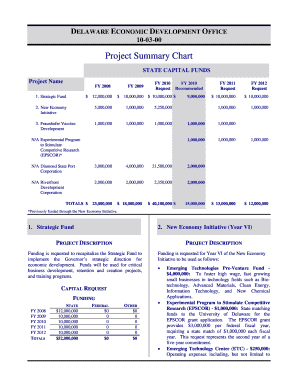

FL DR-501DV 2012 free printable template

Show details

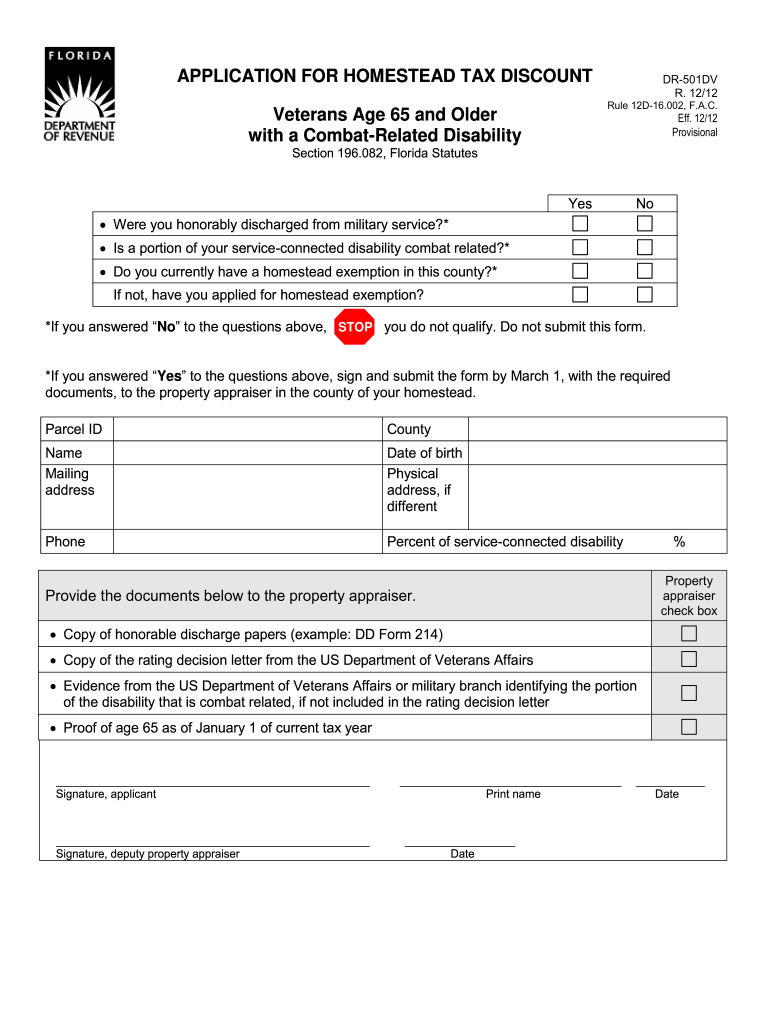

APPLICATION FOR HOMESTEAD TAX DISCOUNT DR-501DV R. 12/12 Rule 12D-16.002, F.A.C. Veterans Age 65 and Older with a Combat-Related Disability Eff. 12/12 Provisional Section 196.082, Florida Statutes

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DR-501DV

Edit your FL DR-501DV form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DR-501DV form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DR-501DV online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit FL DR-501DV. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-501DV Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DR-501DV

How to fill out FL DR-501DV

01

Obtain the FL DR-501DV form from the Florida Department of Revenue website or a local office.

02

Fill in the property appraiser's office information at the top of the form.

03

Provide the applicant's name, address, and contact information accurately.

04

Specify the type of exemption you are applying for and fill out the corresponding sections with the necessary details.

05

Include any required documentation to support your application, such as proof of income or identification.

06

Review all the information for accuracy and completeness before submission.

07

Submit the completed form to your local property appraiser's office by the due date.

Who needs FL DR-501DV?

01

Property owners in Florida who are seeking a discretionary tax exemption for their property under the homestead exemption laws.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to renew homestead exemption every year Florida?

Do I need to re-apply for my Homestead Exemption every year? No, you do not. The Property Appraiser mails out in January an “Automatic Residential Renewal Receipt” to every homesteaded property owner. If you do not have any changes, you can keep the receipt as proof that you are eligible for the automatic renewal.

Do both owners have to apply for homestead exemption in Florida?

However, to be eligible for the homestead exemption, the owner must be a permanent resident of Florida and have a present intent of living at the property. Additionally, the owner must apply for the exemption. Generally, a married couple is entitled to only one homestead exemption.

How much will homestead exemption reduce taxes in Florida?

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

What I must do before claiming Florida homestead exemption?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

What are the rules for homestead exemption in Florida?

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

What is the deadline for homestead exemption in Florida 2022?

March 1 is the deadline to file a timely exemption application.

What do I need to apply for homestead exemption in Florida?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

What documents do I need for homestead exemption in Florida?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

How can I lower my property taxes in Florida?

How Can I Minimize My Property Taxes In Florida? TAX SAVING TIP #1: Make sure that your home's initial valuation is as low as possible. TAX SAVING TIP #2: Be sure and file for Homestead Benefits! TAX SAVING TIP #3: Get as much Portability as you can! TAX SAVING TIP #4: If something is wrong GET IT FIXED!

How much is the senior tax exemption in Florida?

Based on the prior year's income, the income limit is $32,561 for the 2022 exemption. This does not include tax-exempt bond interest or non-taxable social security income. You will be asked to provide a copy of your Federal 1040 Tax Form or your Social Security 1099 Form.

At what age do seniors stop paying property taxes in Florida?

Senior Exemption Information The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1. Total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Do senior citizens get a property tax break in Florida?

Certain property tax benefits are available to persons 65 or older in Florida. Eligibility for property tax exemptions depends on certain requirements. Information is available from the property appraiser's office in the county where the applicant owns a homestead or other property.

Can you have 2 homestead exemptions Florida?

Florida law recognizes that in some situations, married couples who are joint debtors can have separate homesteads. But two separate homesteads are a rare exception, and the multiple homestead exemption must be proven by applicable facts.

Do both spouses have to apply for homestead exemption in Florida?

Married Couples Failing to Apply for Exemptions Together Both spouses should sign the application for exemption. If one spouse dies and the surviving spouse did not sign the original homestead application then the homestead exemption may be lost unless further application is made by the surviving spouse.

Who is exempt from paying property taxes in Florida?

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute FL DR-501DV online?

Easy online FL DR-501DV completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in FL DR-501DV without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing FL DR-501DV and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an eSignature for the FL DR-501DV in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your FL DR-501DV right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is FL DR-501DV?

FL DR-501DV is a form used in Florida for requesting a discount on property taxes for certain classes of property, primarily intended for individuals who qualify for exemptions.

Who is required to file FL DR-501DV?

Taxpayers who wish to apply for specific property tax exemptions, including those for low-income seniors, disabled individuals, or other eligible categories, are required to file FL DR-501DV.

How to fill out FL DR-501DV?

To fill out FL DR-501DV, applicants need to provide their personal information, details about the property, and relevant financial information to assess eligibility for tax exemptions.

What is the purpose of FL DR-501DV?

The purpose of FL DR-501DV is to determine eligibility for property tax relief programs offered by the state of Florida for qualifying individuals.

What information must be reported on FL DR-501DV?

Information required on FL DR-501DV includes the applicant's name, address, property details, income information, and any applicable documentation that supports the exemption claim.

Fill out your FL DR-501DV online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DR-501dv is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.