IRS 1099-DIV 2022 free printable template

Show details

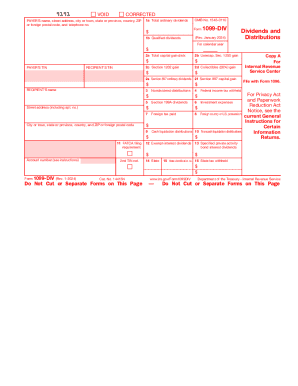

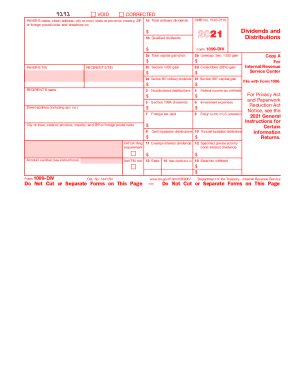

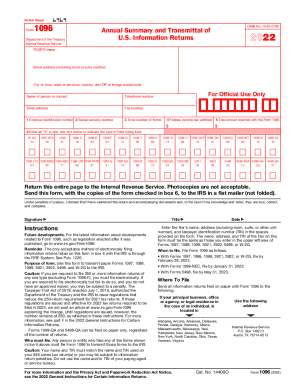

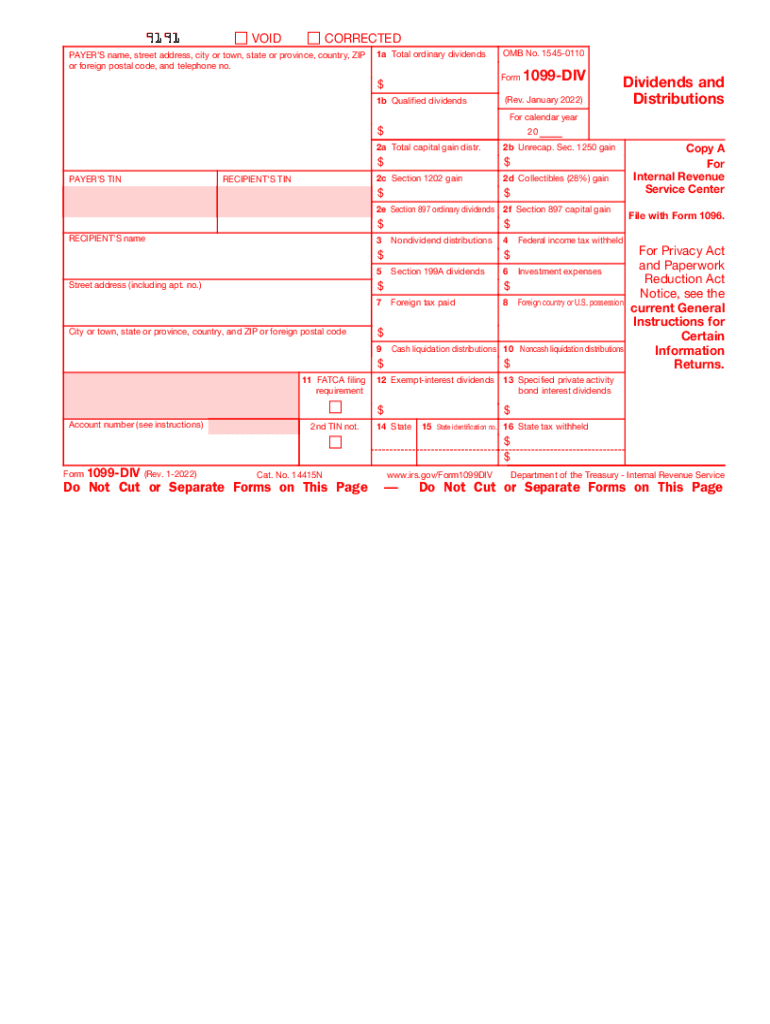

1a Total ordinary dividends OMB No. 1545-0110 Form 1b Qualified dividends 1099-DIV Rev. January 2022 Dividends and Distributions For calendar year PAYER S TIN RECIPIENT S TIN RECIPIENT S name 2a Total capital gain distr. 2b Unrecap. Sec. 1250 gain 2c Section 1202 gain 2d Collectibles 28 gain 2e Section 897 ordinary dividends 2f Section 897 capital gain Nondividend distributions Section 199A dividends Foreign tax paid City or town state or province country and ZIP or foreign postal code 11 FATCA...filing requirement 2nd TIN not. 20 qualified business income deduction under section 199A. See the Box 6. Shows your share of expenses of a nonpublicly offered RIC generally a nonpublicly offered mutual fund. Attention Copy A of this form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not. Do not print and file copy A...downloaded from this website a penalty may be imposed for filing with the IRS information return forms that can t be scanned* See part O in the current General Instructions for Certain Information Returns available at www*irs*gov/form1099 for more information about penalties. Please note that Copy B and other copies of this form which appear in black may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. To order official IRS information...returns which include a scannable Copy A for filing with the IRS and all other applicable copies of the form visit www. IRS*gov/orderforms. Click on Employer and Information Returns and we ll mail you the forms you request and their instructions as well as any publications you may order. Electronically FIRE system visit www. IRS*gov/FIRE or the IRS Affordable Care Act See IRS Publications 1141 1167 and 1179 for more information about printing these tax forms. VOID CORRECTED PAYER S name street...address city or town state or province country ZIP or foreign postal code and telephone no. Investment expenses Foreign country or U*S* possession Account number see instructions Street address including apt* no* Federal income tax withheld Cash liquidation distributions 10 Noncash liquidation distributions 12 Exempt-interest dividends 13 Specified private activity bond interest dividends 14 State Copy A Internal Revenue Service Center File with Form 1096. For Privacy Act and Paperwork Reduction...Act Notice see the current General Certain Information Returns. 15 State identification no. 16 State tax withheld Form 1099-DIV Rev* 1-2022 Cat* No* 14415N Do Not Cut or Separate Forms on This Page www*irs*gov/Form1099DIV Department of the Treasury - Internal Revenue Service Copy 1 For State Tax Department CORRECTED if checked Copy B For Recipient This is important tax information and is being furnished to the IRS* If you are required to file a return a negligence penalty or other sanction may...be imposed on you if this income is taxable and the IRS determines that it has not been reported* keep for your records Recipient s taxpayer identification number TIN.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-DIV

How to edit IRS 1099-DIV

How to fill out IRS 1099-DIV

Instructions and Help about IRS 1099-DIV

How to edit IRS 1099-DIV

Editing the IRS 1099-DIV form can be done using various tools. For those needing to make corrections or updates, pdfFiller provides a simple interface for editing the form online. Users can easily input the correct information and save it for their records or for submission.

How to fill out IRS 1099-DIV

Filling out the IRS 1099-DIV form requires attention to detail. Gather all necessary information related to dividends received, including the payer's details and the total amount of dividends. Use the latest version of the form to ensure accuracy. Follow the instructions specifically for each box on the form.

01

Obtain the IRS 1099-DIV form from a reliable source or platform.

02

Fill in the payer’s name, address, and taxpayer identification number (TIN).

03

Report the total dividends received in the appropriate boxes based on type.

04

Double-check entries for accuracy and compliance.

05

Use pdfFiller to securely store or submit the completed form.

About IRS 1099-DIV 2022 previous version

What is IRS 1099-DIV?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-DIV 2022 previous version

What is IRS 1099-DIV?

IRS 1099-DIV is a tax form used to report dividends and distributions to taxpayers. This form details the amount of dividends or capital gain distributions received from various investments, which are typically paid out by corporations or mutual funds. Investors often rely on this form to accurately report their income when filing taxes.

What is the purpose of this form?

The purpose of IRS 1099-DIV is to inform the IRS and the taxpayer about the dividends received during the tax year. This form enables both parties to reconcile reported income, ensuring compliance with tax regulations. It helps taxpayers categorize their income from dividends correctly, which is essential for tax calculations.

Who needs the form?

Any taxpayer receiving dividends of $10 or more from stocks, mutual funds, or other investments must be issued an IRS 1099-DIV form. This includes individual investors, investment partnerships, and entities that received dividends. Moreover, corporations that distribute dividends are required to issue this form to their shareholders.

When am I exempt from filling out this form?

Taxpayers are exempt from filling out the IRS 1099-DIV form if they received less than $10 in dividends during the tax year. Additionally, certain types of distributions, such as those from qualified retirement plans, are not reported using this form. Be sure to check the IRS guidelines for specific exemptions.

Components of the form

The IRS 1099-DIV form contains several boxes, each serving a unique reporting purpose. Key components include the payer's information, the recipient's details, and various amounts reflecting dividends and capital gains distributions. Understanding these components is crucial for accurately filing your taxes.

01

Box 1a: Total ordinary dividends.

02

Box 1b: Qualified dividends.

03

Box 2a: Total capital gain distributions.

04

Box 3: Non-taxable distributions.

05

Box 4: Federal income tax withheld.

What are the penalties for not issuing the form?

Not issuing the IRS 1099-DIV can result in penalties for both the entity responsible for issuing the form and the taxpayer. The IRS may impose fines for failure to file the form timely, and taxpayers may face complications during tax audits or discrepancies in their reported income. It is crucial to adhere to filing requirements to avoid these penalties.

What information do you need when you file the form?

When filing the IRS 1099-DIV, essential information includes the taxpayer's name, address, and TIN, along with the payer's details. Additionally, total dividends and any relevant amounts listed on the form must be accurate. Keeping organized records of all dividends received throughout the year will facilitate accurate reporting.

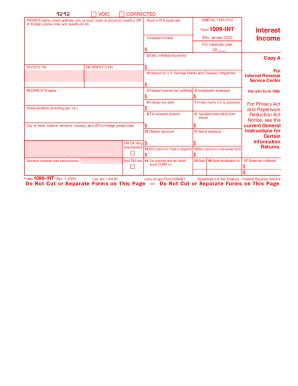

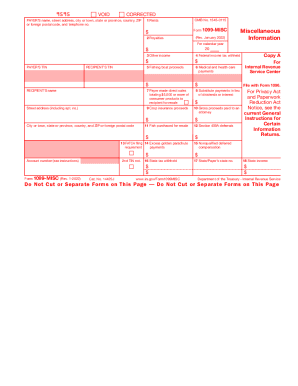

Is the form accompanied by other forms?

The IRS 1099-DIV form is often accompanied by other tax forms, depending on the taxpayer's situation. For instance, if a taxpayer also receives dividends in foreign accounts, related forms such as the 1099-INT may be relevant. Be sure to check for additional forms that may need to be submitted with the 1099-DIV.

Where do I send the form?

The IRS 1099-DIV form should be sent to both the IRS and the recipient. The IRS mailing address depends on the geographical location of the sender and whether the form is filed electronically or by mail. Ensure that you verify the correct mailing address on the IRS website or instructions when submitting the form to avoid delays in processing.

See what our users say