NH DP-10 2009 free printable template

Show details

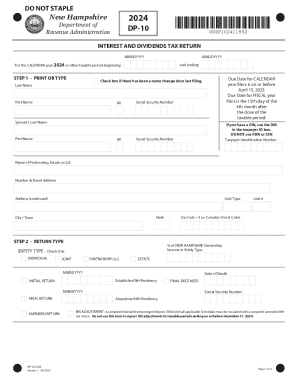

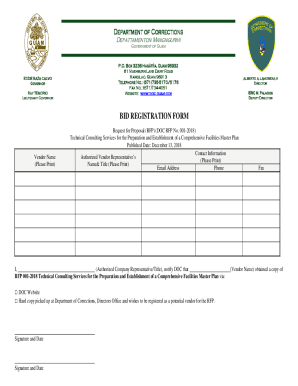

FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION DP-10 INTEREST AND DIVIDENDS TAX RETURN 041 For the CALENDAR year 2009 or other taxable period beginning and ending Due Date for CALENDAR year

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NH DP-10

Edit your NH DP-10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NH DP-10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NH DP-10 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NH DP-10. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NH DP-10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NH DP-10

How to fill out NH DP-10

01

Obtain the NH DP-10 form from the New Hampshire Department of Revenue Administration website or your local town or city office.

02

Start by entering the tax year at the top of the form.

03

Fill in your name, mailing address, and identification number (if applicable).

04

List the specific details of your property, including its location and type.

05

Provide an accurate description of the property and any improvements made.

06

Calculate and enter the current assessed value of the property.

07

Sign and date the form to certify that the information provided is correct.

08

Submit the completed form to the appropriate local assessing office by the specified deadline.

Who needs NH DP-10?

01

Property owners in New Hampshire who wish to appeal their property's assessed value.

02

Individuals seeking to apply for or review exemptions related to their property taxes.

03

Anyone required to notify the assessing authority about changes to their property that may affect its assessed value.

Fill

form

: Try Risk Free

People Also Ask about

What is interest and dividends not taxable to New Hampshire?

The Interest & Dividends ("I&D") Tax was enacted in 1923. The tax is assessed on interest and dividend income at a rate of 5%. Interest and dividend income of $2,400 ($4,800 for joint filers) is exempt from the I&D tax.

What taxes do you pay in New Hampshire?

New Hampshire has a flat 5.00 percent individual income tax rate which is levied only on interest and dividends income. New Hampshire also has a 7.60 percent corporate income tax rate. New Hampshire does not have a state sales tax and does not levy local sales taxes.

What is form DP-10 in New Hampshire?

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program.

Are estimated tax payments mandatory?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Do I need to file a dp10?

The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program. The taxpayer can enter the date of residency during the New Hampshire Q&A.

What tax form do I use for dividends and interest in NH?

The I&D Tax return, Form DP-10, is due on the 15th day of the 4th month following the end of the taxable period. The Form DP-10 and Form DP-10-ES Estimates may be obtain from the Department's website or by calling the Forms Line at (603) 230-5001.

Does New Hampshire require estimated tax payments?

Every taxpayer required to file an Interest and Dividends Tax Return must also make estimated Interest and Dividends Tax payments for its subsequent taxable period, unless the annual estimated tax for the subsequent taxable period is less than $500. See “Exceptions to the Underpayment of Estimated Tax Penalty” below.

What is the tax on dividends and interest in New Hampshire?

What is the Interest and Dividends Tax (I&D Tax)? It is a 5% tax on interest and dividends income.

What is a NH DP-10 form?

DP-10-ES 2022. Version 1.0 06/2021. ESTIMATED INTEREST AND DIVIDENDS TAX. Taxpayer's Worksheet - Keep This Page For Your Records. 1 All interest and dividend income subject to tax under RSA 77.

Who needs to file NH DP-10?

INDIVIDUALS: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

What is not taxed in New Hampshire?

New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire's tax system ranks 6th overall on our 2022 State Business Tax Climate Index.

Who generally does not need to pay estimated taxes?

When can I avoid paying estimated taxes? If you expect to owe less than $1,000 in income tax this year after applying your federal income tax withholding, you don't have to make estimated tax payments.

Do I need to file a New Hampshire state tax return?

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

Can I skip an estimated tax payment?

Myth 2: Missing a estimated quarterly taxes payment deadline is fine as long as you pay on the next deadline. If you have to make estimated tax payments, following the schedule is important. Missing quarterly deadlines, even by one day, can mean accruing penalties and interest.

What type of dividends are not taxable?

Nontaxable dividends are dividends from a mutual fund or some other regulated investment company that are not subject to taxes. These funds are often not taxed because they invest in municipal or other tax-exempt securities.

How much interest and dividends are tax free?

For 2022, qualified dividends may be taxed at 0% if your taxable income falls below: $41,676 for those filing single or married filing separately, $55,801 for head of household filers, or. $83,351 for married filing jointly or qualifying widow(er) filing status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NH DP-10 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your NH DP-10 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute NH DP-10 online?

With pdfFiller, you may easily complete and sign NH DP-10 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit NH DP-10 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign NH DP-10. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is NH DP-10?

NH DP-10 is a tax form used in New Hampshire for the reporting of income and deductions by individuals and businesses.

Who is required to file NH DP-10?

Individuals and corporations that generate income in New Hampshire are required to file the NH DP-10.

How to fill out NH DP-10?

To fill out NH DP-10, gather your financial records, input your income and deductions accurately, then submit the form to the New Hampshire Department of Revenue Administration.

What is the purpose of NH DP-10?

The purpose of NH DP-10 is to report taxable income, calculate taxes owed, and ensure compliance with New Hampshire tax regulations.

What information must be reported on NH DP-10?

Information that must be reported on NH DP-10 includes total income, deductions, credits, and other financial details relevant to taxable income.

Fill out your NH DP-10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NH DP-10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.