Get the free Conventional Loan Delivery Checklist

Show details

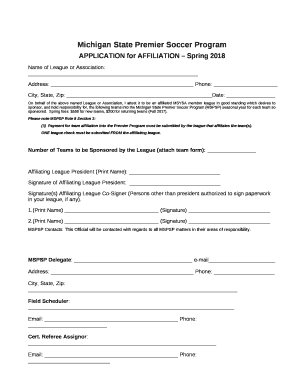

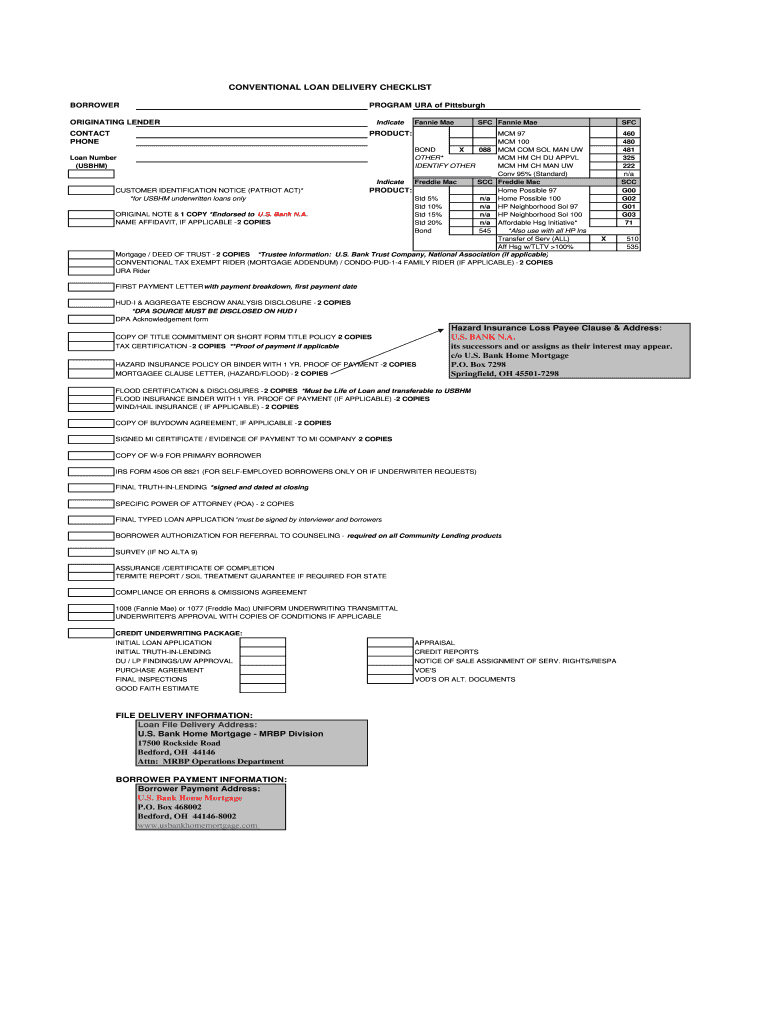

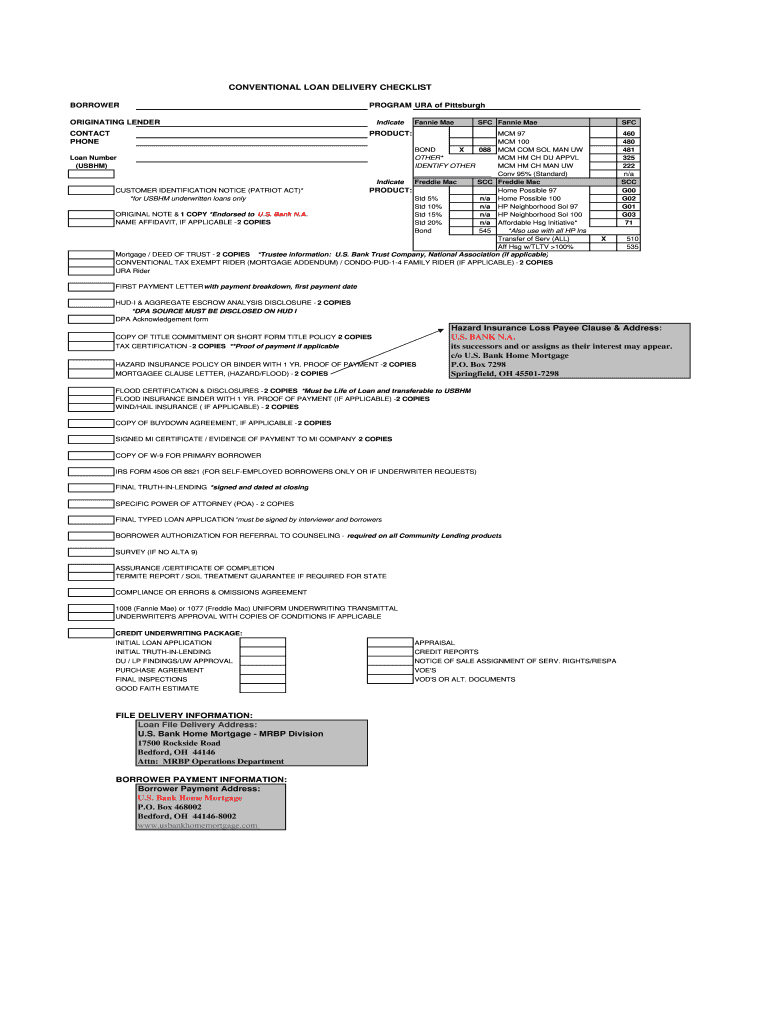

CONVENTIONAL LOAN DELIVERY CHECKLIST BORROWER PROGRAM URA of Pittsburgh ORIGINATING LENDER CONTACT PHONE Indicate Fannie Mae SFC PRODUCT MCM 97 MCM 100 BOND X 088 MCM COM SOL MAN UW Loan Number OTHER MCM HM CH DU APPVL USBHM IDENTIFY OTHER MCM HM CH MAN UW Conv 95 Standard Indicate Freddie Mac SCC Freddie Mac CUSTOMER IDENTIFICATION NOTICE PATRIOT ACT Home Possible 97 for USBHM underwritten loans only Std 5 Std 10 n/a HP Neighborhood Sol 97 ORIGINAL NOTE 1 COPY Endorsed to U*S* Bank N*A....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conventional loan delivery checklist

Edit your conventional loan delivery checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conventional loan delivery checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing conventional loan delivery checklist online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit conventional loan delivery checklist. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conventional loan delivery checklist

How to fill out Conventional Loan Delivery Checklist

01

Gather all necessary borrower information, including credit score and income documentation.

02

Collect property details such as address, type, and value.

03

Verify loan amount and type of conventional loan being requested.

04

Complete the loan application form accurately.

05

Prepare and attach all required supporting documents, including tax returns and bank statements.

06

Review the checklist to ensure all items are completed and accurate.

07

Submit the checklist along with the loan application to the lender.

Who needs Conventional Loan Delivery Checklist?

01

Borrowers applying for a conventional loan.

02

Lenders processing conventional loan applications.

03

Real estate agents assisting clients with loan applications.

04

Mortgage brokers facilitating the loan process.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for a conventional loan to process?

Most personal loan lenders require documents to prove your identity, income, bank account and address. Lenders collect information about your credit score, loan purpose and monthly expenses to determine your eligibility and loan terms.

What are the requirements of a conventional loan?

It's a good idea to get pre-approval for a mortgage before you start looking for a property, so you know what you can afford. Once you've found a property and put in an offer, expect the mortgage closing process to take 30 to 60 days to complete. Check all of your paperwork carefully.

How often do conventional loans get denied?

Here's how it breaks down. Federal Housing Administration loans: 14.4% denial rate. Jumbo loans: 17.8% denial rate. Conventional conforming loans: 7.6% denial rate.

How fast can you close on a house with a conventional loan?

You can usually expect it take between 30 to 60 days to officially close on a house, with the average time falling in the 40 to 45 day range. However, it is possible to close on a home purchase in 30 days or even less with the right lender by obtaining conditional approval in as few as 10 days.

What disqualifies you from a conventional loan?

To qualify for most conventional loans, you'll need a DTI below 50%. Your lender may accept a DTI as high as 65% if you're making a large down payment, you have a high credit score or have a large cash reserve. For a jumbo loan, you'll typically need a DTI of 45% or lower, and most lenders consider this a hard cap.

How long is the underwriting process for a conventional loan?

Each situation is different, but underwriting can take anywhere from a few days to several weeks. Missing signatures or documents, and issues with the appraisal or title insurance are some of the things that can hold up the process.

What documentation is required for a loan?

A set of loan documents should include the following terms and conditions: Parties to the loan. Loan amount. Repayment terms, including applicable interest rate, method of interest accrual, payment type (interest-only or principal and interest), payment amount, payment due dates, required method of payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Conventional Loan Delivery Checklist?

The Conventional Loan Delivery Checklist is a comprehensive guide used by lenders to ensure that all necessary documentation and information for conventional mortgage loans are properly collected and presented before the loan is delivered to the investor.

Who is required to file Conventional Loan Delivery Checklist?

Lenders and mortgage servicers are required to file the Conventional Loan Delivery Checklist when submitting conventional loans to investors to ensure compliance with underwriting guidelines and efficient loan processing.

How to fill out Conventional Loan Delivery Checklist?

To fill out the Conventional Loan Delivery Checklist, lenders should gather all necessary loan documentation, complete the checklist fields with accurate information regarding the loan and borrower, and ensure all required documentation is attached before submission.

What is the purpose of Conventional Loan Delivery Checklist?

The purpose of the Conventional Loan Delivery Checklist is to standardize the documentation process for delivering loans to investors, minimize errors, and ensure that all required information is included for a smooth loan funding process.

What information must be reported on Conventional Loan Delivery Checklist?

The information that must be reported on the Conventional Loan Delivery Checklist typically includes borrower details, property information, loan terms, underwriting decision, and documentation related to the loan such as credit reports, income verification, and asset statements.

Fill out your conventional loan delivery checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conventional Loan Delivery Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.