Get the free CCF-29A - nccourts

Show details

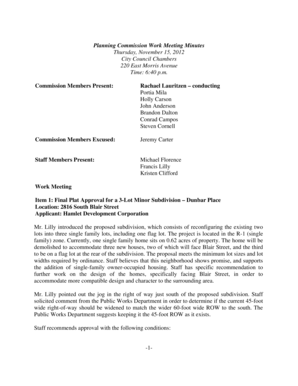

This affidavit is used in domestic violence cases to provide information regarding minor children involved in custody matters. It includes details about custody cases, residency, and living arrangements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ccf-29a - nccourts

Edit your ccf-29a - nccourts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ccf-29a - nccourts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ccf-29a - nccourts online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ccf-29a - nccourts. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ccf-29a - nccourts

How to fill out CCF-29A

01

Begin by downloading the CCF-29A form from the official website.

02

Fill in your personal information, including your full name, address, and contact details.

03

Provide accurate details of your case or application number.

04

Indicate the purpose of the form in the designated section.

05

Carefully read the instructions on each section and provide the required supporting documents.

06

Review the completed form to ensure all information is correct and complete.

07

Sign and date the form in the appropriate sections.

08

Submit the form either electronically or by mailing it to the designated address.

Who needs CCF-29A?

01

Individuals or organizations submitting a request for a specific service or benefit.

02

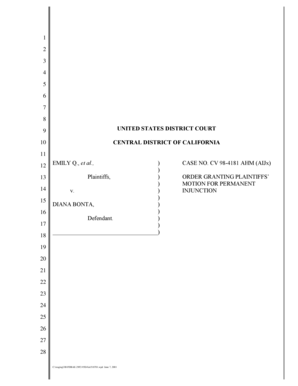

Persons involved in legal proceedings that require documentation of their status.

03

Applicants seeking governmental assistance or support programs.

Fill

form

: Try Risk Free

People Also Ask about

Is federal income tax deductible on 1120?

0:07 1:57 This form is specifically for Ccorporations. Understanding tax deductibility is crucial for accurateMoreThis form is specifically for Ccorporations. Understanding tax deductibility is crucial for accurate reporting federal taxes paid by corporations are generally not deductible as business expenses.

Where does dividend received deduction go on 1120?

Dividends received by or paid by the corporation are reported on Schedule C of Form 1120. Here are the key steps: Enter any dividends received by the corporation on line 3-1 of Schedule C. These are dividends received from domestic corporations that qualify for the dividends received deduction.

What should a taxpayer do with information about non-deductible expenses reported on a schedule K1 from an S Corporation?

Nondeductible expenses reported on Schedule K-1 are not allowed to be deducted by the shareholders or partners on their personal tax returns. These non-deductible expenses are simply passed through and reported to the individual for informational purposes, without affecting their individual tax liabilities.

How much does it cost to file form 1120?

Fees for a corporate tax return (Form 1120) cost about $913. If your tax situation is complex, or you need to file additional IRS forms, additional fees could apply. For example, if you're self-employed, the average cost for Schedule C is $192.

Where do nondeductible expenses go on 1120?

Line 16C - Non Deductible Expenses - This amount represents the taxpayer's non-deductible expenses incurred by the corporation. This amount is not reported on the Form 1040. Instead, the taxpayer should decrease their adjusted basis in their stock in the corporation by this amount.

Where do you put non deductible expenses?

Enter nondeductible expenses on Screen 22, Other Schedule K Items. Go to Input Return ⮕ Schedule K ⮕ Other Schedule K Items. Scroll down to Tax-Exempt Income and Nondeductible Expenses. Enter amount in Nondeductible expenses [Adjust].

Where do non-deductible expenses go on 1120?

Line 16C - Non Deductible Expenses - This amount represents the taxpayer's non-deductible expenses incurred by the corporation. This amount is not reported on the Form 1040. Instead, the taxpayer should decrease their adjusted basis in their stock in the corporation by this amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CCF-29A?

CCF-29A is a form used for reporting specific compliance information to regulatory agencies in various industries.

Who is required to file CCF-29A?

Entities or individuals who are subject to regulations that require the reporting of compliance-related information must file CCF-29A.

How to fill out CCF-29A?

To fill out CCF-29A, follow the provided guidelines, complete all required fields accurately, and submit the form to the appropriate regulatory body.

What is the purpose of CCF-29A?

The purpose of CCF-29A is to ensure compliance with regulations and provide necessary reporting data to regulatory authorities.

What information must be reported on CCF-29A?

Information that must be reported on CCF-29A includes details pertaining to the entity's compliance status, relevant activities, and any violations if applicable.

Fill out your ccf-29a - nccourts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ccf-29a - Nccourts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.