SC DoR C-245 2015 free printable template

Show details

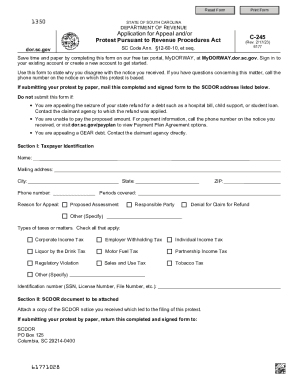

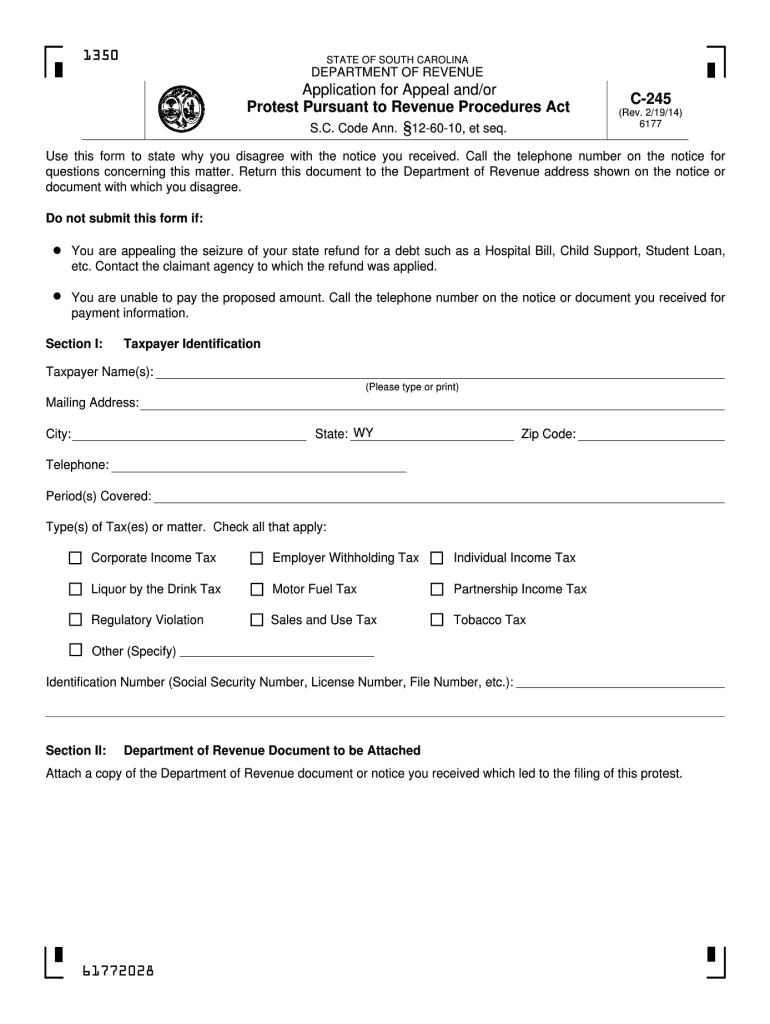

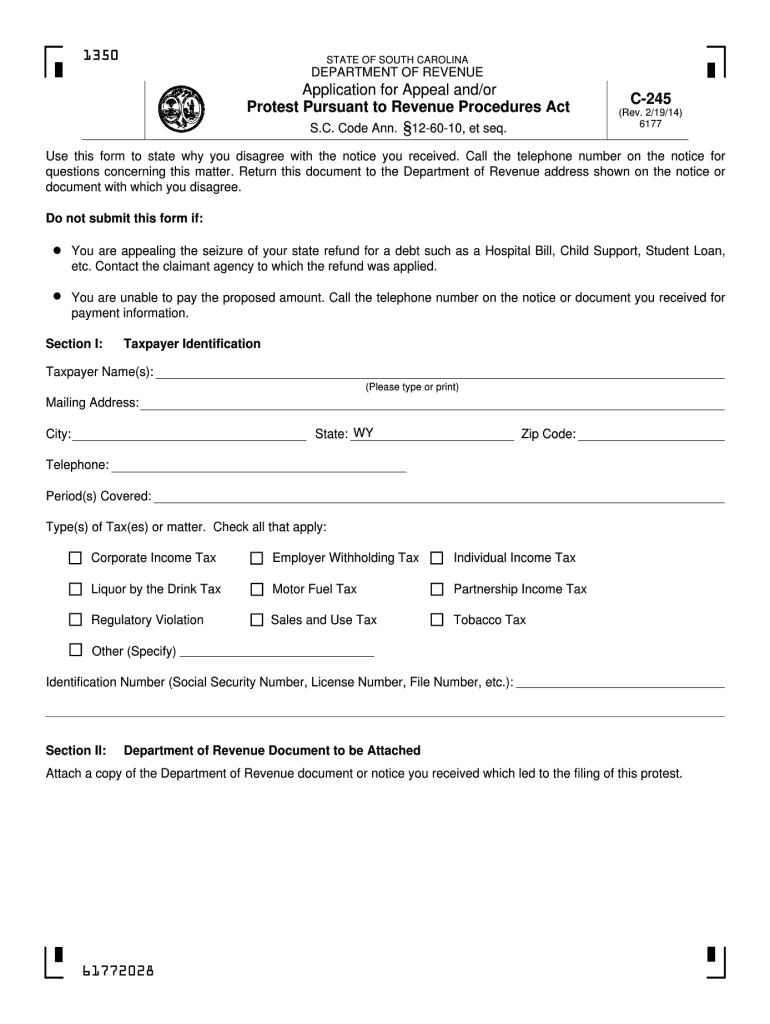

Code Ann. S12-60-10 et seq. S C-245 Rev. 2/19/14 Use this form to state why you disagree with the notice you received. Call the telephone number on the notice for questions concerning this matter. Reset Form Print Form STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Application for Appeal and/or Protest Pursuant to Revenue Procedures Act S*C. Return this document to the Department of Revenue address shown on the notice or document with which you disagree. Do not submit this form if You are...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign c 245 2015-2019 form

Edit your c 245 2015-2019 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c 245 2015-2019 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing c 245 2015-2019 form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit c 245 2015-2019 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR C-245 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out c 245 2015-2019 form

How to fill out SC DoR C-245

01

Obtain the SC DoR C-245 form from the official South Carolina Department of Revenue website.

02

Fill in your personal information including your name, address, and Social Security number.

03

Indicate the type of income or tax credit you are reporting.

04

Provide detailed descriptions and figures for any income, deductions, or credits being claimed.

05

Review the form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the South Carolina Department of Revenue via mail or online, as instructed.

Who needs SC DoR C-245?

01

Individuals or businesses in South Carolina who are required to report income or claim tax credits.

02

Taxpayers seeking to provide documentation for specific tax situations as mandated by the state tax laws.

Instructions and Help about c 245 2015-2019 form

Have you noticed her matzo manage your home or your patio area one kit our fire is taking over your yard let's kick it are you struggling to chop that mouth made your home's his own it's time to get rid of all those creepy crawly tales where all your pest control they just give us a call its Camp;C started eight four three nine zero four zero, and we'll get it

Fill

form

: Try Risk Free

People Also Ask about

How do I register for sales tax in South Carolina?

You can easily acquire your South Carolina Sales Tax License online using the South Carolina Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline (803) 896-1350 or by checking the permit info website .

How do I appeal a property tax assessment in South Carolina?

A. You may appeal a property tax assessment or the denial of a property tax exemption made by the Department of Revenue (“Department”) by filing a protest within 90 days of the date of the property tax assessment or the date of the notice setting forth the denial of the property tax exemption.

Where can I get my taxes done for free in South Carolina?

1040Now® offers free federal and free South Carolina Income Tax preparation and eFile of tax returns for taxpayers who meet the following requirements: Your AGI is $32,000 or less and. You live in South Carolina.

At what age do you stop paying state taxes in South Carolina?

If you have resided in South Carolina as your permanent home and legal residence for a full calendar year (January 1-December 31) and you are 65 years or older, legally blind, or permanently and totally disabled, you are eligible for a Homestead Exemption of $50,000 from the value of your home for tax purposes.

How to file sales tax in South Carolina?

How to File and Pay Sales Tax in South Carolina. You have two options for filing and paying your South Carolina sales tax: File online File online at the South Carolina Department of Revenue. You can remit your payment through their online system.

How do I remit sales tax in South Carolina?

You have two options for filing and paying your South Carolina sales tax: File online File online at the South Carolina Department of Revenue. You can remit your payment through their online system. AutoFile – Let TaxJar file your sales tax for you. We take care of the payments, too.

When appealing an assessed value in North Carolina who has the burden of proof to prove the assessed value is inaccurate?

The Informal Appeal Form for 2023 property values will be available in January 2023. North Carolina General Statutes put the burden of proof on the property owner to show that a tax assessment is inaccurate.

What constitutes a valid objection to tax assessment?

A valid tax objection means the following to a taxpayer: The taxpayer has followed the dictates of the tax law. In case the taxpayer is not satisfied with the decision of the tax commissioner, the taxpayer will have an opportunity to go to the Tax Appeals Tribunal.

How do I get a sales tax permit in South Carolina?

You can easily acquire your South Carolina Sales Tax License online using the South Carolina Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline (803) 896-1350 or by checking the permit info website .

What are the requirements for tax exemption Philippines?

Documentary Requirements Certificate of Income Payments Not Subjected to Withholding Tax (BIR Form 2304), if applicable. Certificate of Creditable Tax Withheld at Source (BIR Form 2307), if applicable. Duly approved Tax Debit Memo, if applicable. Proof of Foreign Tax Credits, if applicable.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

How is assessed value determined in South Carolina?

In South Carolina, an assessment ratio is applied to the market value or to the taxable value of a property to determine the assessed value. By default, under the South Carolina constitution, properties are assessed at 6% of market value (or taxable value if the property value is capped).

What are the requirements for tax exemption?

If your annual income does not exceed Rs 5 lakh, you are eligible for a tax rebate of up to Rs 12,500. Surcharge is applicable on annual incomes of Rs 50 lakh and above. The rates are: 10% on income between Rs 50 lakh and Rs 1 crore.

What items are tax exempt in SC?

Other tax-exempt items in South Carolina CategoryExemption StatusFood and MealsRaw MaterialsEXEMPTUtilities & FuelEXEMPTMedical Goods and Services21 more rows

How often is property reassessed in South Carolina?

South Carolina law requires counties to reassess every five years. Only real property is reassessed every five years. Values of personal property such as cars, boats and motorcycles are kept current through annual updates by the Department of Revenue.

Do seniors pay state income tax in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return. In addition, Social Security benefits are not taxed by the state of South Carolina. Overall, Kiplinger rates South Carolina as a tax-friendly state for retirees.

What qualifies you as exempt on taxes?

You can only file as exempt for the tax year if both of the following are true: You owed no federal income taxes the previous year; and. You expect to owe no federal income taxes for the current year.

Does South Carolina require you to file a tax return?

Do I need to file a South Carolina return? If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get c 245 2015-2019 form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific c 245 2015-2019 form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute c 245 2015-2019 form online?

pdfFiller has made it easy to fill out and sign c 245 2015-2019 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit c 245 2015-2019 form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing c 245 2015-2019 form right away.

What is SC DoR C-245?

SC DoR C-245 is a specific tax form used in the state of South Carolina, designed to report certain financial information for businesses and individuals.

Who is required to file SC DoR C-245?

Individuals and businesses engaging in specific financial activities or meeting certain criteria as outlined by the South Carolina Department of Revenue are required to file SC DoR C-245.

How to fill out SC DoR C-245?

SC DoR C-245 should be filled out by providing the required financial information as specified in the instructions accompanying the form. Make sure to list all necessary data accurately.

What is the purpose of SC DoR C-245?

The purpose of SC DoR C-245 is to collect data relevant to tax compliance and financial reporting from individuals and businesses in South Carolina.

What information must be reported on SC DoR C-245?

The information required on SC DoR C-245 includes financial details such as income, deductions, and other relevant financial activities as specified in the form's instructions.

Fill out your c 245 2015-2019 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

C 245 2015-2019 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.