IRS 1040 Schedule J 2021 free printable template

Show details

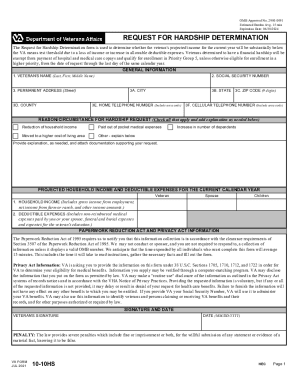

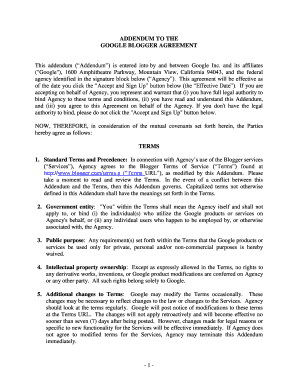

Cat. No. 25513Y Schedule J Form 1040 2018 Page 2 Amount from line 17. line 16. from your 2017 Schedule J line 4. 2016 but not 2017 enter the amount from your 2016 Schedule J line 15. 2015 but not 2016 or 2017 enter the amount from your 2015 Schedule J line 3. Otherwise enter the taxable income from your 2015 Form 1040 line 43 Form 1040A line 27 Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. Otherwise enter the taxable income from your 2015 Form 1040 line 43 Form 1040A line 27...Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. If zero or less see instructions. Divide the amount on line 2a by 3. 0Combine lines 5 and 6. If zero or less enter -0- Enter the amount from line 6 amount from your 2017 Schedule J line 3. If zero or less see instructions. Divide the amount on line 2a by 3. 0Combine lines 5 and 6. If zero or less enter -0- Enter the amount from line 6 amount from your 2017 Schedule J line 3. Otherwise enter the taxable income from your 2017 Form...1040 line 43 Form 1040A line 27 Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040 Department of the Treasury Internal Revenue Service 99 Go OMB No. 1545-0074 Attach to Form 1040 or Form 1040NR. to www.irs.gov/ScheduleJ for instructions and the latest information. Attachment Sequence No. 20 Social security number SSN Name s shown on return Enter the taxable income from your 2018 Form 1040 line 10 or Form 1040NR line...41 2a Enter your elected farm income see instructions. Do not enter more than the amount on line 1. Capital gain included on line 2a b Excess if any of net long-term capital gain over net short-term capital loss. 2b c 2c Unrecaptured section 1250 gain Subtract line 2a from line 1. Figure the tax on the amount on line 3 using the 2018 tax rates see instructions. If you used Schedule J to figure your tax for 2017 enter the amount from your 2017 Schedule J line 11. 2016 but not 2017 enter the...amount from your 2016 Schedule J line 15. 2015 but not 2016 or 2017 enter the amount from your 2015 Schedule J line 3. Otherwise enter the taxable income from your 2015 Form 1040 line 43 Form 1040A line 27 Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. If zero or less see instructions. Divide the amount on line 2a by 3. 0Combine lines 5 and 6. If zero or less enter -0- Enter the amount from line 6 amount from your 2017 Schedule J line 3. Otherwise enter the taxable income from...your 2017 Form 1040 line 43 Form 1040A line 27 Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. If zero or less see instructions. Add lines 4 8 12 and 16 For Paperwork Reduction Act Notice see your tax return instructions. Otherwise enter the tax from your 2017 Form 1040 line 44 Form 1040A line 28 Form 1040EZ line 10 Form 1040NR line 42 or Form 1040NR-EZ line 15. Only include tax reported on this line that is imposed by section 1 of the Internal Revenue Code see instructions. Do...not include alternative minimum tax from Form 1040A. Add lines 19 through 21. Tax. Subtract line 22 from line 18.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 Schedule J

How to edit IRS 1040 Schedule J

How to fill out IRS 1040 Schedule J

Instructions and Help about IRS 1040 Schedule J

How to edit IRS 1040 Schedule J

To edit the IRS 1040 Schedule J, you can use tools like pdfFiller. Start by uploading the form to the platform, then make necessary changes directly within the document. After editing, you can save the updated version securely for future reference or printing.

How to fill out IRS 1040 Schedule J

Filling out the IRS 1040 Schedule J involves several steps. First, gather your financial records for the relevant tax year. You will need to document income, expenses, and other financial data accurately. Follow these steps for completion:

01

Obtain the IRS 1040 Schedule J form from the IRS website or a trusted tax resource.

02

Carefully read the instructions accompanying the form.

03

Input your details in the appropriate fields, ensuring accuracy in all entries.

04

Double-check calculations and ensure that all relevant information is included.

05

Submit the completed form as per your tax filing requirements.

About IRS 1040 Schedule J 2021 previous version

What is IRS 1040 Schedule J?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 Schedule J 2021 previous version

What is IRS 1040 Schedule J?

IRS 1040 Schedule J is a tax form designed for farmers and fishers to average their income for a three-year period. This averaging can help mitigate fluctuations in income and subsequently lower their tax liability. The form allows eligible taxpayers to report their income and special deductions effectively.

What is the purpose of this form?

The purpose of IRS 1040 Schedule J is to help farmers and fishermen adjust their income over a specified period for tax purposes. By averaging their income, these taxpayers can provide a more stable income representation, leading to a fairer tax assessment. This mechanism aims to lessen the tax burden during lower income years.

Who needs the form?

Taxpayers who derive income from farming or fishing operations may need to complete IRS 1040 Schedule J. Specifically, individuals or entities with gross income from farming or fishing exceeding certain thresholds should use this form to report their income effectively. Those engaging in seasonal operations are also eligible to employ this averaging method.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1040 Schedule J if your gross income from farming or fishing does not exceed $5,000 during the tax year. Additionally, if you prefer to report your income without averaging or if you are not a taxpayer involved in farming or fishing, you do not need to complete this form.

Components of the form

The IRS 1040 Schedule J includes three main sections where you report different financial figures. The first part focuses on income averaging calculation, the second section requires reporting of any special deductions, and the final part involves summarizing your taxable income after averaging. It is essential to fill in each section accurately to avoid discrepancies.

What are the penalties for not issuing the form?

The penalties for failing to file IRS 1040 Schedule J when required can vary based on the circumstances. Generally, the IRS may impose fines or interest charges on any unpaid taxes. Additionally, if the failure to file is deemed intentional, more severe penalties may apply, underscoring the importance of compliance.

What information do you need when you file the form?

When filing IRS 1040 Schedule J, you need specific information, including your gross receipts from farming or fishing, any ordinary and necessary expenses, and details of other deductions you plan to apply. It is crucial to have accurate financial statements and records available to support your claims on the form.

Is the form accompanied by other forms?

IRS 1040 Schedule J is typically filed alongside your standard IRS Form 1040 when you report your annual income. Depending on your financial situation, you may also need to include additional forms, such as Schedule F for farm income or Schedule C for business income. Always check the latest IRS guidelines to confirm submission requirements.

Where do I send the form?

Once completed, IRS 1040 Schedule J should be mailed to the address specified for your state in the IRS Form 1040 instructions. It is important to ensure that you send it to the correct location to avoid delays in processing or potential penalties.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.