IRS 1040 - Schedule SE 2021 free printable template

Show details

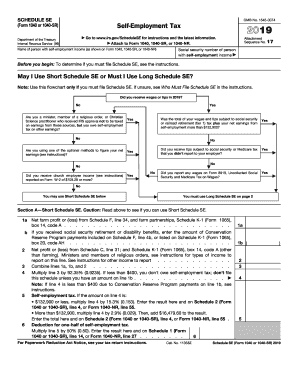

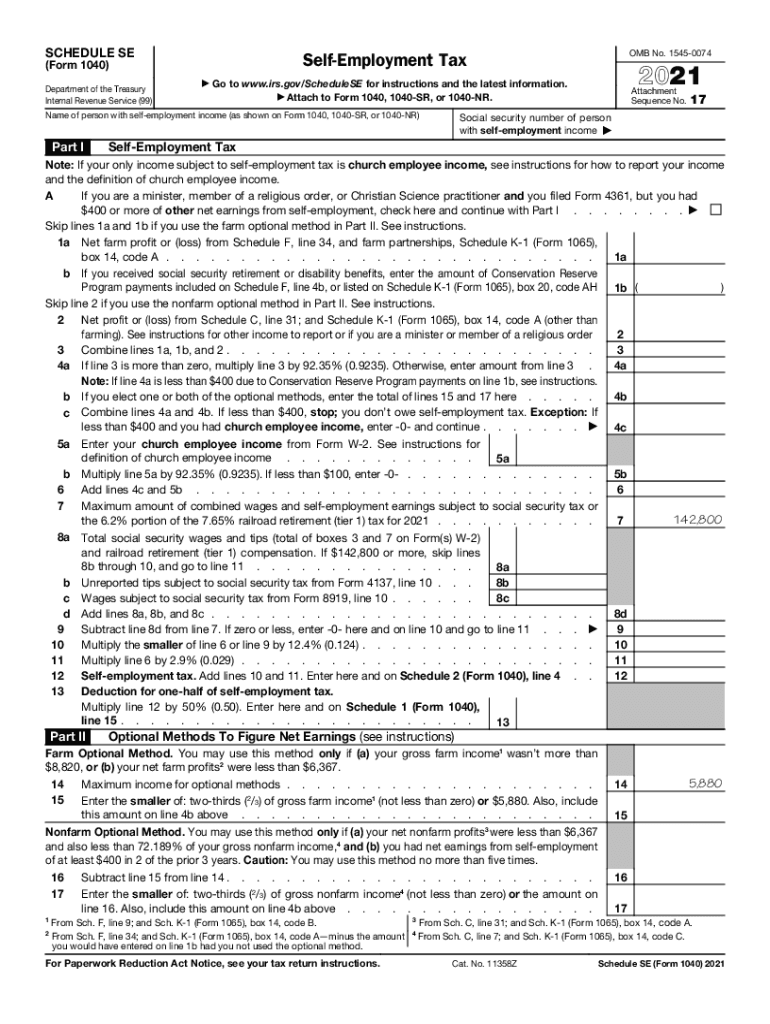

SCHEDULE SE Department of the Treasury Internal Revenue Service (99)2021Go to www.irs.gov/ScheduleSE for instructions and the latest information. Attach to Form 1040, 1040SR, or 1040NR. Name of person

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

How to fill out IRS 1040 - Schedule SE

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

To edit the IRS 1040 - Schedule SE form, you can use pdfFiller, which allows you to fill in your information digitally. Open the form in pdfFiller, and use the editing tools to enter your data accurately. After completing the edits, you can save and print your form or submit it electronically if needed.

How to fill out IRS 1040 - Schedule SE

Filling out IRS 1040 - Schedule SE requires specific financial information. Begin by gathering your self-employment income, as well as any deductions related to your business. Follow these steps:

01

Identify your net earnings from self-employment on Line 2.

02

Complete the rest of the form by following the instructions outlined for each section.

03

Review your entries for accuracy before submitting.

About IRS 1040 - Schedule SE 2021 previous version

What is IRS 1040 - Schedule SE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule SE 2021 previous version

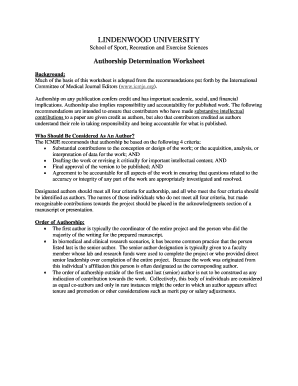

What is IRS 1040 - Schedule SE?

IRS 1040 - Schedule SE is a tax form used by self-employed individuals to calculate their Self-Employment Tax. This form is important for reporting income and calculating Social Security and Medicare taxes owed. Understanding this form is essential for individuals who operate their own business or earn income as freelancers or independent contractors.

What is the purpose of this form?

The primary purpose of IRS 1040 - Schedule SE is to assess and report Self-Employment Tax, which is composed of Social Security and Medicare taxes. It allows self-employed individuals to determine their net earnings and ultimately their tax liabilities. Accurate completion of this form is vital, as these taxes fund important social insurance programs.

Who needs the form?

Individuals who are self-employed and earn $400 or more in a tax year need to file IRS 1040 - Schedule SE. This includes sole proprietors, partners in a partnership, or members of limited liability companies (LLCs) that are taxed as partnerships. Additionally, self-employed individuals receiving compensation from services need to complete this form to report their income accurately.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1040 - Schedule SE if your net earnings from self-employment are less than $400 in the tax year. Additionally, individuals receiving income solely from employment as employees and not from self-employment activities do not need to use this form.

Components of the form

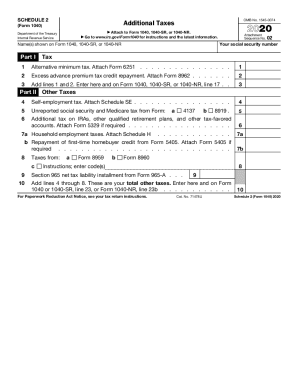

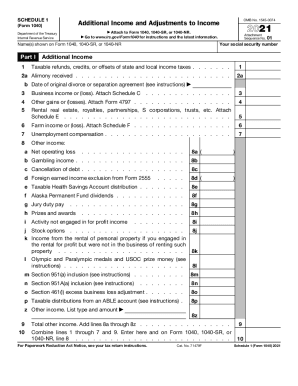

The IRS 1040 - Schedule SE consists of two sections: Part I and Part II. Part I is used to calculate net earnings from self-employment, while Part II calculates the Self-Employment Tax owed based on those earnings. Each section requires specific financial information, so it’s important to have your income statements and expense records handy when filling out the form.

What are the penalties for not issuing the form?

Failing to file IRS 1040 - Schedule SE when required can lead to penalties, including late filing fees and interest on any unpaid taxes. Moreover, not reporting your self-employment income accurately can result in additional taxes owed to the IRS, along with potential audits or further investigations into your financial records.

What information do you need when you file the form?

When filing IRS 1040 - Schedule SE, you need several key pieces of information. Gather your total income from self-employment, any business deductions, and records of your self-employment expenses. It is also useful to have your previous year’s tax returns available for reference and consistency.

Is the form accompanied by other forms?

Typically, IRS 1040 - Schedule SE is filed alongside Form 1040, the standard individual income tax return. Depending on your specific tax situation, you might also need to submit additional forms or schedules that pertain to your business activities or other income sources.

Where do I send the form?

The completed IRS 1040 - Schedule SE should be submitted together with your Form 1040 to the appropriate address provided in the form’s instructions. The mailing address depends on whether you are enclosing a payment or filing without a payment, so checking the latest guidelines is important to ensure proper submission.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

So far excellent, could use a text search and replace feature.

I spent approx $70 for PDF Filler, could not find a page rotate icon when I really needed it, then a screen popped up that I would have to spend $120 per year to have this additional function. I was in the midst of needing to reorient some legal documents so paid the additional money. I find this to be less than fair business practice as when I signed up there was no clear breakdown presented on the functions available for different costs.

See what our users say