IRS 2106 2021 free printable template

Show details

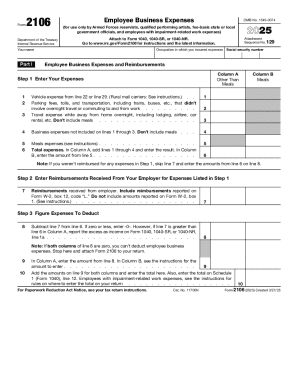

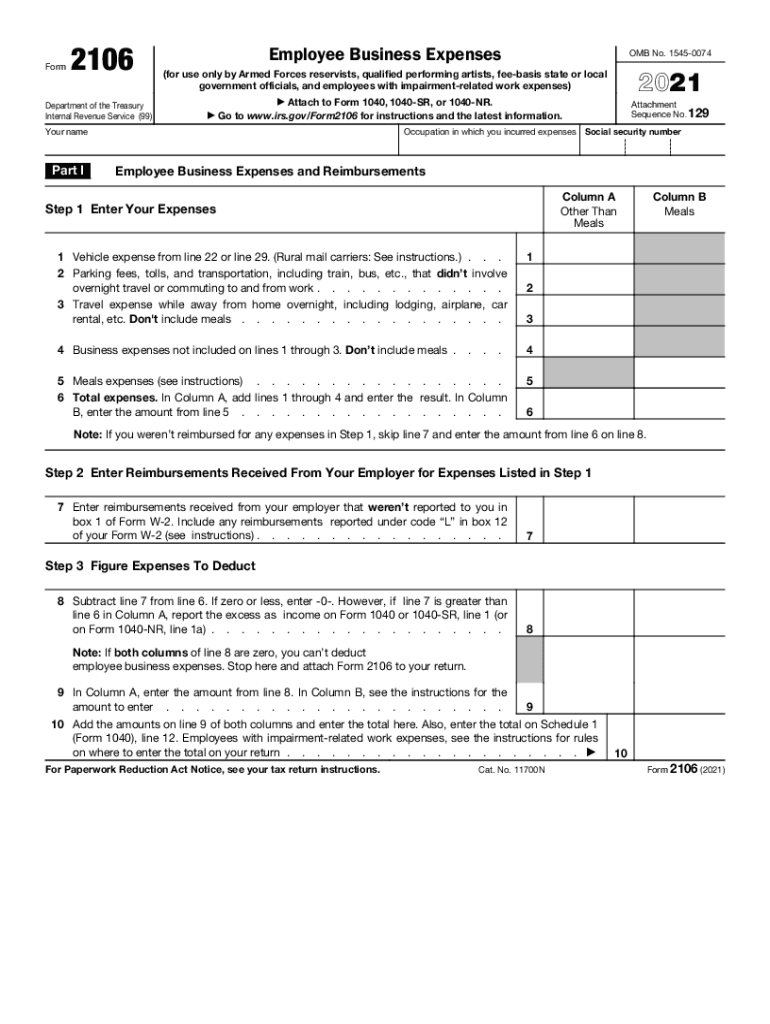

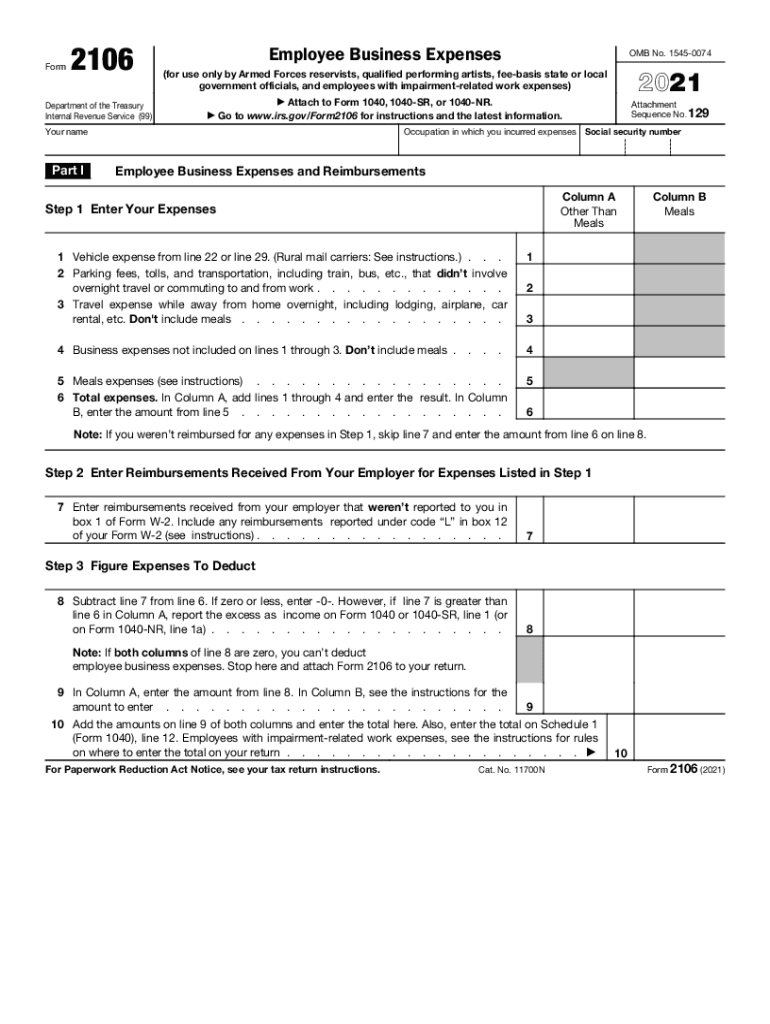

Form2106Department of the Treasury Internal Revenue Service (99)Employee Business Expenses2021(for use only by Armed Forces reservists, qualified performing artists, fee basis state or local government

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 2106

Edit your IRS 2106 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 2106 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 2106 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 2106. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 2106 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 2106

How to fill out IRS 2106

01

Obtain Form 2106 from the IRS website or your tax preparation software.

02

Fill out your identifying information, including your name, address, and Social Security number at the top of the form.

03

Indicate whether you are an employee or a statutory employee.

04

Provide details of your vehicle expenses, including the total miles driven for the year and the miles driven for business purposes.

05

Itemize your actual car expenses, if applicable, such as gas, repairs, insurance, and depreciation, or choose to use the standard mileage rate.

06

Fill in any other deductible expenses related to business use, including meals and entertainment costs.

07

Total your expenses and calculate your deduction.

08

Review the form for accuracy and completeness before submitting it with your tax return.

Who needs IRS 2106?

01

Employees who incur unreimbursed business expenses related to their job, particularly those who use their vehicle for work purposes.

02

Statutory employees who can deduct business expenses to lower their taxable income.

Fill

form

: Try Risk Free

People Also Ask about

Can you still use form 2106?

Form 2106 may be used only by Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses because of the suspension of miscellaneous itemized deductions subject to the 2% floor under section 67(a) by section 67(g).

Is form 2106 still used in 2022?

There was another version of the form. Form 2106-EZ: Unreimbursed Employee Business Expenses was a simplified version and was used by employees claiming a tax deduction because of unreimbursed expenses related to their jobs. This form was discontinued after 2018 after the Tax Cuts and Jobs Act (TCJA) went into effect.

When was form 2106 eliminated?

Key Takeaways. Form 2106-EZ was used by employees to deduct job-related expenses, including meals, hotels, airfare, and vehicle expenses. This form was discontinued after 2018 after the Tax Cuts and Jobs Act repealed all unreimbursed employee expense deductions.

Who can use form 2106 in 2020?

Use Form 2106 if you were an Armed Forces reservist, qualified performing artist, fee-basis state or local government official, or employee with impairment-related work expenses.

What is a 2106 form used for?

Employees file this form to deduct ordinary and necessary expenses for their job. An ordinary expense is one that is common and accepted in your field of trade, business, or profession. A necessary expense is one that is helpful and appropriate for your business.

Is form 2106 still allowed?

Form 2106 may be used only by Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses because of the suspension of miscellaneous itemized deductions subject to the 2% floor under section 67(a) by section 67(g).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 2106?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the IRS 2106 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in IRS 2106?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your IRS 2106 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my IRS 2106 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your IRS 2106 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is IRS 2106?

IRS Form 2106 is a form used by employees to report their unreimbursed employee business expenses for the purpose of tax deductions.

Who is required to file IRS 2106?

Employees who have unreimbursed business expenses related to their job, and who are not reimbursed by their employer, are required to file IRS Form 2106.

How to fill out IRS 2106?

To fill out IRS Form 2106, taxpayers must provide information about their business expenses, including travel, vehicle costs, meals, and entertainment expenses, and calculate the total deductions they can claim.

What is the purpose of IRS 2106?

The purpose of IRS Form 2106 is to allow employees to deduct certain business expenses that were not reimbursed by their employer, reducing their taxable income.

What information must be reported on IRS 2106?

On IRS Form 2106, taxpayers must report details of their business expenses, including the amount spent on travel, meals, transportation, and any other unreimbursed expenses related to their job.

Fill out your IRS 2106 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 2106 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.