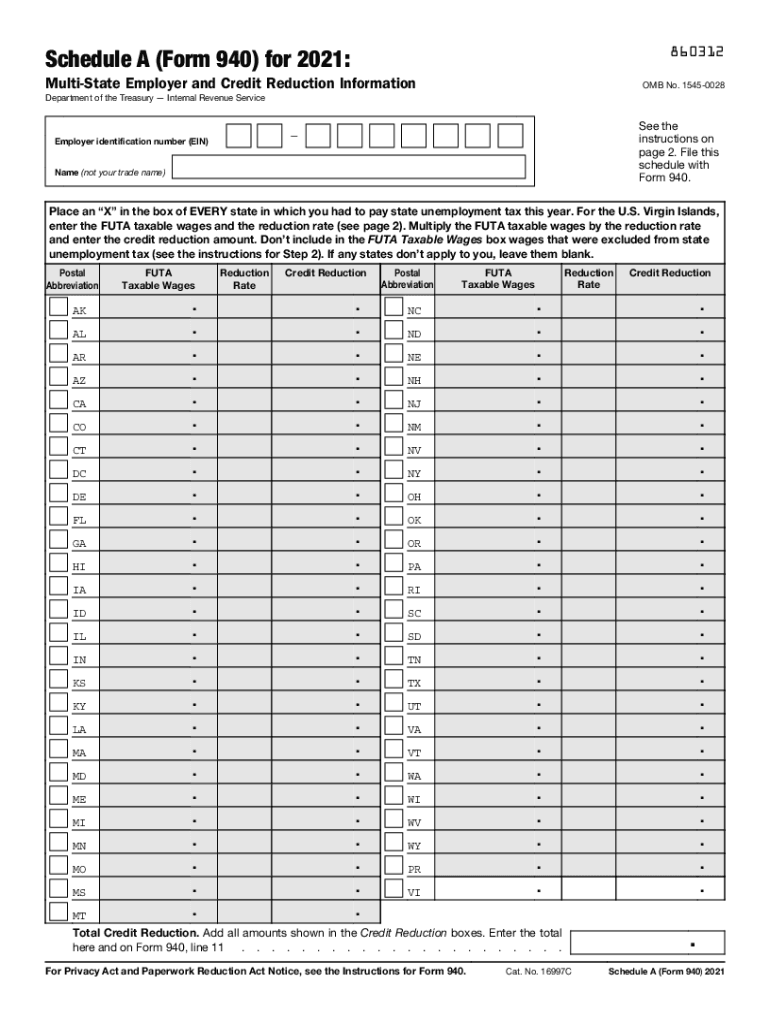

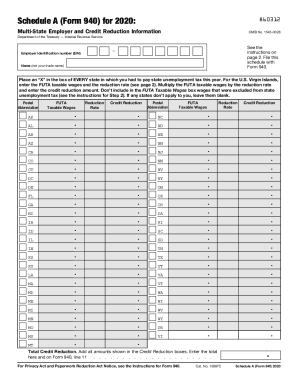

Who files Schedule A (Form 940)?

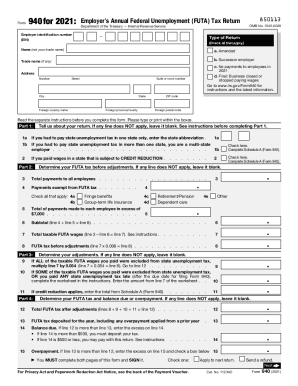

An employer must file Form 940 if it

- paid wages of $1,500 or more to employees in any calendar quarter during 2015 or 2016, or

- had one or more employees for at least some part of a day in any 20 or more different weeks in 2015 or 20 or more different weeks in 2016. All full-time, part-time, and temporary employees should be counted.

For 2016, there are credit reduction states. If the employer paid any wages that are subject to the unemployment compensation laws of a credit reduction state, its credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit reduction state. The employer uses Schedule A (Form 940) to figure the credit reduction.

If the employer is a multi-state employer, it must check the box on line 1b of Form 940, fill out Schedule A and attach it to your Form 940.

What is the Purpose of Schedule A (Form 940)?

Employers use Form 940 for the purpose of reporting the annual Federal Unemployment Tax Act (FTA) tax. Together with state unemployment tax systems, the FTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only employers pay FTA tax. Don't collect or deduct FTA tax from your employees' wages.

The FTA tax applies to the first $7,000 paid to each employee during a calendar year after subtracting any payments exempt from FTA tax.

When is Schedule A Due?

The due date for filing Form 940 for 2016 including Schedule A is January 31st, 2017. If you deposited all your FTA tax when it was due, you may file Form 940 until February 10th, 2017.

How do I Fill out Schedule A?

Step 1. Place an “X” in the box of every state where you had to pay state unemployment taxes this year, even if the state's credit reduction rate is zero.

Step 2. In the FTA Taxable Wages box, enter the total FTA taxable wages that you paid in that state. (The FTA wage base for all states is $7,000.) Do not include in the FTA Taxable Wages box wages that were excluded from state unemployment tax.

Step 3. To calculate the total credit reduction, add up all the Credit Reduction boxes and enter the amount in the Total Credit Reduction box. Finally, enter the total credit reduction on Form 940, line 11.

Where do I Send Schedule A?

The IRS Instructions for Form 940 contain addresses where you can send Form 940 and Schedule A attached to it. You can find the instructions at https://www.irs.gov/pub/irs-pdf/i940.pdf