IRS 940 2021 free printable template

Show details

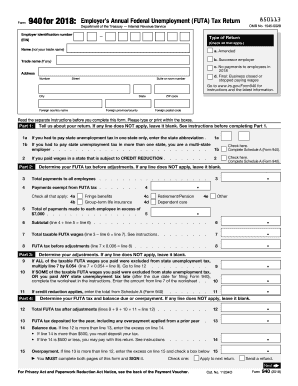

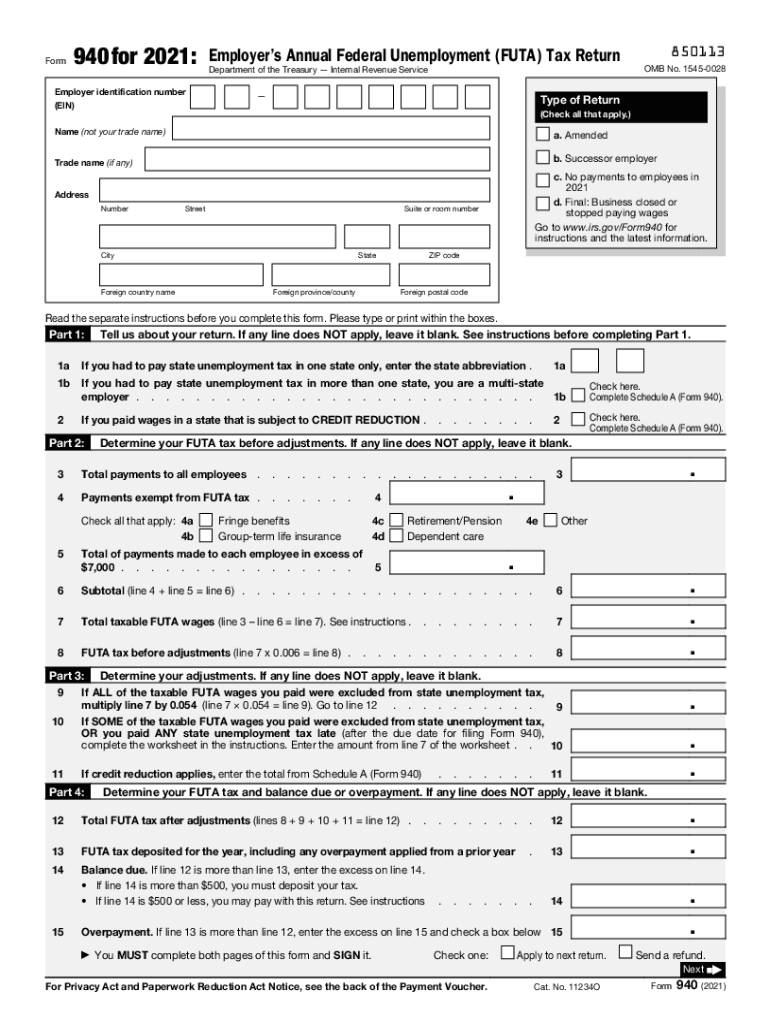

23 min. Preparing copying assembling and sending the form to the IRS. 1 hr. 36 min. If you have comments concerning the accuracy of these time estimates or suggestions for making Form 940 simpler we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to Internal Revenue Service Tax Forms and Publications Division 1111 Constitution Ave. NW IR-6526 Washington DC 20224. Don t send Form 940 to this address. Instead see Where Do You...File in the Instructions for Form 940. Box 1 Employer Identification Number EIN. If you don t have an EIN you may apply for one online by visiting the IRS website at www.irs.gov/EIN. You may also apply for an EIN by faxing or mailing Form SS-4 to the IRS. If you haven t received your EIN by the due date of Form 940 write Applied For and the date you applied in this entry space. Form 940 for 2018 Employer s Annual Federal Unemployment FUTA Tax Return Department of the Treasury Internal Revenue...Service Employer identification number EIN 850113 OMB No. 1545-0028 Type of Return Check all that apply. Name not your trade name a. Amended Trade name if any b. Successor employer c. No payments to employees in d. Final Business closed or stopped paying wages Go to www.irs.gov/Form940 for instructions and the latest information. Address Number Street Suite or room number City ZIP code State Foreign country name Foreign postal code Foreign province/county Read the separate instructions before...you complete this form. Please type or print within the boxes. Don t staple Form 940-V or your payment to Form 940 or to each other. Detach Form 940-V and send it with your payment and Form 940 to the address provided in the Instructions for Note You must also complete the entity information above Part 1 on Form 940. See When Must You Deposit Your FUTA Tax in the Instructions for Form 940. Also see sections 11 and 14 of Pub. 15 for more information about deposits. Use Form 940-V when making any...payment with Form 940. However if you pay an amount with Form 940 that should ve been deposited you CAUTION may be subject to a penalty. If your total FUTA tax after adjustments Form 940 line 12 is more than 500 you must make deposits by electronic funds transfer. Name not your trade name a* Amended Trade name if any b. Successor employer c* No payments to employees in d. Final Business closed or stopped paying wages Go to www*irs*gov/Form940 for instructions and the latest information* Address...Number Street Suite or room number City ZIP code State Foreign country name Foreign postal code Foreign province/county Read the separate instructions before you complete this form* Please type or print within the boxes. Part 1 Tell us about your return* If any line does NOT apply leave it blank. See instructions before completing Part 1. 1a If you had to pay state unemployment tax in one state only enter the state abbreviation. 1b employer. Part 2. Determine your FUTA tax before adjustments. If...any line does NOT apply leave it blank. Total payments to all employees.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 940

How to edit IRS 940

How to fill out IRS 940

Instructions and Help about IRS 940

How to edit IRS 940

To edit IRS 940 efficiently, utilize pdfFiller's document editing tools. Start by uploading the downloaded IRS 940 form to pdfFiller. Once uploaded, you can add text, checkboxes, or signatures as required. After making all necessary changes, save the document to ensure your edits are retained.

How to fill out IRS 940

To fill out IRS 940, follow these steps:

01

Download the latest IRS 940 form from the IRS website or access it through a tax software.

02

Complete the employer information section, which includes your business name, address, and EIN.

03

Report the total taxable payroll, including payments to your employees.

04

Calculate the FUTA tax owed and provide the totals on the form.

05

Sign and date the form before submitting it to the appropriate IRS address.

About IRS previous version

What is IRS 940?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 940?

IRS 940 is the Employer's Annual Federal Unemployment (FUTA) Tax Return. This form is used by employers to report and pay FUTA taxes, which fund unemployment compensation for workers who have lost their jobs. The tax is levied on the first $7,000 of wages paid to each employee in a calendar year.

What is the purpose of this form?

The primary purpose of IRS 940 is to collect FUTA taxes owed by employers. It ensures that employers contribute to the federal unemployment insurance system, which provides benefits to eligible unemployed workers. This form also helps the IRS monitor compliance and verify the correct payment of unemployment taxes.

Who needs the form?

Employers who pay wages of $1,500 or more in any calendar quarter or have at least one employee for any portion of a day in any 20 or more different weeks during the current or previous year must file IRS 940. This requirement applies to businesses, non-profits, and government agencies that meet the specified criteria.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 940 if your business did not have any employees during the year. Additionally, if you only pay wages to individuals who are not subject to FUTA taxes, such as certain state or local government employees, you would also be exempt from filing this form.

Components of the form

IRS 940 consists of several essential components, including fields for reporting your business information, total taxable wages, calculation of the FUTA tax owed, and credits for state unemployment taxes. Each section requires accurate figures to avoid discrepancies in tax liability.

What are the penalties for not issuing the form?

Failure to file IRS 940 by the due date may result in penalties. The IRS imposes a penalty of 5% of the unpaid tax amount for each month the return is late, with a maximum penalty of 25%. Additionally, inaccuracies or fraudulent claims can lead to further penalties, including fines and potential legal action.

What information do you need when you file the form?

When filing IRS 940, you will need the following information:

01

Your Employer Identification Number (EIN).

02

Business name and address.

03

Total wages paid to employees subject to FUTA taxes.

04

FUTA tax calculations and any applicable credits for state unemployment taxes.

Is the form accompanied by other forms?

IRS 940 may not need to be accompanied by other forms unless specific circumstances apply, such as claiming a credit for state unemployment taxes. In such cases, you might need to provide additional documentation supporting your claims.

Where do I send the form?

The completed IRS 940 form should be sent to the address specified in the form's instructions, which varies based on whether you are including a payment. If no payment is required, the form may be filed electronically or sent to a designated processing center as indicated in the IRS guidelines.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

What do you like best?<br>

Great support team with quick responses.

<br>What do you dislike?<br>

Don't dislike anything at this time. It is user friendly for what I need to complete.

<br>What problems are you solving with the product? What benefits have you realized?<br>

Great tool to add and delete from forms.

What do you like best?<br>

The forms are easy to access real time and are user friendly.

<br>What do you dislike?<br>

There wasn’t anything that I disliked about using the forms.

<br>What problems are you solving with the product? What benefits have you realized?<br>

The forms have proven very useful in the preparation and filing of business income taxes.

See what our users say