TX 1099-R TRS Information 2020 free printable template

Show details

Are you a retiree, beneficiary or a former member who received payments from TRS in 2020, such as annuity payments,

death benefits or a refund? If so, TRS began mailing 1099R forms for tax year 2020

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX 1099-R TRS Information

Edit your TX 1099-R TRS Information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX 1099-R TRS Information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

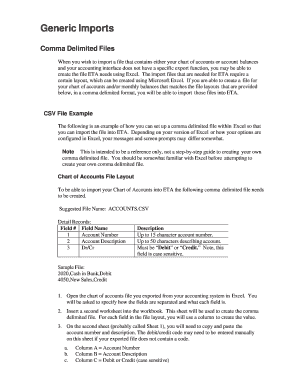

How to edit TX 1099-R TRS Information online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX 1099-R TRS Information. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX 1099-R TRS Information Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX 1099-R TRS Information

How to fill out TX 1099-R TRS Information

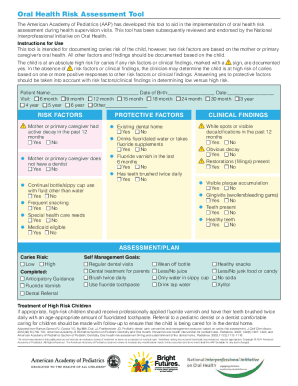

01

Gather all required personal identification information such as Social Security number and address.

02

Collect all relevant financial information, including the total distribution amount and any tax withheld.

03

Obtain the TX 1099-R form from the appropriate authority or financial institution.

04

In Box 1, enter the total amount of taxable distribution received.

05

In Box 2a, indicate the taxable amount (if different from Box 1).

06

In Box 4, report any federal income tax withheld from the distribution.

07

Complete Boxes 10-13 with the necessary details related to the distribution, such as plan number and distribution code.

08

Double-check for accuracy, ensuring all information conforms to IRS guidelines.

09

Sign and date the document if required, and submit it to the IRS and the recipient by the deadline.

Who needs TX 1099-R TRS Information?

01

Individuals who received distributions from retirement plans or pensions.

02

Taxpayers who need to report retirement income on their federal tax returns.

03

Financial institutions that must issue the form on behalf of their clients.

04

States that require reporting of retirement income for state tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate teacher retirement age in Texas?

Normal Age Retirement Age 65 with five or more years of service credit, or. At least age 60, meets the Rule of 80 (combined age and years of service credit equal at least 80), and have at least five years of service credit.

How long does Texas TRS refund take?

Generally, a refund payment will be issued within 60 days after all required documents have been received and your employer's monthly payroll report has been processed by TRS. The process can take up to 90 days depending upon your last date(s) of employment.

What is TRS formula?

To calculate TRS retirement benefits, use the following formula: Multiply your years of service credit by 2.3%. (Example: if you have 30 years of service credit in TRS, 30 x 2.3 = 69%.) Determine the average of your five highest years of salary.

What is the TRS formula in Texas?

Average Salary = Average of Three Highest Annual Salaries Total Percent = Total Years of Service Credit x 2.3% Annual Annuity = Total Percent x Average Salary Monthly Annuity = Annual Annuity ÷ 12 Retirement annuity calculators are available on the TRS website through MyTRS to assist you.

How much does Texas TRS take out of paycheck?

You contribute 7.7% of your salary. Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the IRS.

Is TRS mandatory in Texas?

All employees of the Texas public education system whose employment qualifies as covered employment must participate in TRS unless an exception to TRS membership applies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX 1099-R TRS Information for eSignature?

When you're ready to share your TX 1099-R TRS Information, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in TX 1099-R TRS Information without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing TX 1099-R TRS Information and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the TX 1099-R TRS Information form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign TX 1099-R TRS Information and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is TX 1099-R TRS Information?

TX 1099-R TRS Information is a tax form used to report distributions from retirement plans, specifically for members of the Teacher Retirement System (TRS) in Texas.

Who is required to file TX 1099-R TRS Information?

Entities that make distributions from Texas Teacher Retirement System accounts are required to file TX 1099-R TRS Information.

How to fill out TX 1099-R TRS Information?

To fill out TX 1099-R TRS Information, you need to provide details such as the recipient's information, the type of distribution, tax withheld, and any other pertinent information as required by the form instructions.

What is the purpose of TX 1099-R TRS Information?

The purpose of TX 1099-R TRS Information is to report income received from retirement benefits to the IRS and to the recipients for tax purposes.

What information must be reported on TX 1099-R TRS Information?

Information that must be reported includes the amount of distribution, recipient's name and address, tax identification number, distribution code, and any federal income tax withheld.

Fill out your TX 1099-R TRS Information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX 1099-R TRS Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.