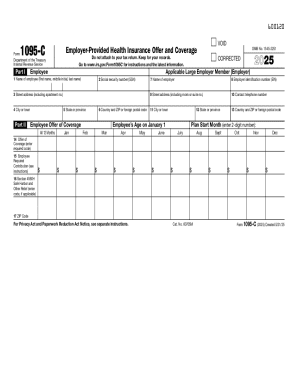

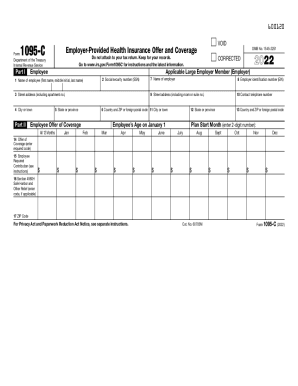

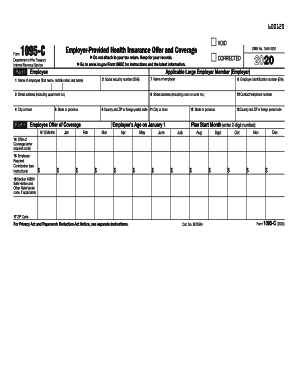

IRS 1095-C 2021 free printable template

Instructions and Help about IRS 1095-C

How to edit IRS 1095-C

How to fill out IRS 1095-C

About IRS 1095-C 2021 previous version

What is IRS 1095-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

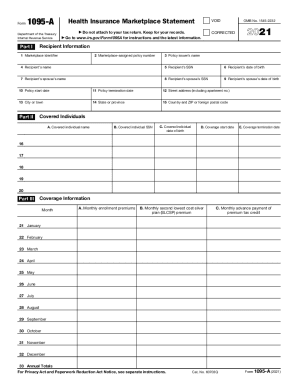

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1095-C

How can I correct an error on my IRS 1095-C?

To correct mistakes on your IRS 1095-C, you will need to file a corrected form by marking the 'Corrected' box at the top of the form. Ensure you submit the revised information to both the IRS and any recipients who received the incorrect version. Keep copies of both the original and corrected forms for your records.

How can I verify the status of my submitted IRS 1095-C?

You can verify the status of your IRS 1095-C submission through the IRS e-Services website if you filed electronically. Common rejection codes will be provided if there are issues, and you can address these by correcting the errors and resubmitting the form. It's essential to track your filing confirmation for your records.

What are the acceptable methods for e-signing the IRS 1095-C?

E-signatures for the IRS 1095-C can be used if they meet IRS requirements, such as being uniquely linked to the individual signing the document and being able to capture intent. Ensure proper protocols are followed to maintain data security and privacy when using e-signatures.

What should I do if I receive an audit notice related to my IRS 1095-C?

If you receive an audit notice regarding your IRS 1095-C, you should gather all relevant documentation, including copies of the form sent, communications with recipients, and any other supporting information. Prepare to respond within the timeline specified in the notice and consider consulting a tax professional for guidance.

What common errors should I be aware of when filing the IRS 1095-C?

Common errors when filing the IRS 1095-C include incorrect employee names or Social Security numbers, failing to include all required coverage dates, and misreporting the coverage offered. To avoid these, double-check all information against official records and verify the accuracy before submission.

See what our users say