IRS 1041-T 2021 free printable template

Show details

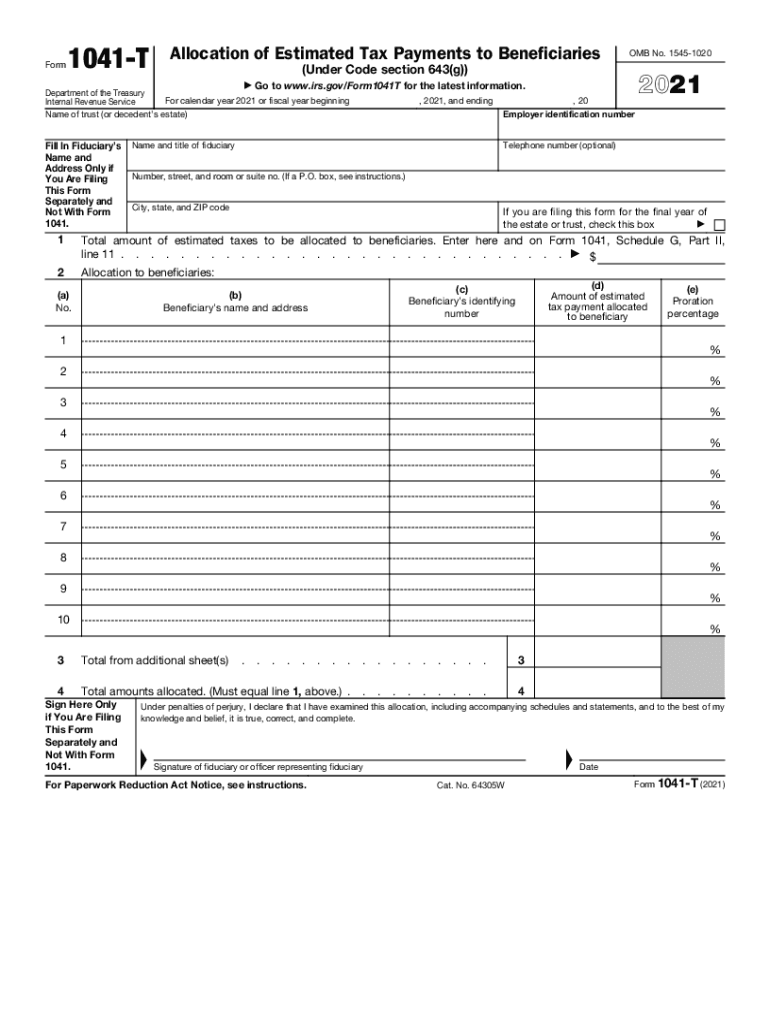

Form1041TAllocation of Estimated Tax Payments to Beneficiaries (Under Code section 643(g))2021Go to www.irs.gov/Form1041T for the latest information. Department of the Treasury For calendar year 2021

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1041-T

How to edit IRS 1041-T

How to fill out IRS 1041-T

Instructions and Help about IRS 1041-T

How to edit IRS 1041-T

To edit IRS 1041-T, you can use a PDF editor that allows you to modify existing fields. You should ensure all changes are accurate and reflect the necessary information as per IRS requirements. Saving your edits securely is essential before final submission.

How to fill out IRS 1041-T

Filling out IRS 1041-T requires you to provide accurate income and deduction information for estates or trusts. Gather the necessary documentation, such as financial statements and previous tax returns. Follow the step-by-step instructions to fill out each section of the form properly.

About IRS 1041-T previous version

What is IRS 1041-T?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1041-T previous version

What is IRS 1041-T?

IRS 1041-T is the tax form used by estates and trusts to report and distribute income. This form specifically relates to the reporting of income tax liabilities and distributions to beneficiaries of an estate or trust. It is essential for transparency and compliance with IRS guidelines.

What is the purpose of this form?

The purpose of IRS 1041-T is to facilitate the reporting process for estates and trusts that need to allocate income to beneficiaries. This ensures that beneficiaries report their distributions correctly on their individual tax returns. The form aids in calculating the taxable income for the estate or trust as well.

Who needs the form?

IRS 1041-T is typically required for estates and trusts that generate income, particularly when distributions are made to beneficiaries. Executors or trustees of estates and trusts should file this form when it is necessary to report distributed income to the IRS.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1041-T if the estate or trust has no taxable income for the tax year or if it does not make distributions to beneficiaries. Specified income thresholds may also determine exemptions, so it is crucial to review IRS guidelines or consult a tax professional.

Components of the form

IRS 1041-T consists of several components including details of the estate or trust, information about the beneficiaries, and a breakdown of distributed income. Correctly completing each section ensures that the form meets IRS requirements and minimizes the chance for errors.

What are the penalties for not issuing the form?

Failing to issue IRS 1041-T can result in significant penalties for the estate or trust. These penalties may include fines from the IRS for late filing or failure to file. It is essential to comply with all reporting requirements to avoid incurring these costs.

What information do you need when you file the form?

When filing IRS 1041-T, you need the following information: the name and taxpayer identification number of the estate or trust, details of beneficiary distributions, and any applicable deductions. Ensuring you have complete and accurate records facilitates a smoother filing process.

Is the form accompanied by other forms?

IRS 1041-T may need to be submitted alongside IRS Form 1041, which reports the overall income of the estate or trust. It is important to check the IRS guidelines to ensure you are submitting all necessary documents for correct processing.

Where do I send the form?

The completed IRS 1041-T should be sent to the address specified in the IRS instructions relevant to your situation. Typically, this will depend on the location of the estate or trust and whether you are filing electronically or by mail.

See what our users say