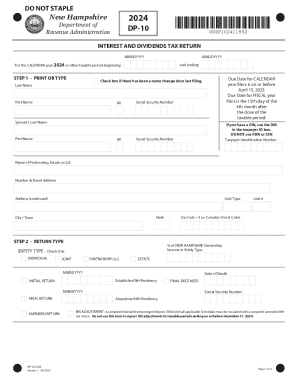

NH DP-10 2015 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NH DP-10

Edit your NH DP-10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NH DP-10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NH DP-10 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NH DP-10. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NH DP-10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NH DP-10

How to fill out NH DP-10

01

Obtain the NH DP-10 form from the New Hampshire Department of Revenue Administration website or local office.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Provide details about the property for which the DP-10 is being filed, including the property address and description.

04

Indicate the reason for the filing by selecting the appropriate checkbox or writing a brief explanation.

05

Include any additional information or documentation required to support your filing.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form to the appropriate local government office, either in person or by mail.

Who needs NH DP-10?

01

Individuals or businesses who own property in New Hampshire and need to report property-related information for taxation or assessment purposes.

02

Property owners seeking exemptions or abatements on their property taxes may also need to file the NH DP-10.

Fill

form

: Try Risk Free

People Also Ask about

What is interest and dividends not taxable to New Hampshire?

The Interest & Dividends ("I&D") Tax was enacted in 1923. The tax is assessed on interest and dividend income at a rate of 5%. Interest and dividend income of $2,400 ($4,800 for joint filers) is exempt from the I&D tax.

What taxes do you pay in New Hampshire?

New Hampshire has a flat 5.00 percent individual income tax rate which is levied only on interest and dividends income. New Hampshire also has a 7.60 percent corporate income tax rate. New Hampshire does not have a state sales tax and does not levy local sales taxes.

What is form DP-10 in New Hampshire?

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program.

Are estimated tax payments mandatory?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Do I need to file a dp10?

The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program. The taxpayer can enter the date of residency during the New Hampshire Q&A.

What tax form do I use for dividends and interest in NH?

The I&D Tax return, Form DP-10, is due on the 15th day of the 4th month following the end of the taxable period. The Form DP-10 and Form DP-10-ES Estimates may be obtain from the Department's website or by calling the Forms Line at (603) 230-5001.

Does New Hampshire require estimated tax payments?

Every taxpayer required to file an Interest and Dividends Tax Return must also make estimated Interest and Dividends Tax payments for its subsequent taxable period, unless the annual estimated tax for the subsequent taxable period is less than $500. See “Exceptions to the Underpayment of Estimated Tax Penalty” below.

What is the tax on dividends and interest in New Hampshire?

What is the Interest and Dividends Tax (I&D Tax)? It is a 5% tax on interest and dividends income.

What is a NH DP-10 form?

DP-10-ES 2022. Version 1.0 06/2021. ESTIMATED INTEREST AND DIVIDENDS TAX. Taxpayer's Worksheet - Keep This Page For Your Records. 1 All interest and dividend income subject to tax under RSA 77.

Who needs to file NH DP-10?

INDIVIDUALS: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

What is not taxed in New Hampshire?

New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire's tax system ranks 6th overall on our 2022 State Business Tax Climate Index.

Who generally does not need to pay estimated taxes?

When can I avoid paying estimated taxes? If you expect to owe less than $1,000 in income tax this year after applying your federal income tax withholding, you don't have to make estimated tax payments.

Do I need to file a New Hampshire state tax return?

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

Can I skip an estimated tax payment?

Myth 2: Missing a estimated quarterly taxes payment deadline is fine as long as you pay on the next deadline. If you have to make estimated tax payments, following the schedule is important. Missing quarterly deadlines, even by one day, can mean accruing penalties and interest.

What type of dividends are not taxable?

Nontaxable dividends are dividends from a mutual fund or some other regulated investment company that are not subject to taxes. These funds are often not taxed because they invest in municipal or other tax-exempt securities.

How much interest and dividends are tax free?

For 2022, qualified dividends may be taxed at 0% if your taxable income falls below: $41,676 for those filing single or married filing separately, $55,801 for head of household filers, or. $83,351 for married filing jointly or qualifying widow(er) filing status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NH DP-10 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your NH DP-10 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I execute NH DP-10 online?

pdfFiller has made it easy to fill out and sign NH DP-10. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit NH DP-10 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing NH DP-10.

What is NH DP-10?

NH DP-10 is a tax form used by individuals and entities in New Hampshire to report interest and dividends.

Who is required to file NH DP-10?

Individuals and entities who receive interest and dividend income that exceeds a certain threshold are required to file NH DP-10.

How to fill out NH DP-10?

To fill out NH DP-10, taxpayers must provide personal information, report total interest and dividend income, and calculate any taxes owed based on that income.

What is the purpose of NH DP-10?

The purpose of NH DP-10 is to collect tax on income generated from interest and dividends for residents and certain entities in New Hampshire.

What information must be reported on NH DP-10?

NH DP-10 requires reporting of the taxpayer's name, address, social security number, total interest income, total dividend income, and any applicable deductions or credits.

Fill out your NH DP-10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NH DP-10 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.