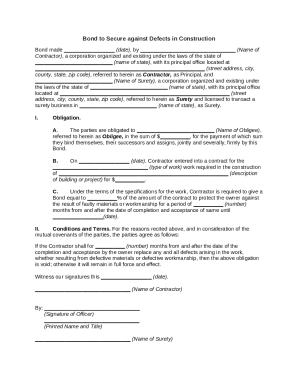

TX Comptroller 05-164 2022 free printable template

Show details

RESET FORM PRINT FORM Texas Franchise Tax Extension Request 05-164 (Rev.9-16/9) FILING REQUIREMENTS Code 13258 Annual AnnualFranchise Taxpayer number Report year Due date 2 0 2 2 05/16/2022 Taxpayer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tx form franchise

Edit your tx form franchise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tx form franchise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tx form franchise online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tx form franchise. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 05-164 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tx form franchise

How to fill out TX Comptroller 05-164

01

Begin by downloading the TX Comptroller 05-164 form from the official website.

02

Fill in the name of the business or individual at the top of the form.

03

Provide the business identification number or the Social Security Number in the designated field.

04

Complete the address section with the correct business or individual address.

05

Specify the type of business activity by selecting the appropriate options provided.

06

Provide any additional information required for your specific situation, such as account numbers or previous tax amounts.

07

Review the form for accuracy and completeness, ensuring all required fields are filled.

08

Sign and date the form at the bottom before submission.

09

Submit the completed form to the appropriate office, either via mail or electronically as instructed.

Who needs TX Comptroller 05-164?

01

Individuals or businesses that are applying for a Texas sales tax permit.

02

Businesses that are needing to report or update their sales tax information.

03

Entities looking to claim a refund for sales tax previously paid.

04

Businesses engaged in retail sales or services in Texas.

Fill

form

: Try Risk Free

People Also Ask about

What is the no tax due report for 2020 in Texas?

The no tax due threshold is as follows: $1,230,000 for reports due in 2022-2023. $1,180,000 for reports due in 2020-2021. $1,130,000 for reports due in 2018-2019.

Which entity is not subject to Texas franchise tax?

Entities Not Subject to Franchise Tax sole proprietorships (except for single member LLCs); general partnerships when direct ownership is composed entirely of natural persons (except for limited liability partnerships);

What is the Texas franchise tax threshold for 2020?

The no tax due threshold has been adjusted, as required by Texas Tax Code Section 171.006(b), and is now $1,180,000 for reports due on or after Jan. 1, 2020 and before Jan. 1, 2022.

How do I become exempt from franchise tax in Texas?

To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

What is Form 05-164?

Use franchise tax Webfile or file Form 05-164, Texas Franchise Tax Extension Request, along with the appropriate payment, on or before the original due date of the report. The extension payment must be at least 90 percent of the tax that will be due with the report filed on or before Nov.

What is the threshold for Texas franchise tax?

Reports and Payments For franchise tax reports originally due…The no tax due threshold is…on or after Jan. 1, 2022, and before Jan. 1, 2024$1,230,000on or after Jan. 1, 2020, and before Jan. 1, 2022$1,180,000on or after Jan. 1, 2018, and before Jan. 1, 2020$1,130,0005 more rows

What is Texas Form 05-167?

Form 05-167 - Texas Franchise Tax Ownership Information Report — The Ownership Information Report (OIR) is to be filed for each taxable entity other than a legally formed corporation, limited liability company, limited partnership, professional association, or financial institution.

What is Texas Form 05 164?

Use franchise tax Webfile or file Form 05-164, Texas Franchise Tax Extension Request, along with the appropriate payment, on or before the original due date of the report. The extension payment must be at least 90 percent of the tax that will be due with the report filed on or before Nov.

Who is required to file Texas franchise tax report?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

What is the Texas franchise tax no tax due threshold?

Tax Rates, Thresholds and Deduction Limits ItemAmountNo Tax Due Threshold$1,000,000Tax Rate (retail or wholesale)0.5%Tax Rate (other than retail or wholesale)1.0%Compensation Deduction Limit$320,0002 more rows

What is Texas Webfile number?

What is my Webfile number and where do I find it? Your Webfile number is your "access code" to Webfile issued by the Comptroller's office. It is printed in the upper left corner of the tax report we mail to each taxpayer and on most notices. It is two letters followed by six numbers (Example: RT666666).

What is Texas Form 05-164?

Use franchise tax Webfile or file Form 05-164, Texas Franchise Tax Extension Request, along with the appropriate payment, on or before the original due date of the report. The extension payment must be at least 90 percent of the tax that will be due with the report filed on or before Nov.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tx form franchise without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like tx form franchise, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send tx form franchise to be eSigned by others?

When you're ready to share your tx form franchise, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find tx form franchise?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tx form franchise and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

What is TX Comptroller 05-164?

TX Comptroller 05-164 is a Texas sales tax form used for reporting and remitting sales taxes collected on taxable sales of goods and services in the state of Texas.

Who is required to file TX Comptroller 05-164?

Any business that collects sales tax from customers while selling taxable goods and services in Texas is required to file TX Comptroller 05-164.

How to fill out TX Comptroller 05-164?

To fill out TX Comptroller 05-164, gather your sales records, enter the total sales for the reporting period, calculate the sales tax due, and provide relevant business information before submitting the form to the Texas Comptroller's office.

What is the purpose of TX Comptroller 05-164?

The purpose of TX Comptroller 05-164 is to facilitate the submission of sales tax collected by businesses to the Texas Comptroller of Public Accounts in a timely and accurate manner.

What information must be reported on TX Comptroller 05-164?

TX Comptroller 05-164 requires reporting of total sales, exempt sales, taxable sales, total sales tax collected, and business identification details such as name, address, and permit number.

Fill out your tx form franchise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tx Form Franchise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.