FL DR-501DV 2021-2026 free printable template

Show details

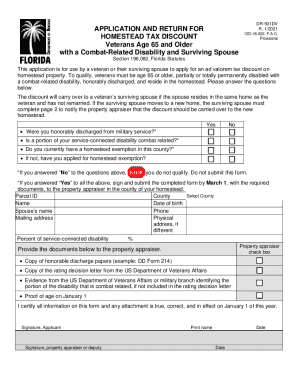

APPLICATION AND RETURN FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 and Older with a Combat-Related Disability and Surviving Spouse DR-501DV R. 11/21 12D-16. 002 F*A. C. Effective 11/21 Page 1 of 2 Section 196. 082 Florida Statutes This application is for use by a veteran or their surviving spouse to apply for an ad valorem tax discount on homestead property. To qualify veterans must be age 65 or older partially or totally permanently disabled with a combat-related disability honorably...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dr 501dv form

Edit your dr501dv form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DR-501DV form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DR-501DV online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit FL DR-501DV. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-501DV Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DR-501DV

How to fill out FL DR-501DV

01

Begin by downloading the FL DR-501DV form from the official Florida Department of Revenue website.

02

Fill out your personal information including your name, address, and contact details at the top of the form.

03

Provide information about the property you are claiming the exemption for, including the property address and parcel number.

04

Indicate your eligibility for the exemption by checking the relevant boxes pertaining to the criteria you meet.

05

If applicable, provide any additional documentation that supports your claim for the exemption.

06

Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge.

07

Submit the completed form to your local property appraiser's office before the deadline.

Who needs FL DR-501DV?

01

Homeowners in Florida who are seeking a property tax exemption for their homestead.

02

Individuals who have recently moved into a new property and want to claim an exemption for which they qualify.

03

Those who are eligible for additional exemptions such as the senior citizen exemption or disability exemption.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to renew homestead exemption every year Florida?

Do I need to re-apply for my Homestead Exemption every year? No, you do not. The Property Appraiser mails out in January an “Automatic Residential Renewal Receipt” to every homesteaded property owner. If you do not have any changes, you can keep the receipt as proof that you are eligible for the automatic renewal.

Do both owners have to apply for homestead exemption in Florida?

However, to be eligible for the homestead exemption, the owner must be a permanent resident of Florida and have a present intent of living at the property. Additionally, the owner must apply for the exemption. Generally, a married couple is entitled to only one homestead exemption.

How much will homestead exemption reduce taxes in Florida?

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

What I must do before claiming Florida homestead exemption?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

What are the rules for homestead exemption in Florida?

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

What is the deadline for homestead exemption in Florida 2022?

March 1 is the deadline to file a timely exemption application.

What do I need to apply for homestead exemption in Florida?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

What documents do I need for homestead exemption in Florida?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

How can I lower my property taxes in Florida?

How Can I Minimize My Property Taxes In Florida? TAX SAVING TIP #1: Make sure that your home's initial valuation is as low as possible. TAX SAVING TIP #2: Be sure and file for Homestead Benefits! TAX SAVING TIP #3: Get as much Portability as you can! TAX SAVING TIP #4: If something is wrong GET IT FIXED!

How much is the senior tax exemption in Florida?

Based on the prior year's income, the income limit is $32,561 for the 2022 exemption. This does not include tax-exempt bond interest or non-taxable social security income. You will be asked to provide a copy of your Federal 1040 Tax Form or your Social Security 1099 Form.

At what age do seniors stop paying property taxes in Florida?

Senior Exemption Information The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1. Total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Do senior citizens get a property tax break in Florida?

Certain property tax benefits are available to persons 65 or older in Florida. Eligibility for property tax exemptions depends on certain requirements. Information is available from the property appraiser's office in the county where the applicant owns a homestead or other property.

Can you have 2 homestead exemptions Florida?

Florida law recognizes that in some situations, married couples who are joint debtors can have separate homesteads. But two separate homesteads are a rare exception, and the multiple homestead exemption must be proven by applicable facts.

Do both spouses have to apply for homestead exemption in Florida?

Married Couples Failing to Apply for Exemptions Together Both spouses should sign the application for exemption. If one spouse dies and the surviving spouse did not sign the original homestead application then the homestead exemption may be lost unless further application is made by the surviving spouse.

Who is exempt from paying property taxes in Florida?

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find FL DR-501DV?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the FL DR-501DV. Open it immediately and start altering it with sophisticated capabilities.

Can I create an eSignature for the FL DR-501DV in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your FL DR-501DV and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out FL DR-501DV on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your FL DR-501DV. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is FL DR-501DV?

FL DR-501DV is a form used in Florida for individuals to apply for a Homestead Exemption on their property.

Who is required to file FL DR-501DV?

Property owners who wish to claim a Homestead Exemption for their primary residence in Florida are required to file FL DR-501DV.

How to fill out FL DR-501DV?

To fill out FL DR-501DV, provide information including your name, property address, social security number, and any applicable information regarding exemptions you are applying for.

What is the purpose of FL DR-501DV?

The purpose of FL DR-501DV is to determine eligibility for the Homestead Exemption, which can provide property tax benefits for qualifying homeowners.

What information must be reported on FL DR-501DV?

Information required on FL DR-501DV includes the applicant's name, property address, date of occupancy, and details of any co-owners or spouse residing at the property.

Fill out your FL DR-501DV online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DR-501dv is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.