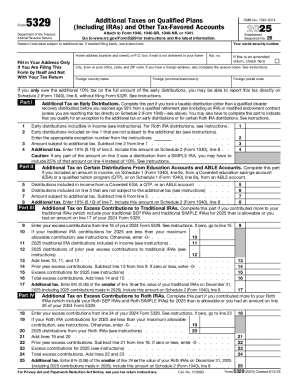

IRS 5329 2021 free printable template

Instructions and Help about IRS 5329

How to edit IRS 5329

How to fill out IRS 5329

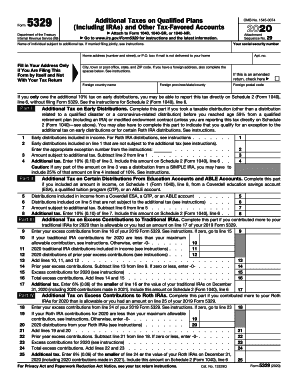

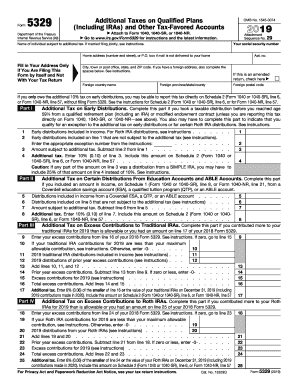

About IRS 5 previous version

What is IRS 5329?

When am I exempt from filling out this form?

Components of the form

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

FAQ about IRS 5329

What should I do if I make an error on my filed IRS 5329?

If you discover an error on your filed IRS 5329, you should amend it by submitting Form 1040-X along with the correction. Ensure you provide an explanation for the correction to avoid complications during processing. It's important to act promptly to mitigate any potential penalties.

How can I verify the status of my IRS 5329 filing?

To verify the status of your IRS 5329 filing, you can use the IRS 'Where's My Refund?' tool if you're due a refund or check your account status on the IRS website. If you e-filed, be mindful of common rejection codes and follow up with corrections if necessary.

Are electronic signatures accepted for IRS 5329?

Yes, electronic signatures are generally accepted for IRS 5329 filings as long as you are using approved e-filing software that meets IRS standards. Make sure your software is up to date to ensure compliance and security.

What should I do if I receive an audit notice regarding my IRS 5329?

If you receive an audit notice related to your IRS 5329, review the notice carefully and gather all relevant documentation to support your filing. Respond promptly and provide the requested information to the IRS to help resolve the inquiry efficiently.

What common errors should I watch for when filing IRS 5329?

Common errors when filing IRS 5329 include incorrect calculations of excise taxes and failure to report all applicable distributions. Double-check your entries and consult IRS instructions to help avoid these pitfalls, ensuring accurate and compliant submissions.

See what our users say