IRS 1040 - Schedule B 2021 free printable template

Show details

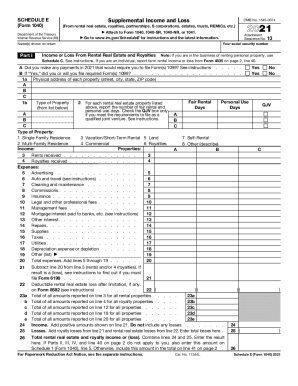

SCHEDULE B Department of the Treasury Internal Revenue Service (99) Go1Interest2021to www.irs.gov/ScheduleB for instructions and the latest information. Attach to Form 1040 or 1040SR. Attachment Sequence

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule B

How to edit IRS 1040 - Schedule B

How to fill out IRS 1040 - Schedule B

Instructions and Help about IRS 1040 - Schedule B

How to edit IRS 1040 - Schedule B

To edit the IRS 1040 - Schedule B form, you can use pdfFiller’s online tools. Upload your completed form to the platform, use the editing features to make necessary changes, and then save or print the revised document. This method allows for easy corrections to ensure accurate information is reported on your tax return.

How to fill out IRS 1040 - Schedule B

Filling out the IRS 1040 - Schedule B requires specific steps to ensure compliance with the IRS regulations. Begin with personal identification information at the top, followed by reporting any interest or dividends earned during the tax year. Ensure that all income sources are accurately listed and categorized. Finally, review all entries for accuracy before submission to avoid any penalties.

About IRS 1040 - Schedule B 2021 previous version

What is IRS 1040 - Schedule B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule B 2021 previous version

What is IRS 1040 - Schedule B?

IRS 1040 - Schedule B is a supplementary form used by U.S. taxpayers to report interest and dividend income. It is an integral part of the IRS 1040 form cycle and helps the IRS calculate the correct tax liability based on a taxpayer's income from investments.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule B is to provide a detailed account of all interest and dividends received by the taxpayer during the year. This form ensures that taxpayers accurately report their investment income, enabling the IRS to assess tax obligations correctly.

Who needs the form?

Taxpayers who earned more than $1,500 in taxable interest or dividends, or who received interest or dividends from foreign accounts, must complete the IRS 1040 - Schedule B. Additionally, anyone answering "Yes" to question regarding certain foreign assets must also file this form.

When am I exempt from filling out this form?

You are exempt from filing IRS 1040 - Schedule B if your taxable interest and dividends are less than $1,500. If you have not received any foreign accounts or reported interests that involve these specifications, you do not need to complete this form.

Components of the form

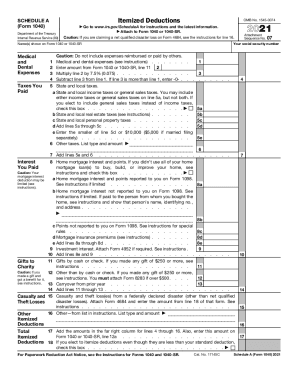

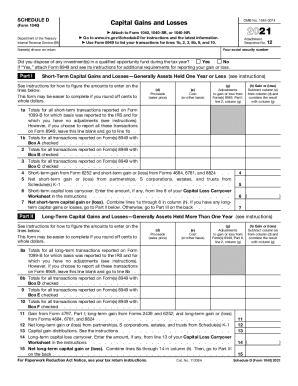

The IRS 1040 - Schedule B consists of several key components, including sections for reporting interest income, dividend income, and questions regarding foreign accounts. It also requires information on the source of income and may include fields for stating the type of income received.

What are the penalties for not issuing the form?

Failing to file IRS 1040 - Schedule B when required can result in significant penalties. Taxpayers may face fines up to $50 for each month the form is late, up to a maximum of $250, in addition to potential interest on any unpaid taxes that were due as a result of non-disclosure of income.

What information do you need when you file the form?

When filing the IRS 1040 - Schedule B, you need to gather detailed information about all interest and dividends received throughout the tax year. This includes bank statements, brokerage statements, and any other documentation that verifies your income sources.

Is the form accompanied by other forms?

Yes, the IRS 1040 - Schedule B is typically filed alongside Form 1040. Depending on your financial situation, you may also need to file additional forms, such as Form 8938 for foreign financial assets or other schedules related to investment income.

Where do I send the form?

The completed IRS 1040 - Schedule B must be submitted alongside your IRS Form 1040 to the designated address outlined in the Form 1040 instructions. This varies depending on whether you are filing electronically or by mail, so be sure to verify the correct destination before sending your documents.

See what our users say