IN BC-100 2024-2025 free printable template

Show details

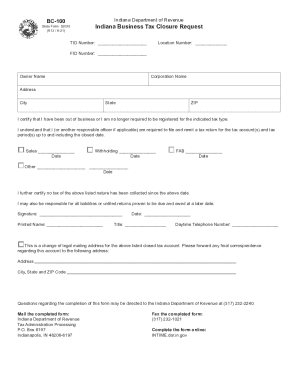

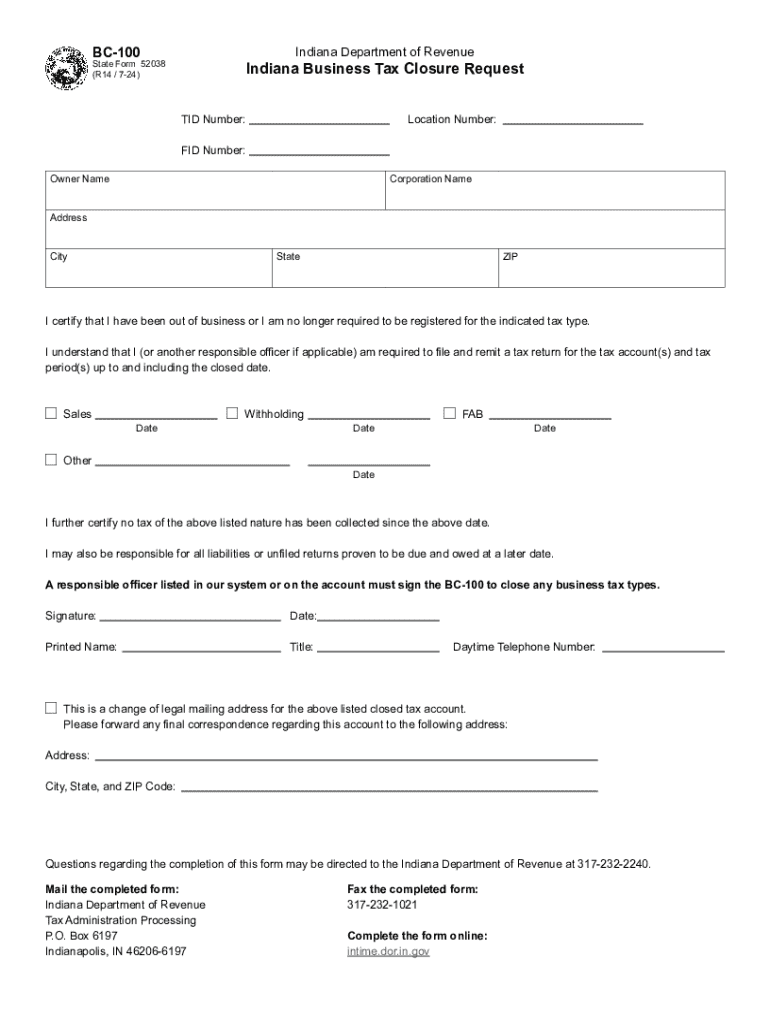

BC100Indiana Department of RevenueIndiana Business Tax Closure RequestState Form 52038

(R14 / 724)TID Number:Location Number:FID Number:

Owner NameCorporation NameAddress

CityStateZIPI certify that

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bc 100 form

Edit your indiana bc 100 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana bc 100 business closure form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indiana tax closure form online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit indiana bc 100 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN BC-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out bc100 form

How to fill out IN BC-100

01

Obtain the IN BC-100 form from the official website or relevant authority.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Fill in your personal information such as your name, address, and contact information in the designated fields.

04

Provide details about the purpose of the form, ensuring you address all the required areas.

05

If applicable, include any supporting documents or evidence requested in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form in the specified section.

08

Submit the form by mail or online as instructed, ensuring you keep a copy for your records.

Who needs IN BC-100?

01

Individuals or organizations applying for specific benefits or services that require the IN BC-100 form.

02

Anyone seeking to formalize their request through official documentation pertaining to the jurisdiction that requires this form.

Video instructions and help with filling out and completing form bc100

Instructions and Help about bc 100

Fill

indiana business closure form

: Try Risk Free

People Also Ask about pdf merger

How do you close a business officially?

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

How do I contact the Indiana Department of Revenue?

317-233-5656 All tax forms can be found online and downloaded here.

How to close a Business in state of Indiana?

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

How do I close my Indiana sales tax account?

In order to close your sales tax permit in Indiana, you can close your account using Indiana's online portal, INTIME, or by filling out the Indiana Business Closure Request Form BC-100.

How do I close my sales tax account in Indiana?

In order to close your sales tax permit in Indiana, you can close your account using Indiana's online portal, INTIME, or by filling out the Indiana Business Closure Request Form BC-100.

How do I close a business entity in Indiana?

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

What is a BT 1 form?

Business Tax. Register a New Business. Online Business Tax Application (BT-1) Checklist.

How do I withdraw a corporation in Indiana?

All businesses registered with the Secretary of State Corporate Division must first file Articles of Dissolution with the Indiana Secretary of State. You may reach their office at 317-232-6576.

How do I get a TID number in Indiana?

Indiana Tax Identification Number Register online with INBiz. Click Register Now at the bottom of the page and follow the instructions. You'll receive your Tax Identification Number within 2-3 hours after completing the registration online. For more information, please contact the agency at (317) 233-4016.

What is a BC-100 form?

Businesses can close their tax accounts on INTIME. If a business does not have an INTIME account, then it is required to send an Indiana Tax Closure Request (Form BC-100). If the tax account isn't closed on INTIME or the BC-100 isn't filed, DOR may continue to send bills for estimated taxes.

How long does it take to dissolve an LLC in Indiana?

Processing time will vary depending on how you deliver your filing: walk-ins and filings sent via express mail should be processed by noon of the following day, and mailed-in filings usually require 3-5 business days. An articles of dissolution form is available for download from the SOS website.

Do Indiana sales tax certificates expire?

Tax exemption certificates last for one year in Alabama and Indiana. Certificates last for five years in at least 9 states: Florida, Illinois, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia.

How do I close an online business?

Close your business Decide to close. Sole proprietors can decide on their own, but any type of partnership requires the co-owners to agree. File dissolution documents. Cancel registrations, permits, licenses, and business names. Comply with employment and labor laws. Resolve financial obligations. Maintain records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send indiana bc 100 business closure request fill to be eSigned by others?

When you're ready to share your indiana bc 100 tax form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete indiana bc 100 business form online?

pdfFiller makes it easy to finish and sign indiana bc 100 request online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit indiana department of revenue bc 100 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing indiana bc 100 fill, you can start right away.

What is IN BC-100?

IN BC-100 is a form used for reporting specific business information to the relevant tax authority, often related to business income and expenses.

Who is required to file IN BC-100?

Business owners and entities that meet certain revenue thresholds or regulatory requirements must file IN BC-100.

How to fill out IN BC-100?

To fill out IN BC-100, gather all necessary financial documents, accurately input income and expense figures, and follow the form instructions provided by the tax authority.

What is the purpose of IN BC-100?

The purpose of IN BC-100 is to provide tax authorities with information on a business's financial performance, ensuring compliance with tax laws.

What information must be reported on IN BC-100?

IN BC-100 requires reporting of gross income, allowable deductions, business expenses, and any other relevant financial data as specified in the filing instructions.

Fill out your form bc100 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Bc 100 Business is not the form you're looking for?Search for another form here.

Keywords relevant to indiana bc 100 business closure request form

Related to indiana bc100

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.