PA DEX 93 2023 free printable template

Show details

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

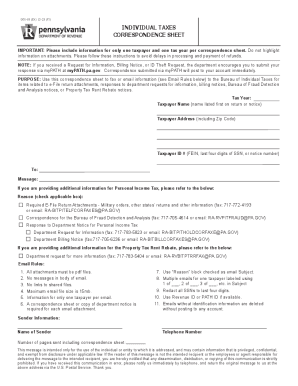

DEX93 (EX) 0323 (FI)PERSONAL INCOME TAX

CORRESPONDENCE SHEETOFFICIAL USE ONLYIMPORTANT: Please include information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DEX 93

Edit your PA DEX 93 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DEX 93 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA DEX 93 online

To use the professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA DEX 93. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DEX 93 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DEX 93

How to fill out PA DEX 93

01

Start by gathering all necessary personal information, including your name, address, and contact details.

02

Review the instructions provided with PA DEX 93 to ensure you understand the form's requirements.

03

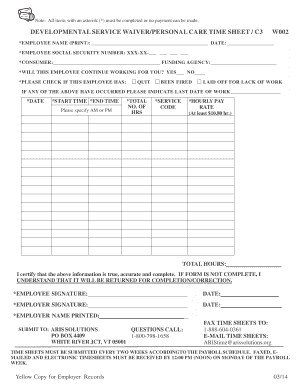

Fill out the sections that require your current employment status and any relevant job details.

04

Provide information about your benefits or services for which you are applying or updating.

05

Double-check all entries for accuracy and completeness before submitting.

06

Sign and date the form where indicated.

07

Keep a copy of the completed form for your records.

Who needs PA DEX 93?

01

Individuals applying for assistance or benefits through Pennsylvania's Department of Human Services.

02

Current beneficiaries who need to update their information.

03

Anyone seeking to access services that require eligibility documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is a DEX 93?

Personal Income Tax Correspondence Sheet (DEX-93)

How do I get my PA 40 form?

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

How do I get a copy of my PA-40?

Requesting Pennsylvania Tax Records Requests for tax records must be submitted using the REV-467, Authorization for Release of Tax Records. The form should be submitted electronically by using the following fax number: 717-783-4355.

Where can I get a hard copy 1040?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What is a PA 40 tax form?

PERSONAL INCOME TAX (PA-40 ES) Use the 2021 Form PA-40 ES-I to make your quarterly estimated payment of tax owed.

Does everyone have to fill out a 10/40 form?

While people with more complicated tax situations may need more forms and schedules, everyone filing taxes will need to fill out Form 1040 in order to file their taxes.

How do I get a PA 40 tax form?

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

Where to send correspondence to the PA Department of Revenue?

The mailing address is: PA Department of Revenue Harrisburg Call Center 6th Floor Strawberry Square-Quad 620 4th and Walnut Street Harrisburg, PA 17128-1210 You should include a copy of the notice

Who must file PA 40?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

How do I appeal a PA Department of Revenue?

The Board of Appeals can be reached by calling 717-783-3664. Forms can be downloaded from the Board's Online Petition Center at .boardofappeals.state.pa.us, or obtained by calling 1-888-PATAXES (728-2937).

Who files a PA-40 form?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete PA DEX 93 online?

pdfFiller has made filling out and eSigning PA DEX 93 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out the PA DEX 93 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign PA DEX 93. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit PA DEX 93 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute PA DEX 93 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is PA DEX 93?

PA DEX 93 is a specific form used in Pennsylvania for reporting and reconciling certain financial information, typically related to tax or business compliance.

Who is required to file PA DEX 93?

Entities or individuals who are subject to the reporting requirements established by the Pennsylvania Department of Revenue may be required to file PA DEX 93.

How to fill out PA DEX 93?

To fill out PA DEX 93, gather the required financial information, complete the form with accurate data, and ensure all sections are filled out as per the instructions provided by the Pennsylvania Department of Revenue.

What is the purpose of PA DEX 93?

The purpose of PA DEX 93 is to facilitate the accurate reporting of financial activities and ensure compliance with state tax regulations in Pennsylvania.

What information must be reported on PA DEX 93?

PA DEX 93 typically requires reporting of financial data such as income, deductions, and tax liabilities, as well as other relevant financial transactions.

Fill out your PA DEX 93 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DEX 93 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.