Get the free Small Business Banking Open a Business Bank Account

Show details

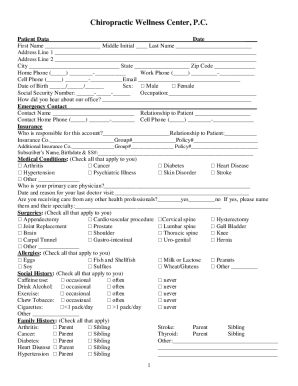

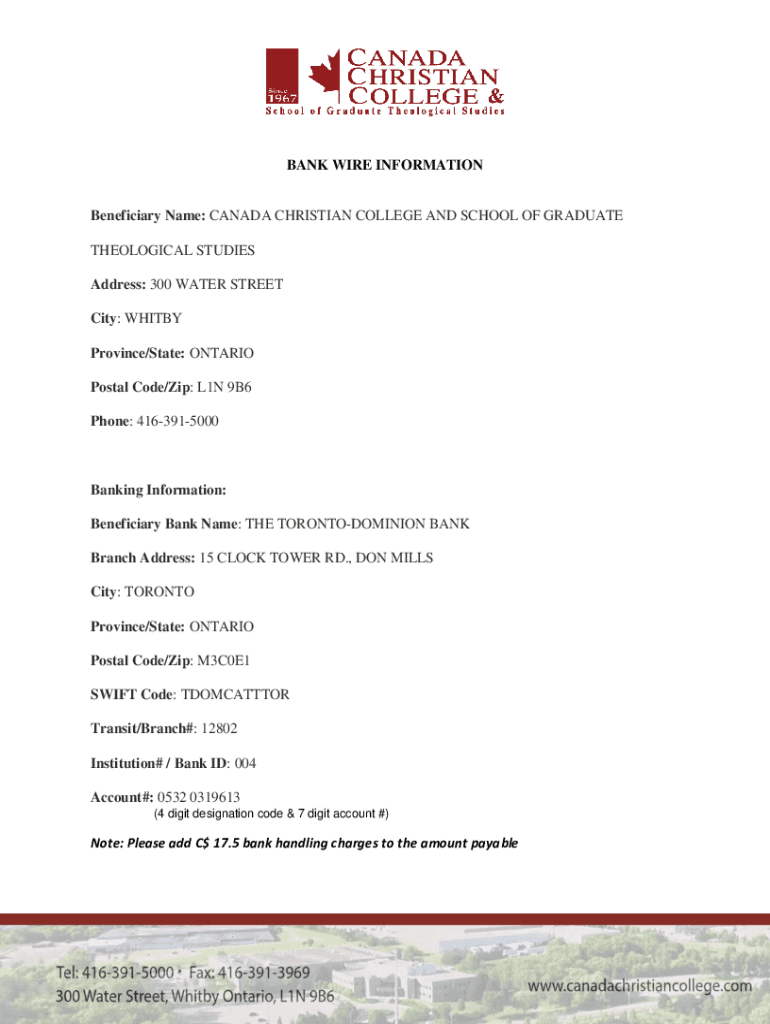

BANK WIRE INFORMATIONBeneficiary Name: CANADA CHRISTIAN COLLEGE AND SCHOOL OF GRADUATE THEOLOGICAL STUDIES Address: 300 WATER STREET City: WHITBY Province/State: ONTARIO Postal Code/Zip: L1N 9B6 Phone:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business banking open

Edit your small business banking open form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business banking open form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business banking open online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit small business banking open. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business banking open

How to fill out small business banking open

01

Gather all necessary documents and information, such as your business registration documents, identification documents, and tax identification number.

02

Research and compare different small business banking options to find the best fit for your needs. Consider factors such as fees, account features, and customer reviews.

03

Visit the chosen bank's website or branch and navigate to the small business banking section.

04

Look for the option to open a new small business bank account. This may be labeled as 'Open an Account' or 'Apply Now'.

05

Follow the step-by-step instructions provided by the bank to complete the application. This typically includes providing your personal and business information, confirming your identity, and agreeing to the bank's terms and conditions.

06

Review the application carefully before submitting to ensure all information is accurate and complete.

07

If required, upload any necessary supporting documents, such as your business registration documents.

08

Submit the application online or at the branch, depending on the bank's application process.

09

Wait for the bank to review and process your application. This may take a few days.

10

Once approved, the bank will provide you with the details of your new small business bank account, such as the account number and any associated debit or credit cards.

Who needs small business banking open?

01

Small business owners who require a separate bank account for their business activities.

02

Entrepreneurs who want to maintain clear financial records and separate personal and business finances.

03

Startups and growing businesses that need banking services tailored to their unique needs, such as business loans, merchant services, and payroll solutions.

04

Freelancers and independent contractors who want to manage their business finances separately from their personal finances.

05

Sole proprietors and partnerships who need to establish a legal and accountable financial structure for their business.

06

Businesses that want to benefit from specialized small business banking features, such as automatic expense categorization, invoicing tools, and integration with accounting software.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit small business banking open from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including small business banking open, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send small business banking open to be eSigned by others?

When you're ready to share your small business banking open, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete small business banking open on an Android device?

Use the pdfFiller app for Android to finish your small business banking open. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is small business banking open?

Small business banking open refers to the services and accounts specifically designed to meet the financial needs of small businesses, including checking accounts, savings accounts, loans, and credit options.

Who is required to file small business banking open?

Small business owners and entities engaged in business activities that require financial reporting and banking services are required to file small business banking open.

How to fill out small business banking open?

To fill out small business banking open, gather all necessary financial documents, complete the application form provided by the bank, and submit it along with any required identification and supporting documents.

What is the purpose of small business banking open?

The purpose of small business banking open is to provide small businesses with specialized banking solutions that help manage finances, access credit, and facilitate transactions to support operational growth.

What information must be reported on small business banking open?

Information that must be reported includes business name, business structure, tax identification number, financial statements, and details of the owners or partners involved.

Fill out your small business banking open online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Banking Open is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.