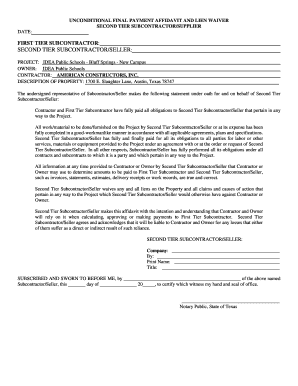

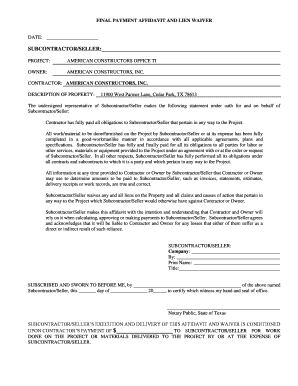

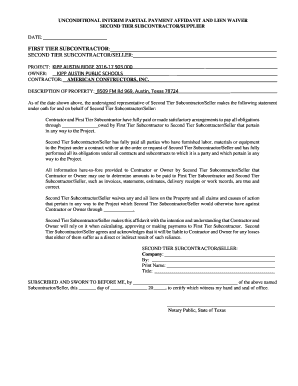

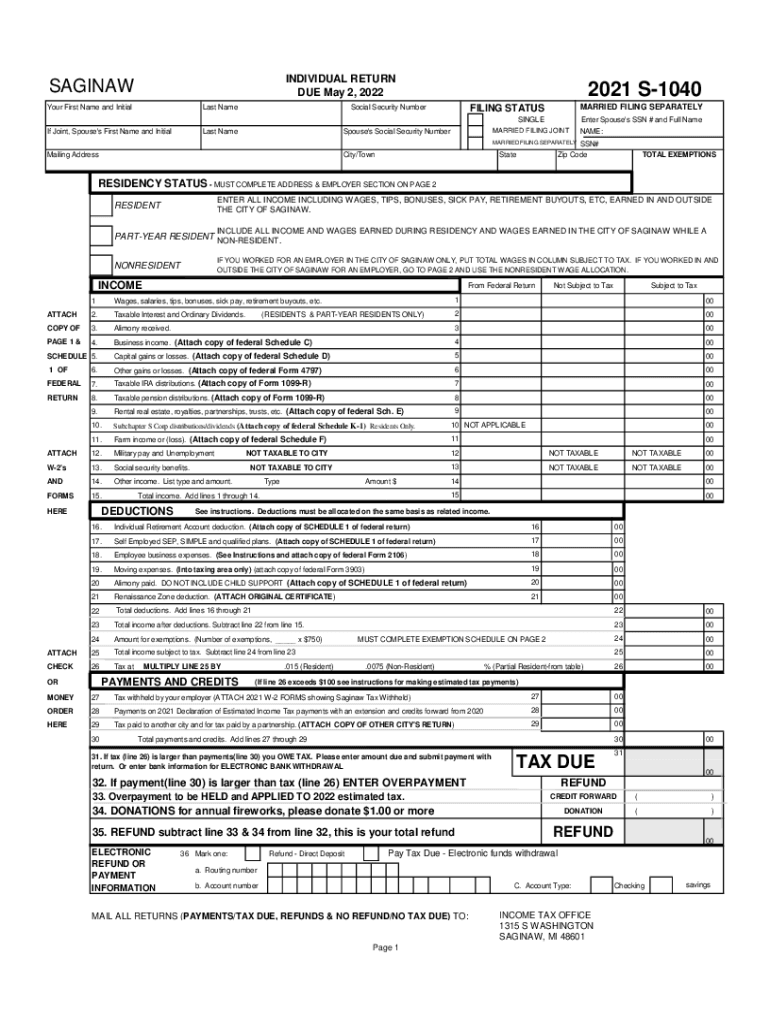

MI S-1040 - Saginaw City 2021 free printable template

Show details

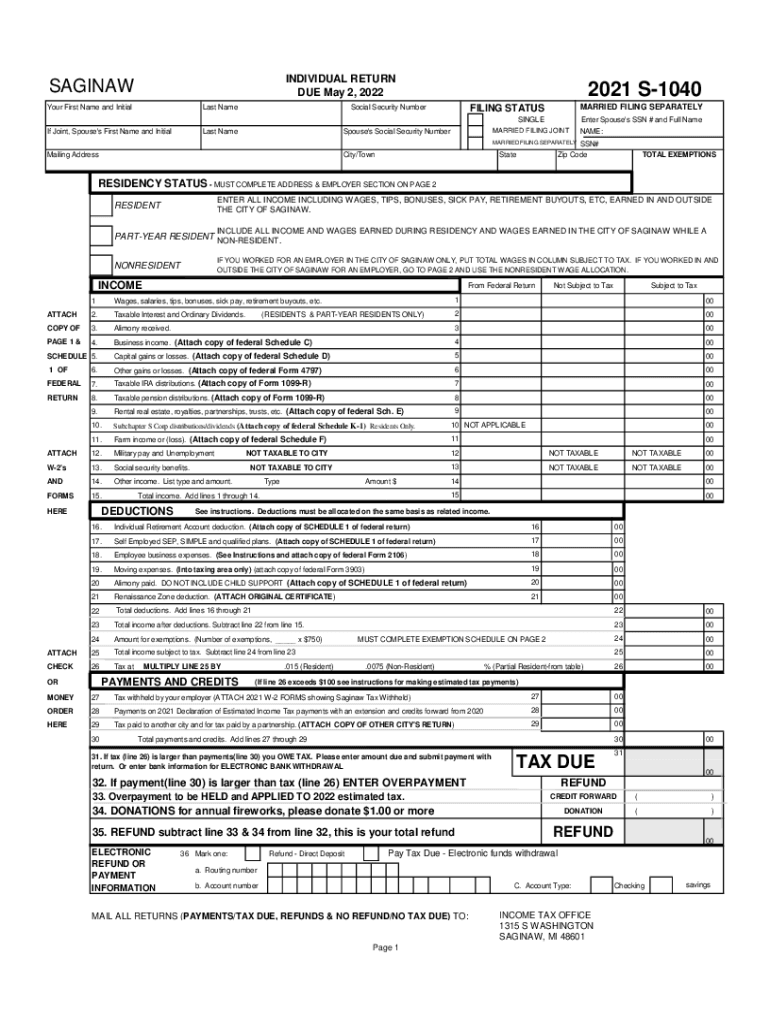

INDIVIDUAL RETURN DUE May 2, 2022SAGINAW Your First Name and Initially Name Joint, Spouse's First Name and Initially Name2021 S1040Social Security NumberMARRIED FILING SEPARATELYFILING STATUS SINGLESpouse's

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI S-1040 - Saginaw City

Edit your MI S-1040 - Saginaw City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI S-1040 - Saginaw City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI S-1040 - Saginaw City online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MI S-1040 - Saginaw City. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI S-1040 - Saginaw City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI S-1040 - Saginaw City

How to fill out MI S-1040 - Saginaw City

01

Gather your personal information, including your Social Security number, and address.

02

Obtain the MI S-1040 forms from the Michigan Department of Treasury website or local tax office.

03

Begin by entering your name and address at the top of the form.

04

Fill out the income section, reporting all applicable income sources.

05

Deduct any eligible tax deductions and credits.

06

Calculate your total tax owed or refund due.

07

Review your completed form for accuracy and ensure all required signatures are included.

08

Submit the form either electronically or via mail to the appropriate tax authority.

Who needs MI S-1040 - Saginaw City?

01

Residents of Saginaw City who earned income during the tax year.

02

Individuals who are required to file a tax return in Michigan.

03

Taxpayers looking to claim local tax credits or deductions specific to Saginaw City.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Michigan tax return if I had no income?

You are required to file a Federal Income Tax return. You must file a Michigan Individual Income Tax return, even if you do not owe Michigan tax.

Who has to pay Michigan state taxes?

Every wage-earning person that lives or works in Michigan pays a flat 4.25% for Michigan state income tax. View more information about Michigan tax rates. In addition, 24 Michigan cities charge their own local income taxes on top of the state income tax rate.

Who has to file an MI-1040?

You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W. For more information on part-year residency view the MI-1040 instruction booklet .

What forms do I need to mail with my 1040?

Attach copies of income forms W-2, 1099, and other income documents to the front of your Form 1040. The IRS address you use depends on where you live and whether you are enclosing a check or expecting a refund. You can find the right IRS mailing address to use here.

What is an MI-1040?

2021 Michigan Individual Income Tax Return MI-1040.

Who is exempt from Michigan income tax?

An additional personal exemption is available if you are the parent of a stillborn child in 2021. The state also provides a $2,800 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind.

Who is exempt from Michigan income tax?

The state also provides a $2,800 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. An additional $400 exemption is available for each disabled veteran in the household.

Who Must file MI-1040?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax. Select the tax year link desired to display the list of forms available to download.

How do I get a copy of 1040 papers?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What is MI-1040 tax form?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

Do I need to file a tax return in Michigan?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

Which people are legally required to file a tax return?

Most U.S. citizens – and permanent residents who work in the United States – need to file a tax return if they make more than a certain amount for the year. You may want to file even if you make less than that amount, because you may get money back if you file.

How do I get my MI-1040?

Commonly used Michigan income tax forms are also available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Do you attach W-2 to Michigan tax return?

Start with your completed U.S. 1040-NR. You will also need any W-2, 1042-S, or 1099 forms that you received for 2020.

What do I send with MI-1040?

If the following forms are filed, all pages must be submitted with a completed MI-1040: Additions and Subtractions (Schedule 1) Nonresident and Part-Year Resident (Schedule NR) Withholding Tax Schedule (Schedule W) - attach a copy if reporting Michigan withholding.

Who must pay Michigan income tax?

The state of Michigan requires you to pay taxes if you're a resident or nonresident that receives income from a Michigan source. The state income tax rate is 4.25%, and the sales tax rate is 6%.

Do you have to file taxes if you earn no income?

Individuals who fall below the minimum may still have to file a tax return under certain circumstances; for instance, if you had $400 in self-employment earnings, you'll have to file and pay self-employment tax. If you have no income, however, you aren't obligated to file.

Who is required to file a Michigan tax return?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax. Select the tax year link desired to display the list of forms available to download.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MI S-1040 - Saginaw City without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like MI S-1040 - Saginaw City, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete MI S-1040 - Saginaw City on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your MI S-1040 - Saginaw City. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Can I edit MI S-1040 - Saginaw City on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as MI S-1040 - Saginaw City. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is MI S-1040 - Saginaw City?

MI S-1040 - Saginaw City is a local income tax form used by residents and non-residents working in Saginaw City, Michigan, to report their income and calculate local tax liabilities.

Who is required to file MI S-1040 - Saginaw City?

Residents of Saginaw City and individuals who earn income from Saginaw City sources, including non-residents, are required to file MI S-1040 - Saginaw City.

How to fill out MI S-1040 - Saginaw City?

To fill out MI S-1040 - Saginaw City, collect all required income information, complete each section accurately including personal information, income, deductions, and tax credits, and then submit the form as per the provided instructions.

What is the purpose of MI S-1040 - Saginaw City?

The purpose of MI S-1040 - Saginaw City is to enable the city to collect income taxes from individuals who live or work in the city, ensuring compliance with local tax regulations.

What information must be reported on MI S-1040 - Saginaw City?

The MI S-1040 - Saginaw City form requires reporting personal identification details, total income earned, applicable deductions, credits, and the total tax liability calculated for the local income tax.

Fill out your MI S-1040 - Saginaw City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI S-1040 - Saginaw City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.