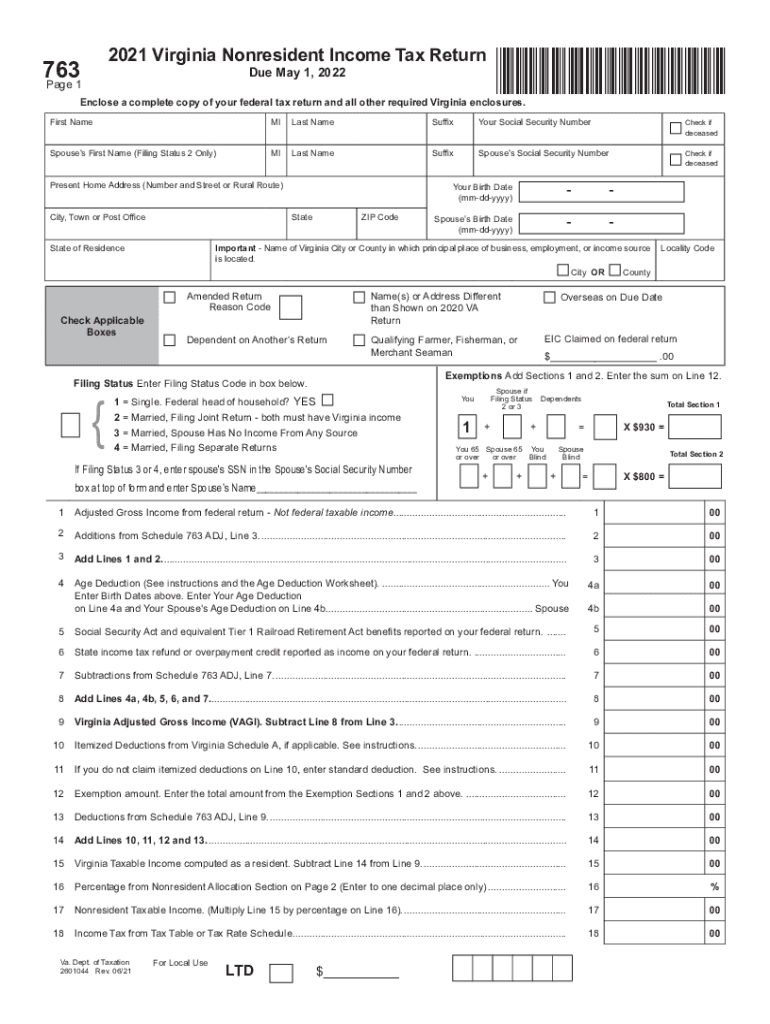

VA DoT 763 2021 free printable template

Instructions and Help about VA DoT 763

How to edit VA DoT 763

How to fill out VA DoT 763

About VA DoT previous version

What is VA DoT 763?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about VA DoT 763

What should I do if I realize I've made a mistake on my va 763 form after submission?

If you identify an error on your va 763 form after submitting, you should file an amended or corrected form as soon as possible. Make sure to highlight the changes clearly to avoid confusion. It's important to include any required documentation that supports the amendments.

How can I verify the status of my va 763 form submission?

To track the status of your submitted va 763 form, check the official portal or contact the relevant office directly. You can also reference any tracking numbers or confirmation emails received at the time of submission for more accurate updates.

What common errors should I be aware of when submitting the va 763 form?

When submitting the va 763 form, common errors include incorrect personal information and not following required e-filing formats. To prevent these mistakes, double-check all fields or consider using a checklist to ensure that every detail matches official records.

Can I e-file the va 763 form, and what internet browsers are supported?

Yes, you can e-file the va 763 form. Most current web browsers, such as Chrome, Firefox, Edge, and Safari, support the online submission. Make sure your browser is updated to avoid compatibility issues during the filing process.