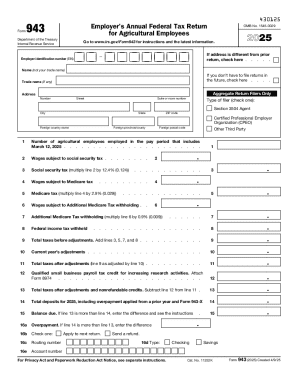

IRS 943 2021 free printable template

Instructions and Help about IRS 943

How to edit IRS 943

How to fill out IRS 943

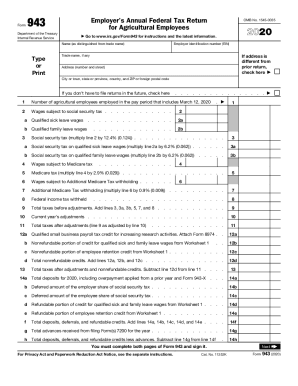

About IRS previous version

What is IRS 943?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

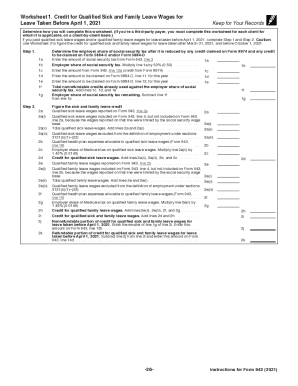

Is the form accompanied by other forms?

FAQ about IRS 943

What should I do if I discover an error after submitting my IRS 943?

If you discover an error on your IRS 943 after submission, you should file an amended form promptly to correct the information. An amended IRS 943 can be submitted to reflect accurate data on payroll or taxes withheld. It's important to keep records of previous submissions and any related correspondence with the IRS.

How can I verify the status of my filed IRS 943?

You can verify the status of your filed IRS 943 by using the IRS online tools available for checking the status of your returns. If you e-filed, ensure you keep your confirmation number, which can help track your submission. Additionally, if there are any rejections, the IRS typically sends a notice detailing the reasons for rejection.

Are electronic signatures acceptable on the IRS 943?

Yes, electronic signatures are acceptable on the IRS 943, provided you follow the IRS guidelines for e-signatures. Ensure that your e-filing software complies with these requirements to avoid complications. The acceptance of e-signatures helps streamline the filing process and enhances data security.

What common errors should I avoid when filing the IRS 943?

When filing the IRS 943, common errors include mismatching taxpayer identification numbers, incorrect wage reporting, and failure to sign the form. Double-check all entries for accuracy, and consider using e-filing software that can help flag these mistakes. Avoiding these errors can ensure smoother processing and reduce the likelihood of receiving notifications from the IRS.

See what our users say