PA DEX 93 2018 free printable template

Show details

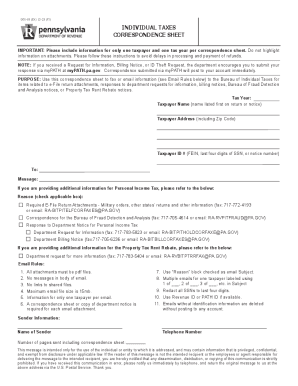

DEX93 (EX) 1218 (FI)PERSONALINCOMETAX

CORRESPONDENCESHEETOFFICIAL USE OneNote:Pleaseincludeinformationforonlyonetaxpayerandonetaxyearpercorrespondencesheet. Do not highlight

information on attachments.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DEX 93

Edit your PA DEX 93 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DEX 93 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA DEX 93 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA DEX 93. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DEX 93 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DEX 93

How to fill out PA DEX 93

01

Begin by gathering all necessary personal information, including your name, address, and Social Security number.

02

Fill out the section for household members, listing all individuals living in your home.

03

Provide details about your income sources, ensuring to include all jobs, benefits, and supports.

04

Complete the section for expenses, such as housing costs, utility bills, and any other regular payments.

05

Review the completed form for accuracy, checking all entries against your documentation.

06

Submit the PA DEX 93 to the appropriate agency or office, following any specific submission guidelines provided.

Who needs PA DEX 93?

01

Individuals applying for food assistance or public assistance programs in Pennsylvania.

02

Families needing to report their income and household composition for state benefits.

03

Residents who need to update their benefit information due to changes in their situation.

Fill

form

: Try Risk Free

People Also Ask about

What is a DEX 93?

Personal Income Tax Correspondence Sheet (DEX-93)

How do I get my PA 40 form?

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

How do I get a copy of my PA-40?

Requesting Pennsylvania Tax Records Requests for tax records must be submitted using the REV-467, Authorization for Release of Tax Records. The form should be submitted electronically by using the following fax number: 717-783-4355.

Where can I get a hard copy 1040?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What is a PA 40 tax form?

PERSONAL INCOME TAX (PA-40 ES) Use the 2021 Form PA-40 ES-I to make your quarterly estimated payment of tax owed.

Does everyone have to fill out a 10/40 form?

While people with more complicated tax situations may need more forms and schedules, everyone filing taxes will need to fill out Form 1040 in order to file their taxes.

How do I get a PA 40 tax form?

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

Where to send correspondence to the PA Department of Revenue?

The mailing address is: PA Department of Revenue Harrisburg Call Center 6th Floor Strawberry Square-Quad 620 4th and Walnut Street Harrisburg, PA 17128-1210 You should include a copy of the notice

Who must file PA 40?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

How do I appeal a PA Department of Revenue?

The Board of Appeals can be reached by calling 717-783-3664. Forms can be downloaded from the Board's Online Petition Center at .boardofappeals.state.pa.us, or obtained by calling 1-888-PATAXES (728-2937).

Who files a PA-40 form?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit PA DEX 93 online?

With pdfFiller, the editing process is straightforward. Open your PA DEX 93 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I edit PA DEX 93 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing PA DEX 93 right away.

How can I fill out PA DEX 93 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your PA DEX 93 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is PA DEX 93?

PA DEX 93 is a form used in Pennsylvania for reporting various data related to individuals and businesses. It typically pertains to tax-related information.

Who is required to file PA DEX 93?

Entities and individuals who meet certain qualifications for reporting specific tax information in Pennsylvania are required to file PA DEX 93.

How to fill out PA DEX 93?

To fill out PA DEX 93, follow the instructions provided with the form, ensuring that all required fields are accurately completed with the relevant information.

What is the purpose of PA DEX 93?

The purpose of PA DEX 93 is to collect and report essential data for tax administration and compliance purposes in the state of Pennsylvania.

What information must be reported on PA DEX 93?

Information that must be reported on PA DEX 93 includes identifying details of the filer, financial data, and any relevant tax-related information specific to the entity or individual.

Fill out your PA DEX 93 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DEX 93 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.