AL DoR PTE-V 2014 free printable template

Show details

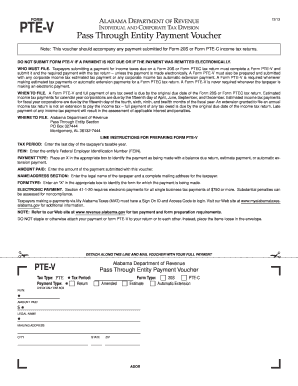

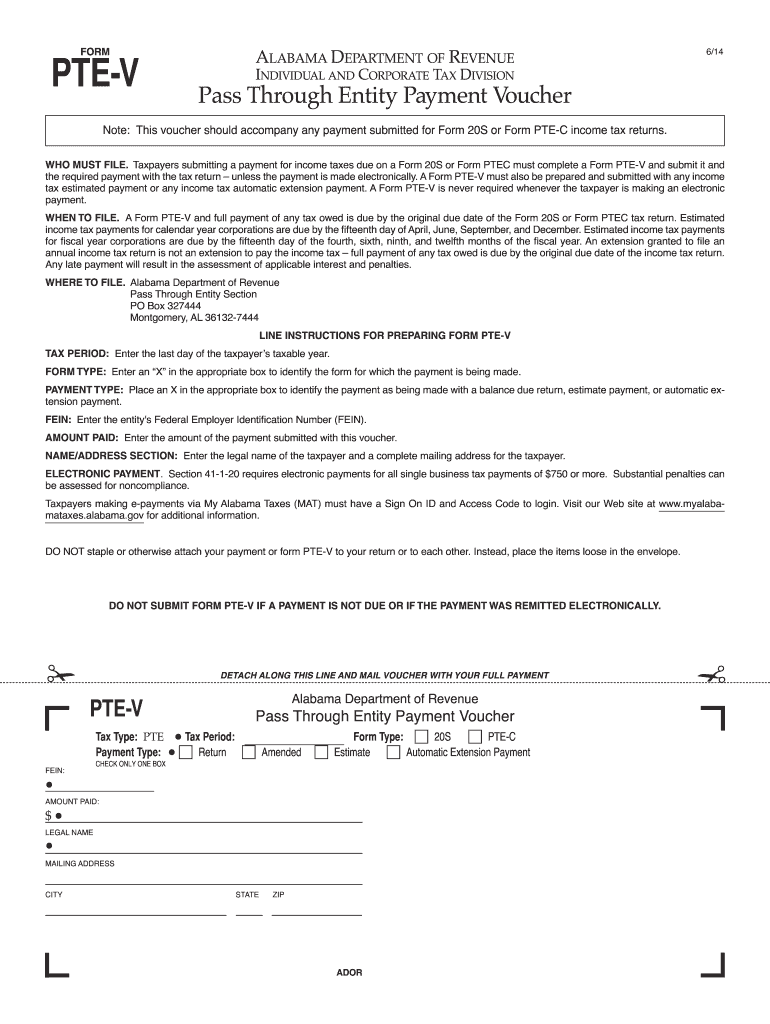

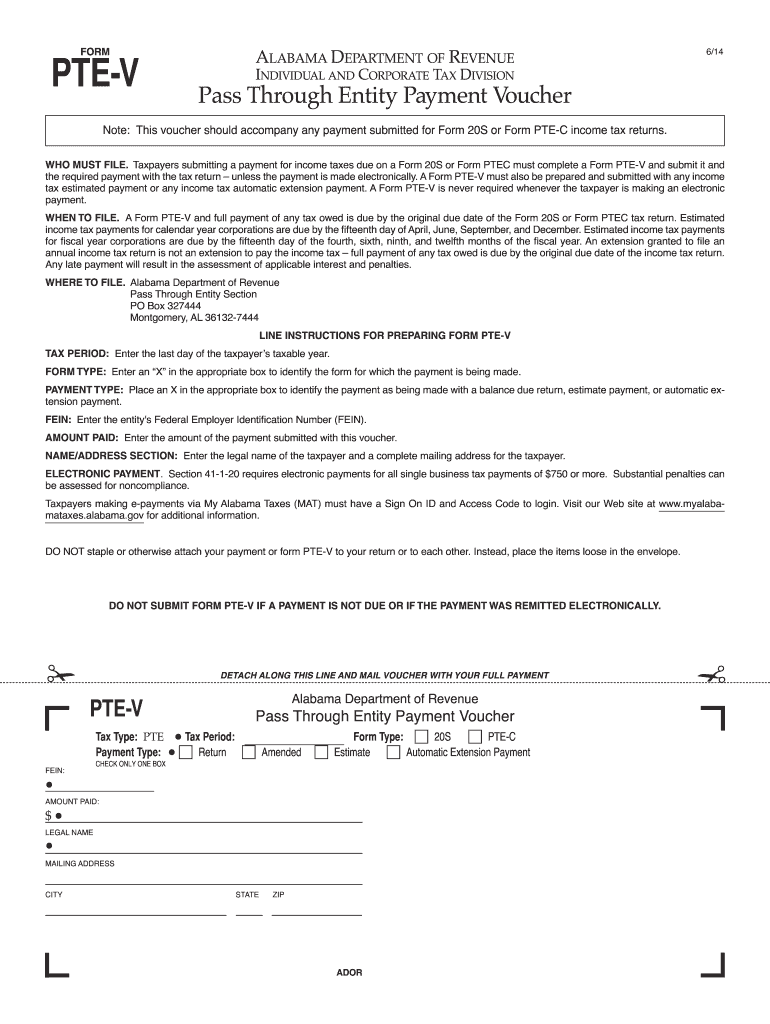

FORMPTEV6/14AlAbAmA Department of revenue Individual And CorPorATE Tax Divisions Through Entity Payment voucherNote: This voucher should accompany any payment submitted for Form 20S or Form PTC income

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL DoR PTE-V

Edit your AL DoR PTE-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL DoR PTE-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AL DoR PTE-V online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AL DoR PTE-V. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL DoR PTE-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL DoR PTE-V

How to fill out AL DoR PTE-V

01

Gather all necessary personal and business information required for the form.

02

Open the AL DoR PTE-V form from the official website or office.

03

Fill in your name, address, and contact details in the designated sections.

04

Provide your business details, including name, address, and Tax ID.

05

Indicate the type of business entity you are reporting for.

06

Enter all required financial data accurately, including income and expenses.

07

Review all entries for accuracy to avoid mistakes.

08

Sign and date the form at the designated area.

09

Submit the completed form according to the instructions provided, either electronically or by mail.

Who needs AL DoR PTE-V?

01

Individuals or businesses that are required to report their personal property taxes in Alabama.

02

Partners or owners of pass-through entities like partnerships and S corporations.

03

Anyone who has taxable personal property in Alabama that needs to be reported annually.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of PTE in tax?

The pass-through entity (PTE) tax strategy is a work around to the limitation on the State and Local tax (SALT) deduction created by the Tax Cuts and Jobs Act (TCJA).

What is Alabama form Pte V?

Estimated tax payments made by check should be submitted with the form PTE-V and mailed to the address provided on this form.

What is a PTE tax return?

Pass-through entity (PTE) elective tax. Credits. Pass-through elective tax.

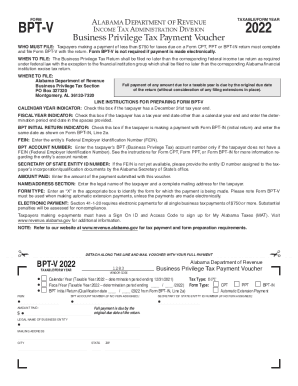

What is the Alabama privilege tax rate for 2023?

Alabama has changed the minimum tax due on the Alabama privilege tax forms. On AL Forms BPT-IN, PPT, and CPT the minimum tax has been reduced from $100 to $50 for 2023. Privilege tax is filed and paid for the upcoming tax year, so the forms are dated for the next tax year in the current year software (links below).

What is pass-through entity tax Alabama?

A pass-through entity must provide a tax return that shows the total amount paid or credited to its nonresident members. A pass-through entity is also required to provide its nonresident members with a record of Alabama income tax remitted to the Alabama Department of Revenue.

What is the Alabama privilege tax for 2023?

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

What is the Ptet tax rate in Alabama?

This allows taxpayers to make the election on a profitable entity, and not on a loss entity that wouldn't receive a benefit under the election. The entity level tax is 5% of Alabama apportioned taxable income, not Federal income.

How is the Alabama business privilege tax calculated?

The tax is calculated on net worth plus additions, minus exclusions, times the apportionment factor, less the deductions, which equals taxable net worth. The rate is based on the ability to pay and is determined by the entity's federal taxable income apportioned to Alabama.

How to file a final Alabama business privilege tax return?

How to File Your Alabama Business Privilege Tax Return Find your business entity's due date and determine your filing fees. Download and complete your tax return. File your return and pay your business privilege tax.

What is Alabama Form Pte V?

Estimated tax payments made by check should be submitted with the form PTE-V and mailed to the address provided on this form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute AL DoR PTE-V online?

With pdfFiller, you may easily complete and sign AL DoR PTE-V online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the AL DoR PTE-V in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your AL DoR PTE-V in seconds.

How do I fill out AL DoR PTE-V using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign AL DoR PTE-V and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is AL DoR PTE-V?

AL DoR PTE-V is a specific form used for reporting certain financial information for pass-through entities in Alabama.

Who is required to file AL DoR PTE-V?

Pass-through entities such as partnerships, limited liability companies, and S corporations operating in Alabama are required to file AL DoR PTE-V.

How to fill out AL DoR PTE-V?

To fill out AL DoR PTE-V, gather the necessary financial information, follow the instructions provided with the form carefully, and complete all required sections before submission.

What is the purpose of AL DoR PTE-V?

The purpose of AL DoR PTE-V is to report income, deductions, and credits of pass-through entities to ensure compliance with Alabama tax regulations.

What information must be reported on AL DoR PTE-V?

Information that must be reported on AL DoR PTE-V includes entity identification details, income, deductions, credits, and any other financial data relevant for tax assessment.

Fill out your AL DoR PTE-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL DoR PTE-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.