AL DoR PTE-V 2019-2026 free printable template

Show details

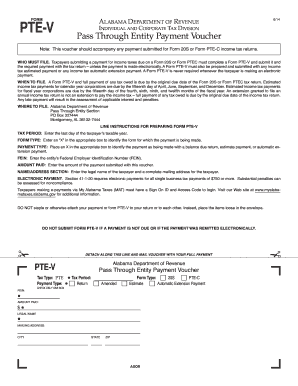

FORMPTEVAlAbAmA Department of revenue

Individual And CorPorATE Tax Divisions Through Entity Payment voucherNote: This voucher should accompany any non-electronic payments submitted for Form 20S or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign alabama pte v form

Edit your alabama pte v form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL DoR PTE-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AL DoR PTE-V online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AL DoR PTE-V. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL DoR PTE-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL DoR PTE-V

How to fill out AL DoR PTE-V

01

Gather all necessary personal and business information.

02

Download the AL DoR PTE-V form from the official website.

03

Fill out the header with your name and contact information.

04

Provide your business's legal name and address.

05

Include your Alabama business entity number, if applicable.

06

List the total amount of tax due.

07

Sign and date the form at the bottom.

08

Submit the completed form by the deadline either online or via mail.

Who needs AL DoR PTE-V?

01

Any business entity operating in Alabama that has made certain eligible payments.

02

Taxpayers seeking to claim a refund or credit for specific taxes.

03

Individuals or organizations registered for taxation in Alabama.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of PTE in tax?

The pass-through entity (PTE) tax strategy is a work around to the limitation on the State and Local tax (SALT) deduction created by the Tax Cuts and Jobs Act (TCJA).

What is Alabama form Pte V?

Estimated tax payments made by check should be submitted with the form PTE-V and mailed to the address provided on this form.

What is a PTE tax return?

Pass-through entity (PTE) elective tax. Credits. Pass-through elective tax.

What is the Alabama privilege tax rate for 2023?

Alabama has changed the minimum tax due on the Alabama privilege tax forms. On AL Forms BPT-IN, PPT, and CPT the minimum tax has been reduced from $100 to $50 for 2023. Privilege tax is filed and paid for the upcoming tax year, so the forms are dated for the next tax year in the current year software (links below).

What is pass-through entity tax Alabama?

A pass-through entity must provide a tax return that shows the total amount paid or credited to its nonresident members. A pass-through entity is also required to provide its nonresident members with a record of Alabama income tax remitted to the Alabama Department of Revenue.

What is the Alabama privilege tax for 2023?

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

What is the Ptet tax rate in Alabama?

This allows taxpayers to make the election on a profitable entity, and not on a loss entity that wouldn't receive a benefit under the election. The entity level tax is 5% of Alabama apportioned taxable income, not Federal income.

How is the Alabama business privilege tax calculated?

The tax is calculated on net worth plus additions, minus exclusions, times the apportionment factor, less the deductions, which equals taxable net worth. The rate is based on the ability to pay and is determined by the entity's federal taxable income apportioned to Alabama.

How to file a final Alabama business privilege tax return?

How to File Your Alabama Business Privilege Tax Return Find your business entity's due date and determine your filing fees. Download and complete your tax return. File your return and pay your business privilege tax.

What is Alabama Form Pte V?

Estimated tax payments made by check should be submitted with the form PTE-V and mailed to the address provided on this form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AL DoR PTE-V?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the AL DoR PTE-V in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in AL DoR PTE-V?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your AL DoR PTE-V to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit AL DoR PTE-V on an Android device?

You can edit, sign, and distribute AL DoR PTE-V on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is AL DoR PTE-V?

AL DoR PTE-V is a form used in Alabama for reporting the income, deductions, and credits of pass-through entities such as partnerships and S corporations.

Who is required to file AL DoR PTE-V?

Pass-through entities doing business in Alabama are required to file AL DoR PTE-V, including partnerships and S corporations that need to report their income and distributions to their partners or shareholders.

How to fill out AL DoR PTE-V?

To fill out AL DoR PTE-V, businesses need to provide their entity information, report total income, allowable deductions, and credits, and allocate income or loss to each partner or shareholder according to their ownership percentages.

What is the purpose of AL DoR PTE-V?

The purpose of AL DoR PTE-V is to ensure that pass-through entities report their financial activities accurately for tax purposes, facilitating the proper taxation of income that is passed on to individual partners or shareholders.

What information must be reported on AL DoR PTE-V?

The AL DoR PTE-V must report the entity's name, tax identification number, income, deductions, credits, and detailed allocations of income or loss to each partner or shareholder.

Fill out your AL DoR PTE-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL DoR PTE-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.