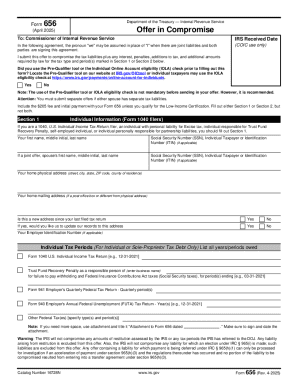

IRS 656 2024 free printable template

Instructions and Help about 656 pdf

How to edit 656 pdf

How to fill out 656 pdf

Latest updates to 656 pdf

All You Need to Know About 656 pdf

What is 656 pdf?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 656

What should I do if I need to correct an error on my submitted 656 pdf?

If you discover an error after submitting your 656 pdf, you can file an amended return. It's essential to clearly mark the form as 'Amended' and include any necessary documentation that supports the correction. Keep a copy of the amended form for your records.

How can I verify the status of my submitted 656 pdf?

To track the status of your submitted 656 pdf, you can check online through the relevant government portal or contact customer service. Ensure to have your submission details handy, as common e-file rejection codes can also be found in their help sections.

Are there any common errors that filers make with the 656 pdf?

Common errors include incorrect taxpayer identification numbers, missing signatures, or incomplete information. To avoid these mistakes, double-check all entries before submission and refer to the filing instructions for guidance.

What happens if I receive a notice after filing the 656 pdf?

If you receive a notice or letter regarding your 656 pdf, carefully read the communication for instructions. Gather and prepare any requested documentation and respond promptly to avoid further issues or delays.

Is e-filing the 656 pdf secure, and what are the requirements?

Yes, e-filing the 656 pdf is designed to be secure. Ensure you are using compatible software and browsers as specified by the forms' guidelines. Additionally, maintain a stable internet connection and keep your personal data protected during the process.