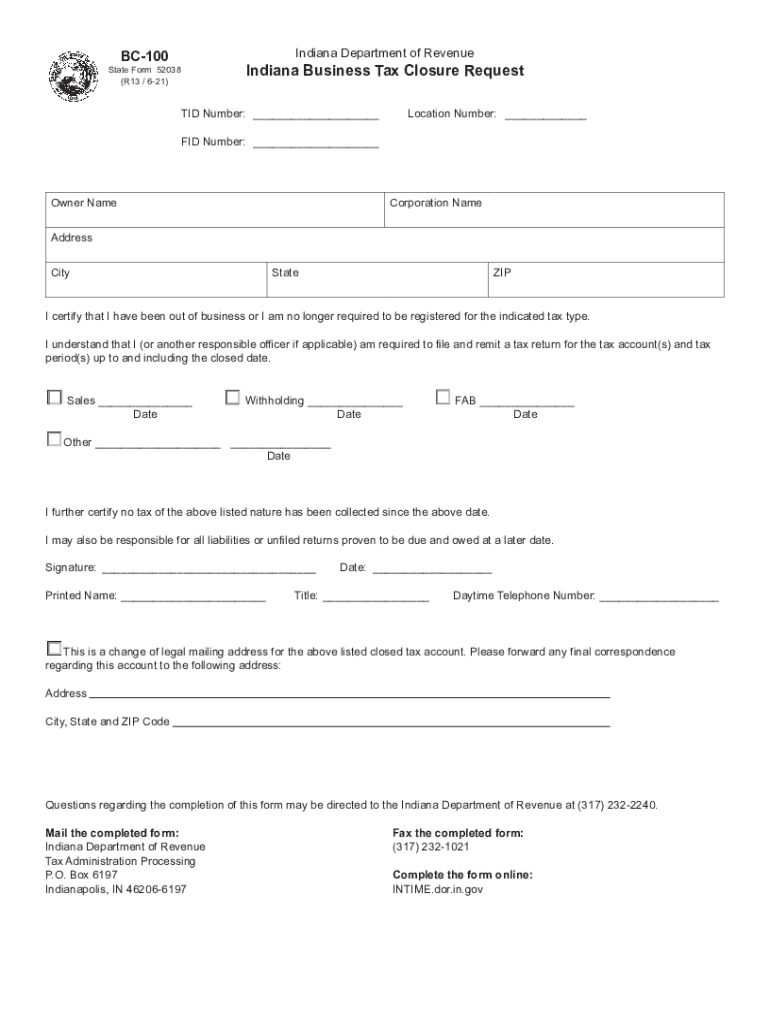

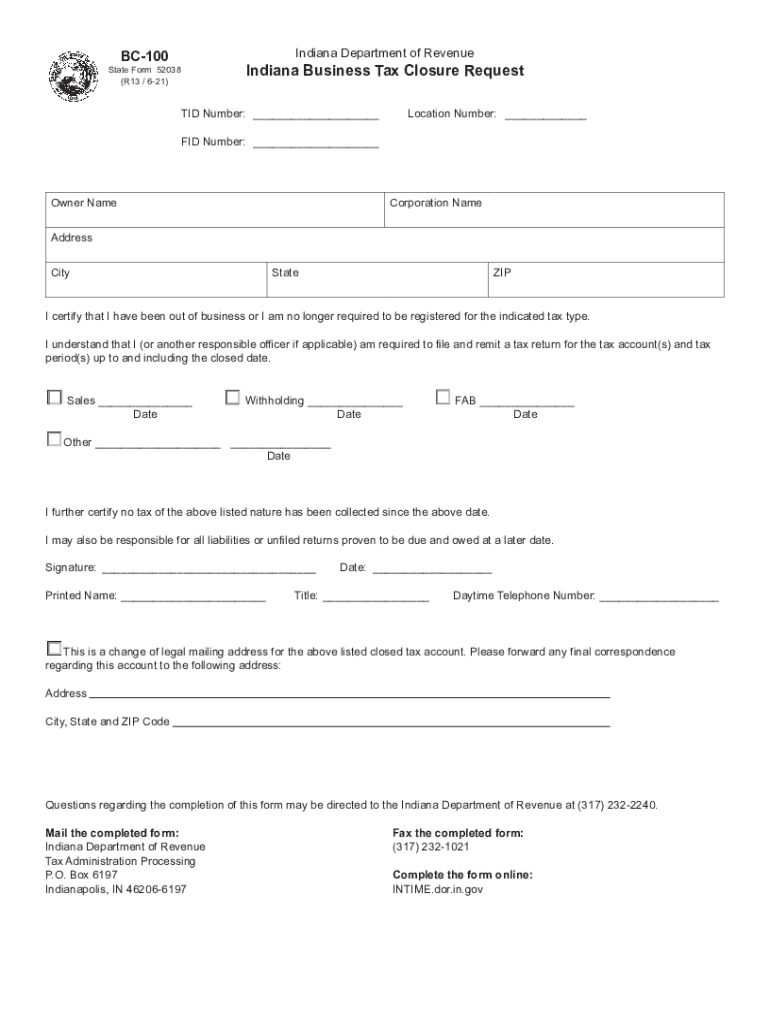

IN BC-100 2021 free printable template

Show details

Indiana Department of RevenueBC100Indiana Business Tax Closure Sequestrate Form 52038 (R13 / 621)TID Number: Location Number: FID Number: Owner Reincorporation Headdress CityStateZIPI certify that

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bc 100 business form

Edit your indiana bc 100 tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bc 100 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indiana bc 100 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit indiana bc 100 business closure request form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN BC-100 Form Versions

Version

Form Popularity

Fillable & printabley

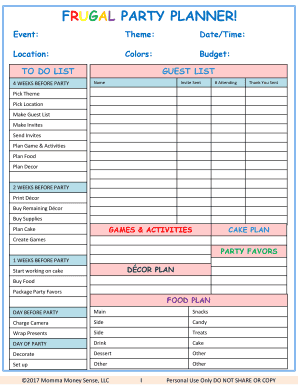

How to fill out bc 100 form

How to fill out IN BC-100

01

Obtain the IN BC-100 form from the official website or relevant office.

02

Carefully read the instructions provided with the form.

03

Begin by filling out the applicant's personal information in the designated sections.

04

Provide detailed information regarding the purpose of the application.

05

Attach any required documents as specified in the instructions.

06

Review the form for accuracy and completeness before submission.

07

Sign and date the form as required.

08

Submit the completed form along with any accompanying documents to the appropriate office.

Who needs IN BC-100?

01

Individuals applying for specific permits or licenses in British Columbia.

02

Organizations seeking approvals or registrations related to their activities.

03

Anyone required to report certain information to government authorities.

Video instructions and help with filling out and completing bc 100 online

Instructions and Help about bc 100 business tax form printable

Fill

indiana bc 100 form

: Try Risk Free

People Also Ask about indiana business closure

How do you close a business officially?

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

How do I contact the Indiana Department of Revenue?

317-233-5656 All tax forms can be found online and downloaded here.

How to close a Business in state of Indiana?

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

How do I close my Indiana sales tax account?

In order to close your sales tax permit in Indiana, you can close your account using Indiana's online portal, INTIME, or by filling out the Indiana Business Closure Request Form BC-100.

How do I close my sales tax account in Indiana?

In order to close your sales tax permit in Indiana, you can close your account using Indiana's online portal, INTIME, or by filling out the Indiana Business Closure Request Form BC-100.

How do I close a business entity in Indiana?

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

What is a BT 1 form?

Business Tax. Register a New Business. Online Business Tax Application (BT-1) Checklist.

How do I withdraw a corporation in Indiana?

All businesses registered with the Secretary of State Corporate Division must first file Articles of Dissolution with the Indiana Secretary of State. You may reach their office at 317-232-6576.

How do I get a TID number in Indiana?

Indiana Tax Identification Number Register online with INBiz. Click Register Now at the bottom of the page and follow the instructions. You'll receive your Tax Identification Number within 2-3 hours after completing the registration online. For more information, please contact the agency at (317) 233-4016.

What is a BC-100 form?

Businesses can close their tax accounts on INTIME. If a business does not have an INTIME account, then it is required to send an Indiana Tax Closure Request (Form BC-100). If the tax account isn't closed on INTIME or the BC-100 isn't filed, DOR may continue to send bills for estimated taxes.

How long does it take to dissolve an LLC in Indiana?

Processing time will vary depending on how you deliver your filing: walk-ins and filings sent via express mail should be processed by noon of the following day, and mailed-in filings usually require 3-5 business days. An articles of dissolution form is available for download from the SOS website.

Do Indiana sales tax certificates expire?

Tax exemption certificates last for one year in Alabama and Indiana. Certificates last for five years in at least 9 states: Florida, Illinois, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia.

How do I close an online business?

Close your business Decide to close. Sole proprietors can decide on their own, but any type of partnership requires the co-owners to agree. File dissolution documents. Cancel registrations, permits, licenses, and business names. Comply with employment and labor laws. Resolve financial obligations. Maintain records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bc 100 tax directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign indiana bc100 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete form bc100 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your indiana 100 form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete indiana business closure form on an Android device?

Complete indiana bc 100 business closure form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IN BC-100?

IN BC-100 is a form used for reporting business activities and tax obligations in the province of British Columbia, Canada.

Who is required to file IN BC-100?

Businesses operating in British Columbia that are registered for the provincial sales tax or have a specific tax liability are required to file IN BC-100.

How to fill out IN BC-100?

To fill out IN BC-100, businesses must provide their business information, report sales and purchases, and calculate their tax liabilities according to the guidelines provided on the form.

What is the purpose of IN BC-100?

The purpose of IN BC-100 is to ensure businesses report their tax liabilities accurately and comply with British Columbia's tax regulations.

What information must be reported on IN BC-100?

IN BC-100 requires businesses to report their sales revenue, purchase amounts, applicable taxes collected, and any exemptions claimed during the reporting period.

Fill out your IN BC-100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Bc 100 Business Request Template is not the form you're looking for?Search for another form here.

Keywords relevant to bc 100 printable

Related to indiana bc100 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.