TX 1099-R TRS Information 2021 free printable template

Show details

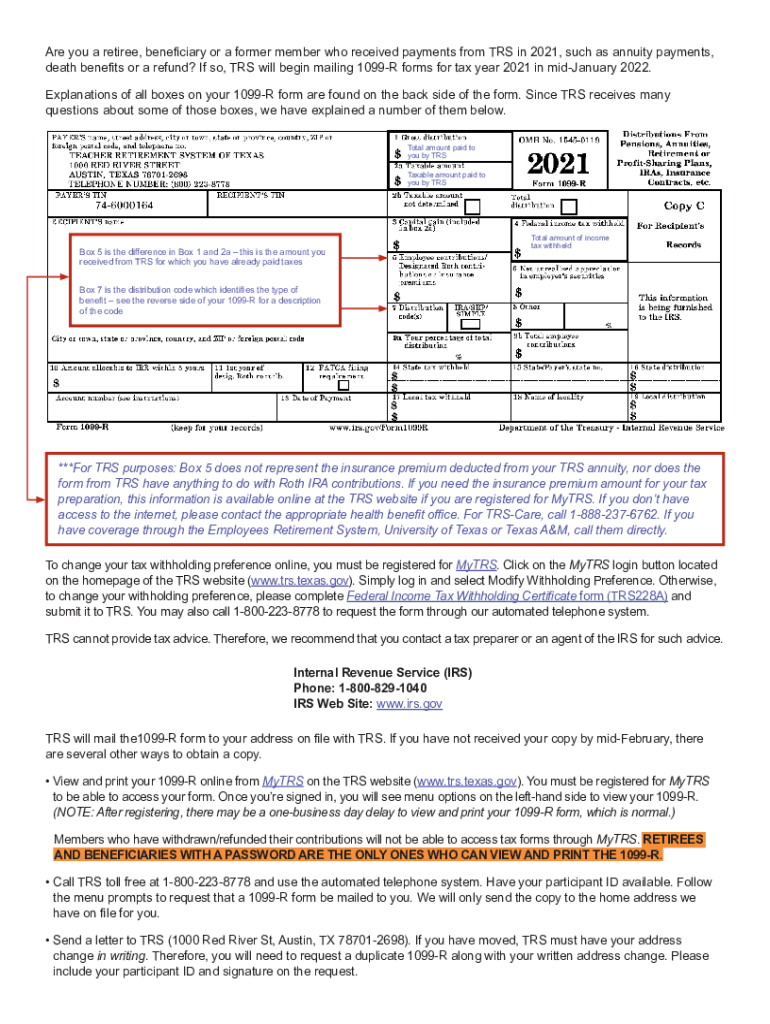

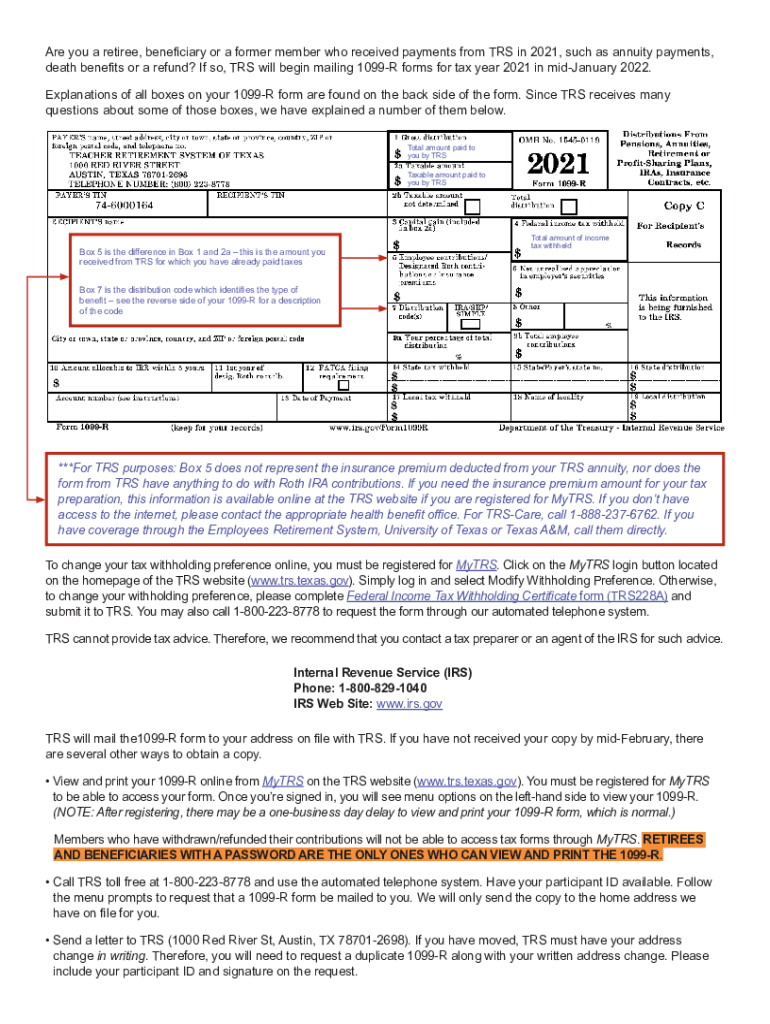

Are you a retiree, beneficiary or a former member who received payments from TRS in 2021, such as annuity payments, death benefits or a refund? If so, TRS will begin mailing 1099R forms for tax year

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX 1099-R TRS Information

Edit your TX 1099-R TRS Information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX 1099-R TRS Information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX 1099-R TRS Information online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX 1099-R TRS Information. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX 1099-R TRS Information Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX 1099-R TRS Information

How to fill out TX 1099-R TRS Information

01

Gather necessary personal information such as your name, address, and Social Security number.

02

Obtain the total distribution amount to report from your records.

03

Fill in the recipient's information accurately, including details such as account number if applicable.

04

Indicate the correct distribution code in box 7 based on the type of distribution received.

05

Complete the payer’s information including name, address, and EIN (Employer Identification Number).

06

Verify that all information is correct and matches with supporting documents.

07

File the form with the IRS and provide copies to the recipients by the due dates.

Who needs TX 1099-R TRS Information?

01

Individuals who received distributions from a pension or retirement plan.

02

Payers or plan administrators reporting distributions to the IRS.

03

Tax professionals assisting clients with tax preparations involving retirement distributions.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate teacher retirement age in Texas?

Normal Age Retirement Age 65 with five or more years of service credit, or. At least age 60, meets the Rule of 80 (combined age and years of service credit equal at least 80), and have at least five years of service credit.

How long does Texas TRS refund take?

Generally, a refund payment will be issued within 60 days after all required documents have been received and your employer's monthly payroll report has been processed by TRS. The process can take up to 90 days depending upon your last date(s) of employment.

What is TRS formula?

To calculate TRS retirement benefits, use the following formula: Multiply your years of service credit by 2.3%. (Example: if you have 30 years of service credit in TRS, 30 x 2.3 = 69%.) Determine the average of your five highest years of salary.

What is the TRS formula in Texas?

Average Salary = Average of Three Highest Annual Salaries Total Percent = Total Years of Service Credit x 2.3% Annual Annuity = Total Percent x Average Salary Monthly Annuity = Annual Annuity ÷ 12 Retirement annuity calculators are available on the TRS website through MyTRS to assist you.

How much does Texas TRS take out of paycheck?

You contribute 7.7% of your salary. Your contribution is tax deferred, which means it is subtracted from your gross income before it is reported to the IRS.

Is TRS mandatory in Texas?

All employees of the Texas public education system whose employment qualifies as covered employment must participate in TRS unless an exception to TRS membership applies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit TX 1099-R TRS Information straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing TX 1099-R TRS Information, you can start right away.

Can I edit TX 1099-R TRS Information on an iOS device?

You certainly can. You can quickly edit, distribute, and sign TX 1099-R TRS Information on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete TX 1099-R TRS Information on an Android device?

On an Android device, use the pdfFiller mobile app to finish your TX 1099-R TRS Information. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is TX 1099-R TRS Information?

TX 1099-R TRS Information is a tax form used to report distributions from retirement plans, specifically from the Teacher Retirement System (TRS) in Texas.

Who is required to file TX 1099-R TRS Information?

Financial institutions, employers, and any entity that makes distributions from a retirement plan governed by TRS to an individual are required to file the TX 1099-R TRS Information.

How to fill out TX 1099-R TRS Information?

To fill out TX 1099-R TRS Information, enter the recipient's personal information, the distribution amount, any tax withheld, and the appropriate distribution codes as specified by the IRS guidelines.

What is the purpose of TX 1099-R TRS Information?

The purpose of TX 1099-R TRS Information is to report taxable distributions received by individuals from retirement plans, ensuring proper tax compliance and informing the IRS about taxpayer income from retirement sources.

What information must be reported on TX 1099-R TRS Information?

The information that must be reported includes the recipient's name, address, Social Security number, the amount of distribution, any federal income tax withheld, the type of distribution, and the name of the payer.

Fill out your TX 1099-R TRS Information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX 1099-R TRS Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.