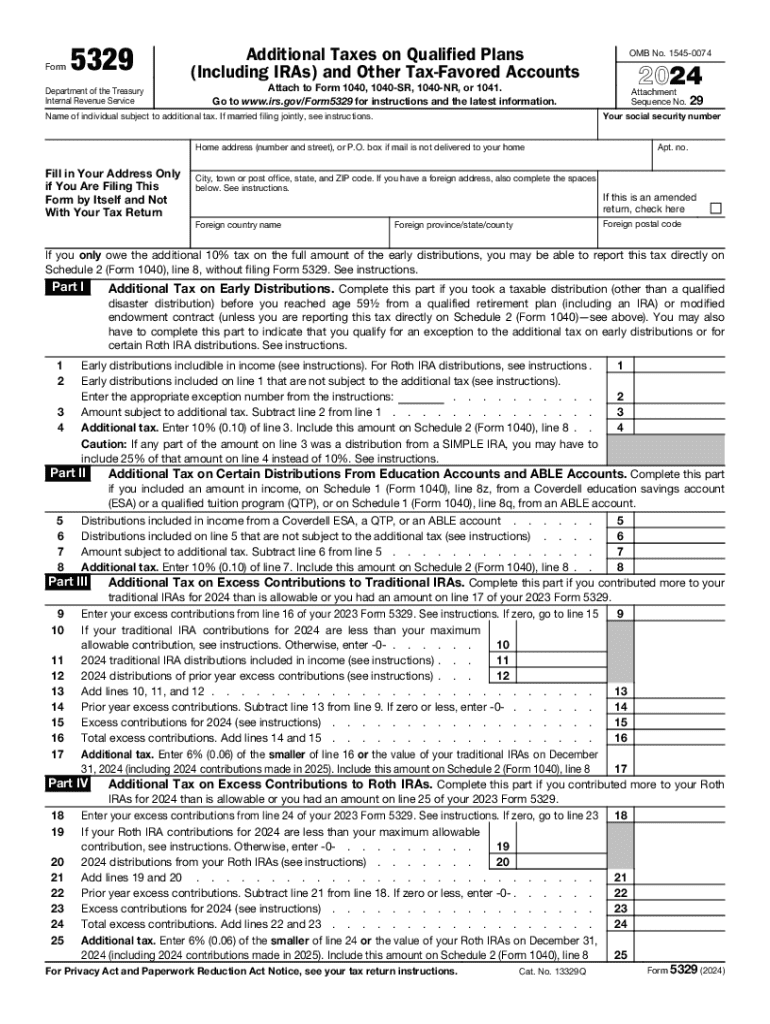

What is irs form 5329?

IRS form 5329 is used to report additional taxes on qualified retirement plans and IRAs. This form is essential for individuals who have taken early distributions or failed to meet mandatory distribution requirements. Ensuring accurate completion of this form can help you avoid unnecessary penalties.

Who needs the form?

You need to file IRS form 5329 if you have taken early distributions from your retirement account, contributed more than the allowed limit to your IRA, or failed to adhere to required minimum distributions. It applies to individual taxpayers who encounter these specific situations throughout the tax year.

Components of the form

The components of IRS form 5329 include various sections that address specific tax situations. Common sections visible on the form are for early distributions, excess contributions, and penalties for not taking required minimum distributions. Each section requires detailed information relevant to the taxpayer's situation. Ensure you review each part thoroughly before submission.

How many copies of the form should I complete?

Typically, you only need to complete one copy of IRS form 5329 for your personal tax filings. However, if you are filing multiple returns or have joint accounts, ensure that each applicable return submits a copy if necessary. Always keep a copy for your records.

What are the penalties for not issuing the form?

The penalties for failing to issue IRS form 5329 can include significant fines, which can accumulate over time. For instance, failing to pay additional taxes related to early distributions can result in a 10% penalty on the amount distributed. Additionally, not adhering to RMD rules may incur a 50% penalty on the required amount that was not withdrawn.

Is the form accompanied by other forms?

IRS form 5329 may need to be accompanied by other forms, primarily if you are filing additional returns related to your tax situation. For instance, if you need to report income or losses from retirement accounts, you may also need to submit forms 1040 or 1040-SR. Always ensure you check IRS guidelines for any necessary accompanying forms.

What is the purpose of this form?

The purpose of IRS form 5329 is to assess any additional taxes that may apply to your retirement account distributions. This includes taxes on early withdrawals, excess contributions, and failure to take required minimum distributions (RMDs). Properly filing this form helps maintain compliance with IRS regulations and avoids potential penalties.

When am I exempt from filling out this form?

You may be exempt from filling out IRS form 5329 in several scenarios. For instance, if you did not take any early distributions, did not exceed contribution limits, or correctly adhered to RMD rules, then you typically do not need to file the form. Confirm your eligibility by reviewing IRS guidelines.

Due date

The due date for IRS form 5329 typically coincides with the federal tax return deadline, which is usually April 15 of each year. If you are filing for an extension, the form must be submitted by the extended deadline. It’s crucial to adhere to this timeline to avoid penalties.

What payments and purchases are reported?

IRS form 5329 reports additional taxes on early distributions from retirement plans, excessive contributions to IRAs, and taxes incurred for not withdrawing required minimum distributions. Regular contributions, typical withdrawals, or distributions that are not classified as penalties are not reported on this form. Carefully track any transactions that fall under the reporting requirements.

What information do you need when you file the form?

When filing IRS form 5329, you need detailed information regarding your retirement accounts, including:

01

Your name and Social Security number.

02

The type and amount of distribution or contribution in question.

03

The basis for any claimed exemptions or calculations relevant to penalties.

This information is crucial for accurately assessing any potential additional taxes.

Where do I send the form?

The submission location for IRS form 5329 depends on whether you are filing by mail or electronically. If filing by mail, send the completed form to the address specified for your location on the IRS website. For electronic submissions, follow the procedures provided by your tax preparation software or service to ensure proper delivery to the IRS database.