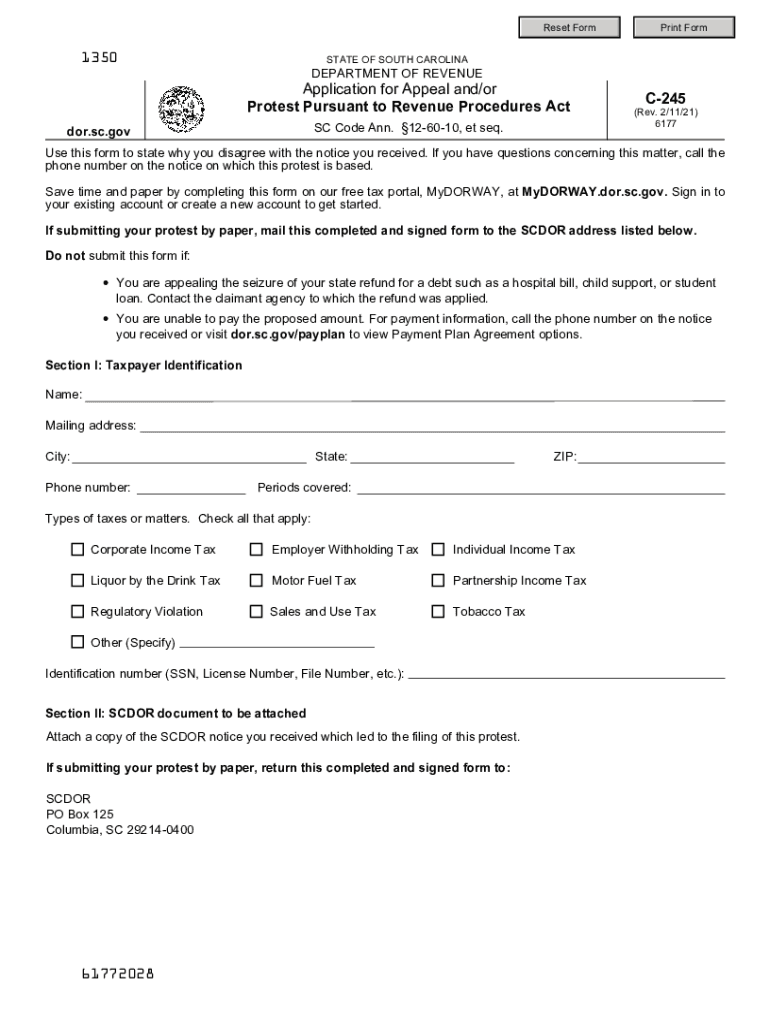

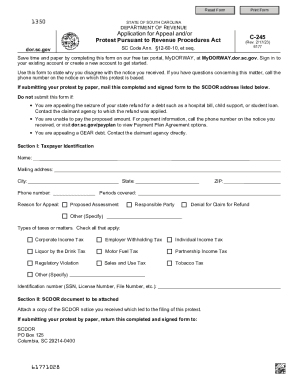

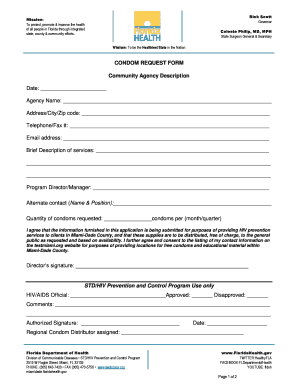

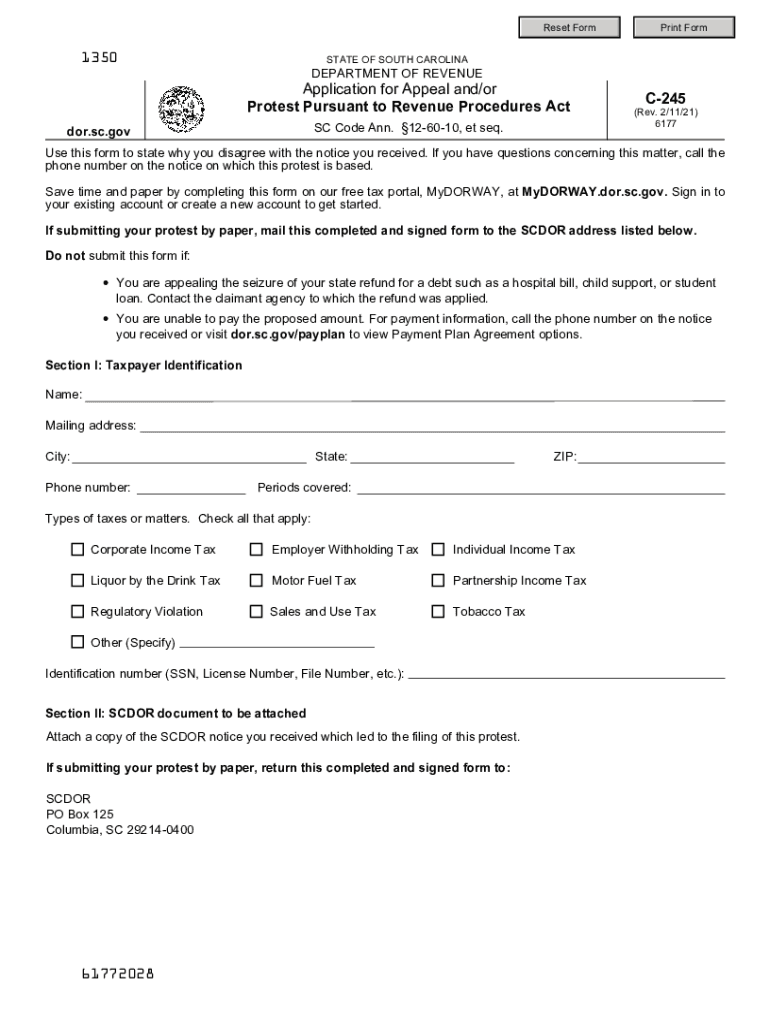

SC DoR C-245 2021 free printable template

Get, Create, Make and Sign south carolina form c

Editing south carolina form c online

Uncompromising security for your PDF editing and eSignature needs

SC DoR C-245 Form Versions

How to fill out south carolina form c

How to fill out SC DoR C-245

Who needs SC DoR C-245?

Instructions and Help about south carolina form c

About retiring to the great state of South Carolina will join the crowd because South Carolina is becoming the floor to north for Northeastern retirees its probably good idea to know how South Carolina's taxes retirees before you make that track or if you're already in South Carolina before you hit the retirement, and you say I'm staying here put for the rest of my life lets take a look and dive right into how the great state of South Carolina taxes retirees right here at the Heritage wealth planning YouTube channel if you like what you see here don't forget to subscribe right there my friends hit the notification bell to be notified our future content for sure so subscribe and hit the notification bell I do about five videos a week, and you want to keep a prize because there's lots going on in the world of financial planning in fact I just read that the Supreme Court Rule that the SEC Securities Exchange is Commission they cannot appoint administrative judges those judges have to be appointed by President so very interesting stuff don't know how it's going to affect the investment world probably not much, but I don't know, but that's the kind of stuff you need to be kept in the loop on, and you will here at the Heritage wealth planning YouTube channel right so lets dive right into South Carolina and see how they tax retirees because it's interesting for sure South Iron is actually quite favorable generally speaking at least I live in Georgia and every time I'm driving through South Carolina or to South Carolina I certainly want to get my gas in Georgia in that South Carolina not Georgia because I knew for a fact the gas taxes is lower but when a GUE here's Kip lingers with a light green for South Carolina even though my state here in Georgia is a dark green interesting so lets see why Kip lingers is not giving South Carolina at the dark green for retirees so lets see what we got here you're going to click on there my friends there we go and let's see what we got alright, so the Palmetto state extends of southern hospitality as retirees the state does not tax Social Security benefits and provides them generous retirement income deduction when calculating state income tax as well it is also phasing in a new deduction for military retirement income over the next few years as well as fantastic state income tax rates are reasonable and property taxes are very low senior homeowners will qualify for homestead exemption so, so far so good I like the idea of a low property tax lots of the deductions and exemptions for income tax see by the sales tax from not so bad at seven point two to six percent state levy and two and a half percent for both counties so which is the average of seven point two percent, so that's not horrific by any stretch of imagination once your tax income is over fourteen thousand six hundred you're going to pay seven percent income tax which with state income tax the rates are reasonable that's not reasonable 614 thousand six...

People Also Ask about

How do I register for sales tax in South Carolina?

How do I appeal a property tax assessment in South Carolina?

Where can I get my taxes done for free in South Carolina?

At what age do you stop paying state taxes in South Carolina?

How to file sales tax in South Carolina?

How do I remit sales tax in South Carolina?

When appealing an assessed value in North Carolina who has the burden of proof to prove the assessed value is inaccurate?

What constitutes a valid objection to tax assessment?

How do I get a sales tax permit in South Carolina?

What are the requirements for tax exemption Philippines?

Where can I get hard copies of tax forms?

How is assessed value determined in South Carolina?

What are the requirements for tax exemption?

What items are tax exempt in SC?

How often is property reassessed in South Carolina?

Do seniors pay state income tax in South Carolina?

What qualifies you as exempt on taxes?

Does South Carolina require you to file a tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my south carolina form c directly from Gmail?

How do I edit south carolina form c in Chrome?

How do I edit south carolina form c on an Android device?

What is SC DoR C-245?

Who is required to file SC DoR C-245?

How to fill out SC DoR C-245?

What is the purpose of SC DoR C-245?

What information must be reported on SC DoR C-245?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.