AU Hesta 5051 2021-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

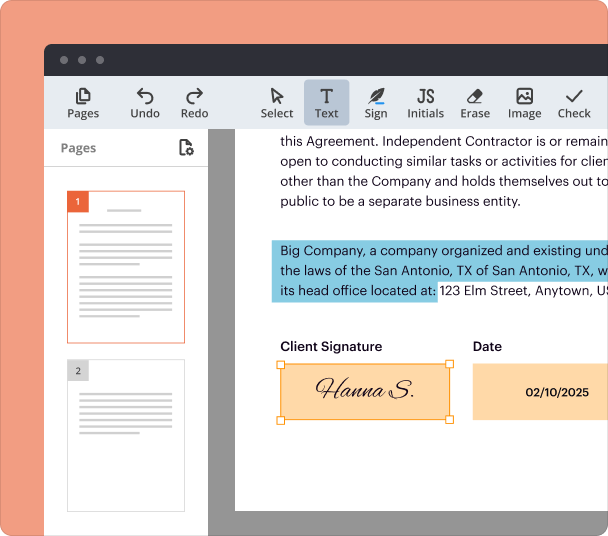

Edit and sign in one place

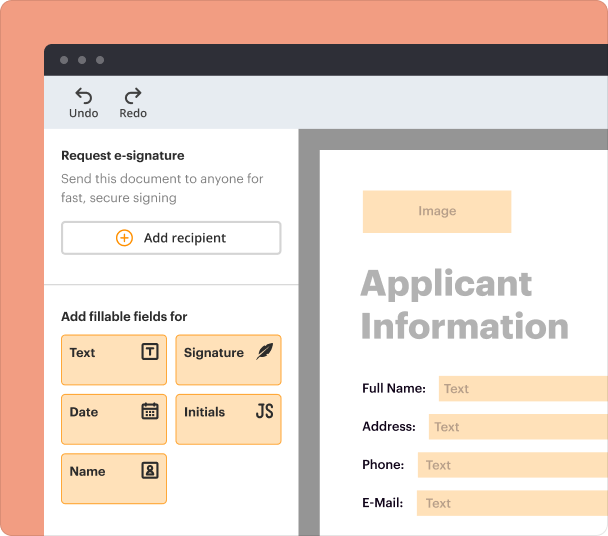

Create professional forms

Simplify data collection

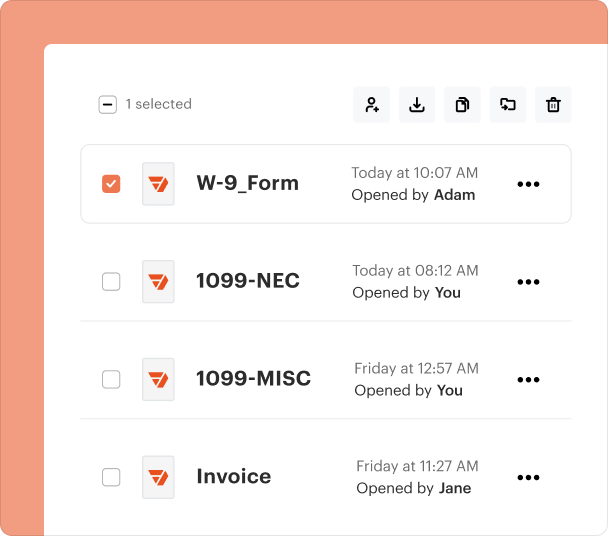

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the au hesta 5-2025 Form

What is the au hesta 5-2025 Form?

The au hesta 5-2025 form is a specific document designed for individuals seeking to manage their HESTA Income Stream. It facilitates the withdrawal of funds, allowing members to request lump sum disbursements from their superannuation accounts during specified periods. Understanding this form is crucial for ensuring compliance with regulations and effectively accessing your retirement savings.

Eligibility Criteria for the au hesta 5-2025 Form

To complete the au hesta 5-2025 form successfully, applicants must meet certain eligibility requirements. Typically, this includes age limitations and the necessity of having ceased employment or having reached the preservation age. Additionally, individuals must possess unrestricted non-preserved benefits to qualify for withdrawal. It is advisable to verify your eligibility before proceeding.

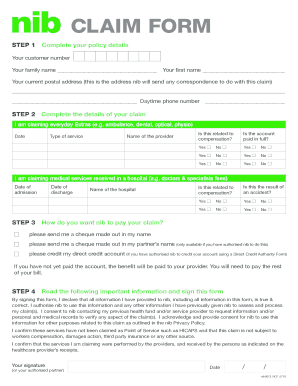

How to Fill the au hesta 5-2025 Form

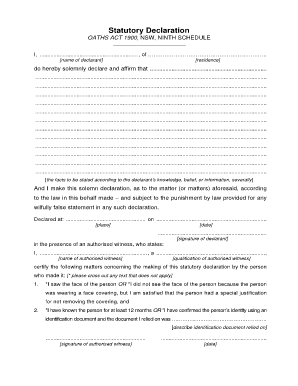

Filling out the au hesta 5-2025 form requires careful attention. Start by entering your personal details in BLOCK letters. You will need to provide information such as your title, name, date of birth, and postal address. Ensure that you mark the appropriate boxes to indicate your withdrawal intentions. Moreover, it's essential to nominate the exact amount to withdraw from your account and specify the preferred investment options.

Common Errors and Troubleshooting

When completing the au hesta 5-2025 form, applicants may encounter common issues that could delay processing. Errors in personal information, failing to sign the form, or providing an incorrect withdrawal amount are frequent mistakes. Double-check all entries, ensure compliance with the signature requirements, and review the eligibility criteria to minimize problems during submission.

Submission Methods and Delivery

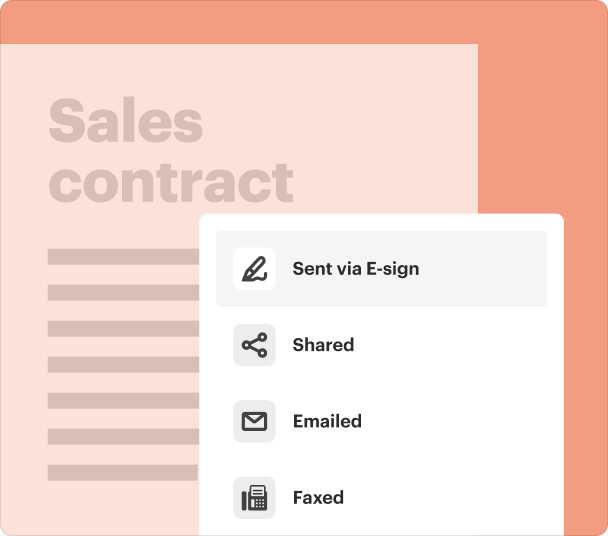

Once you have completed the au hesta 5-2025 form, you can submit it through several methods. Typically, forms can be submitted via mail or electronically, depending on the specific guidelines offered by HESTA. Review the instructions for each submission option carefully, as certain methods may require additional documentation or confirmation.

Benefits of Using the au hesta 5-2025 Form

Utilizing the au hesta 5-2025 form can significantly streamline the process of withdrawing funds from your superannuation. Its structured format ensures that all necessary information is collected, promoting accuracy and efficiency. Additionally, correctly completing this form allows seamless access to your funds, offering greater financial flexibility during important life transitions.

Best Practices for Accurate Completion

To ensure the au hesta 5-2025 form is filled out correctly, follow best practices such as reviewing all instructions thoroughly before you start. Utilize a checklist to confirm that every required section is completed, and consider seeking advice from a financial adviser if needed. Submitting a well-prepared form enhances the likelihood of a swift and successful transaction.

Frequently Asked Questions about hesta form printable

What should I do if I'm unsure about my eligibility for the au hesta 5-2025 form?

If you are unsure about your eligibility for the au hesta 5-2025 form, it is recommended to contact HESTA directly or consult a financial adviser who can provide guidance based on your specific circumstances.

Can I withdraw part of my superannuation using this form?

Yes, the au hesta 5-2025 form allows you to specify the exact amount you wish to withdraw, as long as you meet the eligibility criteria.

pdfFiller scores top ratings on review platforms