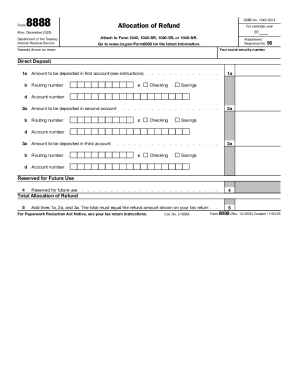

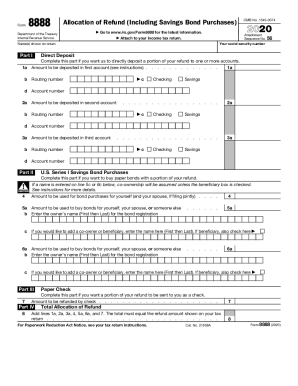

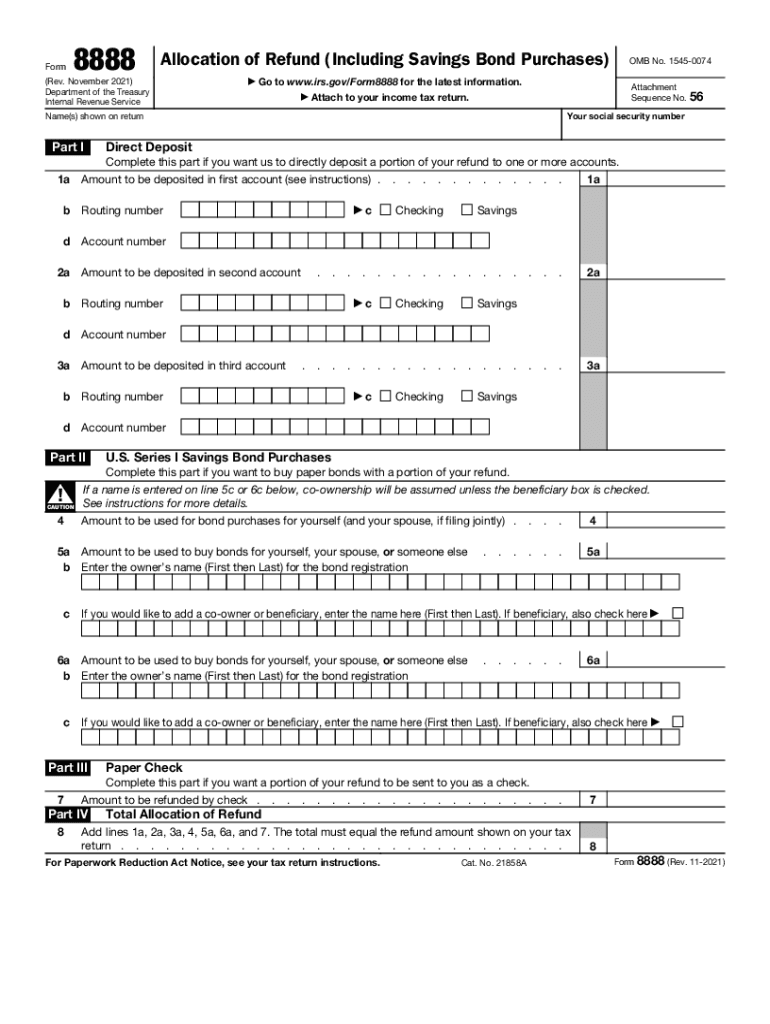

IRS 8888 2021 free printable template

Instructions and Help about IRS 8888

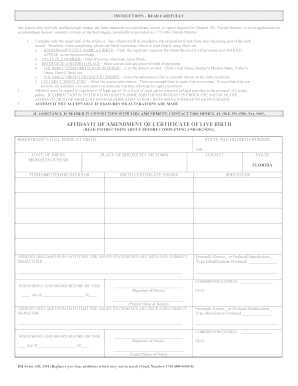

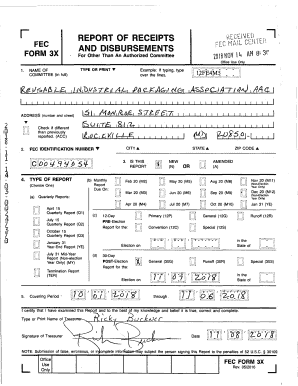

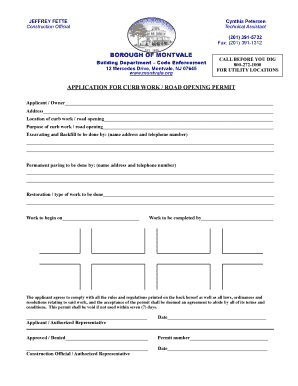

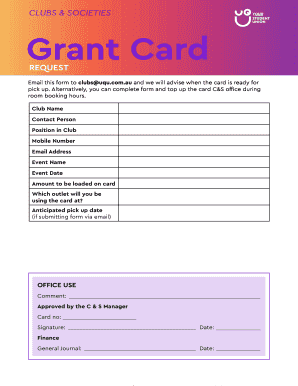

How to edit IRS 8888

How to fill out IRS 8888

About IRS 8888 previous version

What is IRS 8888?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

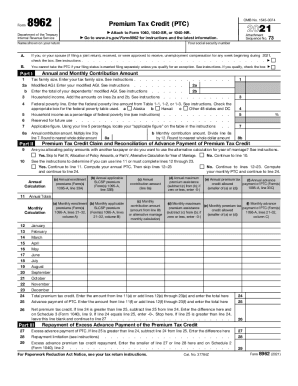

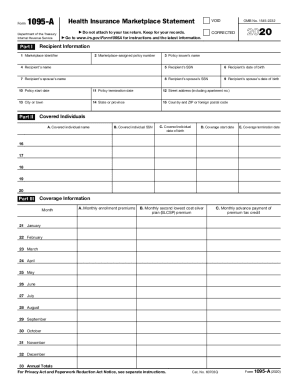

Is the form accompanied by other forms?

FAQ about IRS 8888

What should I do if I realize I made a mistake after filing IRS 8888?

If you discover an error after submitting IRS 8888, you can file an amended return using Form 1040-X. This form allows you to correct mistakes or provide missing information. Ensure to clearly explain the changes and keep a copy of your amended return for your records.

How can I track the status of my IRS 8888 submission?

To track your IRS 8888 submission, visit the IRS website and use the 'Where's My Refund?' tool if you are expecting a refund. This tool can provide information about the processing status of your return. Additionally, keep an eye out for any communications from the IRS regarding your filing.

What should I do if my IRS 8888 submission is rejected?

If your IRS 8888 submission is rejected, the IRS will notify you of the reason through a rejection code. Review this code carefully and correct the identified issues before resubmitting your form electronically. Addressing these mistakes promptly increases the chances of successful processing.

Are there any specific privacy measures I should consider when filing IRS 8888 online?

When filing IRS 8888 online, ensure you use a secure internet connection and reputable e-filing software that adheres to privacy standards. Be cautious with personal information and understand the data retention policies of the platforms you use to protect your information.

Can someone else file IRS 8888 on my behalf?

Yes, someone can file IRS 8888 on your behalf if they are an authorized representative or hold a Power of Attorney (POA). Ensure they have all necessary information to complete the form accurately, and be aware that you may need to sign a specific authorization form allowing this filing.

See what our users say