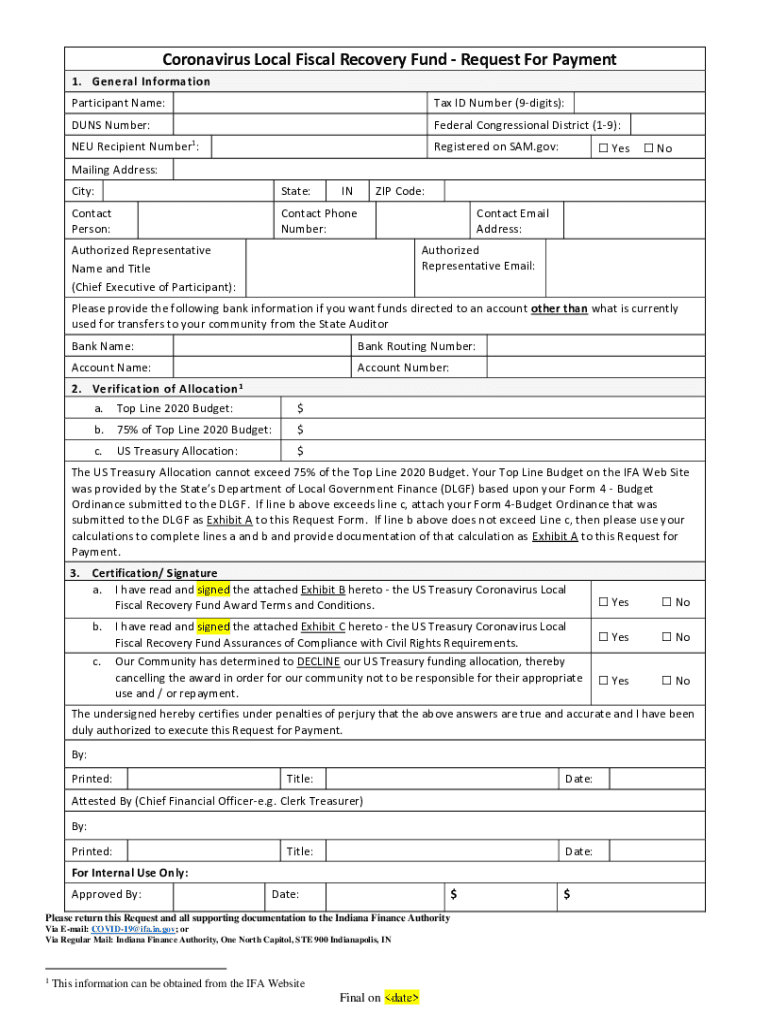

Coronavirus Local Fiscal Recovery Fund Request For Payment 1. General Information Participant Name:Tax ID Number (9digits):DUNS Number:Federal Congressional District (19):NEW Recipient Number1:Registered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign coronavirus local fiscal recovery

Edit your coronavirus local fiscal recovery form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your coronavirus local fiscal recovery form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing coronavirus local fiscal recovery online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit coronavirus local fiscal recovery. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out coronavirus local fiscal recovery

How to fill out coronavirus local fiscal recovery

01

Access the official website of your local government or the designated platform for the coronavirus local fiscal recovery.

02

Start by reading the instructions and guidelines provided for filling out the application.

03

Gather all the necessary documents and information required for the application, which may include financial records, budget plans, and impact assessments.

04

Begin filling out the application form according to the provided instructions.

05

Ensure all the required fields are properly filled and all necessary documents are attached.

06

Double-check the accuracy and completeness of the filled-out form and supporting documents.

07

Submit the completed application either online or through the designated submission method mentioned in the guidelines.

08

Keep a copy of the submitted application and any relevant receipts or acknowledgements for future reference.

09

Await communication from the local government regarding the status and outcome of your application.

10

Follow any further instructions or requirements provided by the local government in case of additional steps needed.

11

If approved, carefully manage and utilize the received local fiscal recovery funds according to the specified guidelines and regulations.

12

Maintain transparency and accountability in the use of funds by keeping accurate records and reports as requested by the local government.

13

Comply with any reporting or auditing requirements related to the coronavirus local fiscal recovery as specified by the local government.

Who needs coronavirus local fiscal recovery?

01

Local governments and municipalities affected by the economic impact of the coronavirus pandemic.

02

Businesses and organizations that have experienced financial losses due to the pandemic.

03

Community development and infrastructure projects that require additional funding for recovery.

04

Non-profit organizations and charitable institutions affected by reduced donations and support.

05

Individuals who have faced job loss, reduction in income, or financial difficulties resulting from the pandemic.

06

Education institutions in need of financial assistance for adapting to remote learning or implementing safety measures.

07

Healthcare facilities and medical institutions requiring additional funds for treating COVID-19 patients and maintaining safety protocols.

08

Tourism sectors heavily impacted by travel restrictions and reduced visitor numbers.

09

Transportation systems and services facing financial strain due to decreased ridership and operational challenges.

10

Other sectors and entities struggling financially as a direct result of the coronavirus outbreak.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my coronavirus local fiscal recovery directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your coronavirus local fiscal recovery and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify coronavirus local fiscal recovery without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your coronavirus local fiscal recovery into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete coronavirus local fiscal recovery online?

pdfFiller has made it easy to fill out and sign coronavirus local fiscal recovery. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is coronavirus local fiscal recovery?

Coronavirus local fiscal recovery refers to financial support provided to local governments to help them recover from the economic impact of the COVID-19 pandemic. This funding aims to restore lost revenues and support the essential services that local jurisdictions provide.

Who is required to file coronavirus local fiscal recovery?

Local governments that receive funding under the coronavirus local fiscal recovery programs are required to file reports detailing how the funds have been used and the financial status of their recovery efforts.

How to fill out coronavirus local fiscal recovery?

To fill out the coronavirus local fiscal recovery report, local governments must provide detailed information regarding the use of the funds, including expenditures, revenue losses, and any relevant financial documentation. The forms typically follow a standardized format provided by the administering agency.

What is the purpose of coronavirus local fiscal recovery?

The purpose of coronavirus local fiscal recovery is to assist local governments in mitigating the financial effects of the pandemic, ensuring they can continue to provide critical services, support public health initiatives, and stimulate economic recovery within their communities.

What information must be reported on coronavirus local fiscal recovery?

Local governments must report information including the amount of funds received, how the funds were allocated, expenditures made, revenue impacts, and any other relevant financial data as required by their funding agreement.

Fill out your coronavirus local fiscal recovery online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Coronavirus Local Fiscal Recovery is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.