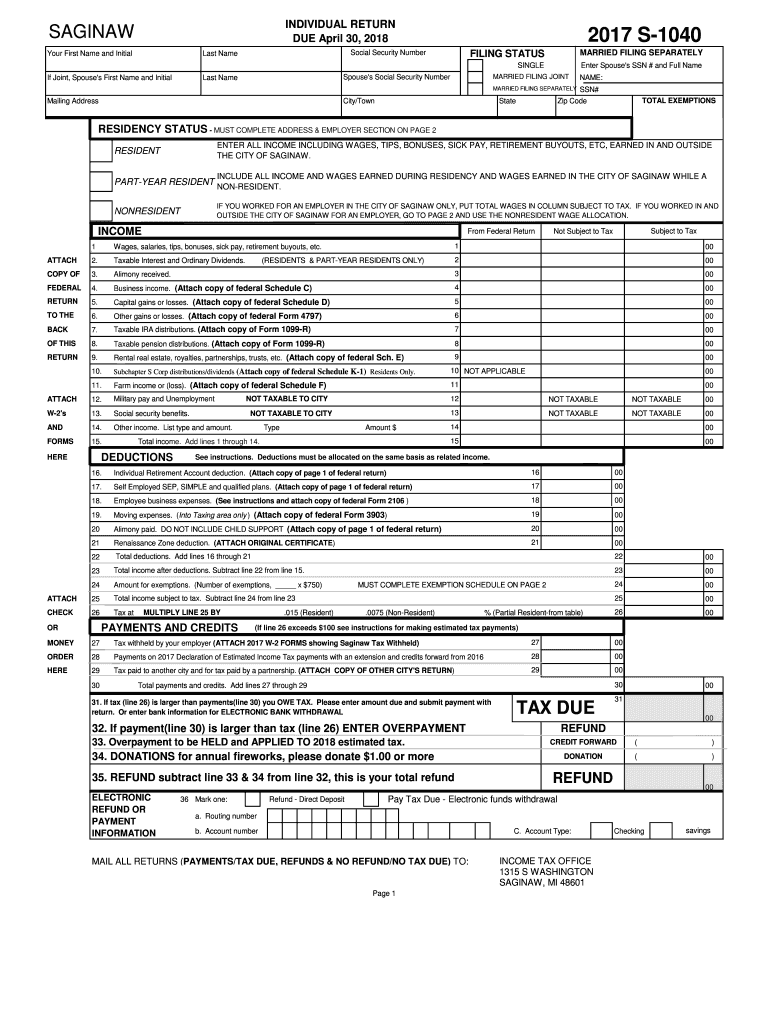

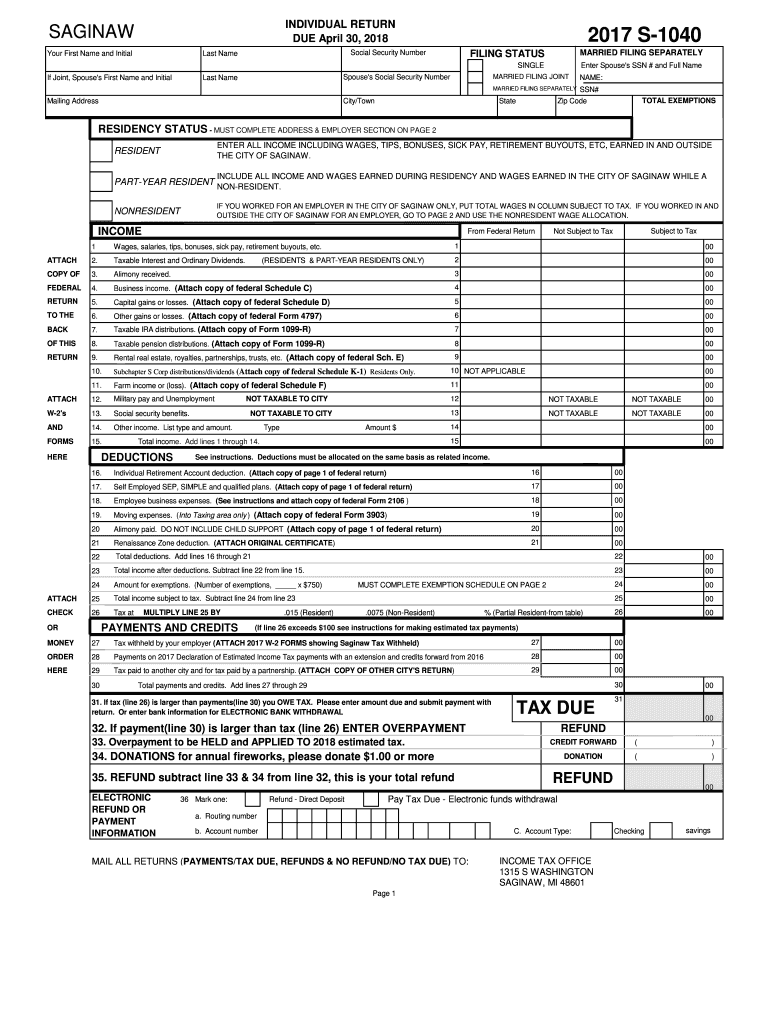

MI S-1040 - Saginaw City 2017 free printable template

Show details

INDIVIDUAL RETURN DUE April 30, 2018SAGINAW Your First Name and Initially Name Joint, Spouse's First Name and Initially Name2017 S1040Social Security NumberMARRIED FILING SEPARATELYFILING STATUS SINGLESpouse's

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI S-1040 - Saginaw City

Edit your MI S-1040 - Saginaw City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI S-1040 - Saginaw City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI S-1040 - Saginaw City online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI S-1040 - Saginaw City. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI S-1040 - Saginaw City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI S-1040 - Saginaw City

How to fill out MI S-1040 - Saginaw City

01

Gather your necessary documents such as W-2s, 1099s, and other income statements.

02

Download the MI S-1040 form from the Michigan Department of Treasury website or obtain a physical copy.

03

Fill out your personal information, including your name, address, and Social Security number.

04

Report your total income in the appropriate sections based on your documents.

05

Calculate any deductions or allowances you may qualify for.

06

Compute your taxable income by subtracting deductions from your total income.

07

Refer to the tax tables provided in the form instructions to determine your tax liability.

08

Complete any additional sections relevant to your situation, such as credits and payments.

09

Review your completed form for accuracy.

10

Sign and date your form before submitting it to the appropriate address.

Who needs MI S-1040 - Saginaw City?

01

Residents of Saginaw City who earned income during the tax year and need to report it for local income tax purposes.

02

Individuals or businesses that have a tax obligation in Saginaw City.

Fill

form

: Try Risk Free

People Also Ask about

Does Michigan have an 8879?

If the Michigan return is transmitted with the federal return, Michigan will accept the federal signature method (Practitioner PIN) as fulfilling the Michigan preparer signature requirement. The preparer may also use a federal Form 8879 to satisfy the signature requirement.

Who has to file an MI-1040?

You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W. For more information on part-year residency view the MI-1040 instruction booklet .

What is the difference between Form 1040 and 1040?

1040-A is longer and a bit more complex, and Form 1040 is the most detailed and challenging of the lot. While anyone can file Form 1040, you must meet certain requirements to use the shorter 1040-EZ or 1040-A forms. Here's a quick rundown to help you choose the correct form for your situation.

Do I need to file a tax return in Michigan?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

Does Michigan have an e file authorization form?

The Michigan Business Tax e-file Authorization MI-8879-MBT is the declaration document and signature authorization for a State Stand Alone (unlinked) return. If you e-file your Michigan return as a Fed/State (linked) return, Michigan will accept the federal signature method.

Who is a liable to pay income tax?

Every person who is carrying on any business or profession whose total sale, turnover, or gross receipts are or is likely to exceed five lakh rupees in any previous year.

Who is exempt from Michigan income tax?

The state also provides a $2,800 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. An additional $400 exemption is available for each disabled veteran in the household.

What is a 1040 form and where do I get it?

Form 1040. The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Do I have to pay Michigan taxes if I live in Ohio?

Residents of reciprocal states working in Michigan, do not have to pay Michigan tax on their salaries or wages earned in Michigan. The following states have a reciprocal agreement with Michigan: Illinois, Indiana, Kentucky, Minnesota, Ohio, and Wisconsin.

What is e-file signature authorization?

The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

Which people are legally required to file a tax return?

Most U.S. citizens – and permanent residents who work in the United States – need to file a tax return if they make more than a certain amount for the year. You may want to file even if you make less than that amount, because you may get money back if you file.

Do I need to file a MI state tax return?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

Can I Efile my Michigan State taxes?

Yes. State Standalone e-file lets you submit your Michigan individual income tax return separately from your federal return. You can even e-file your homestead property tax credit claim, home heating credit claim and/or City of Detroit return separately.

Who must pay Michigan income tax?

The state of Michigan requires you to pay taxes if you're a resident or nonresident that receives income from a Michigan source. The state income tax rate is 4.25%, and the sales tax rate is 6%.

Who is required to file a Michigan tax return?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax. Select the tax year link desired to display the list of forms available to download.

Do I need to file a Michigan tax return if I had no income?

You are required to file a Federal Income Tax return. You must file a Michigan Individual Income Tax return, even if you do not owe Michigan tax.

What is a MI-1040 form?

2021 Michigan Individual Income Tax Return MI-1040.

What is a MI 8453?

Form MI-8453 is the declaration and signature document for a State Stand-Alone (unlinked) return. If you e-file your federal and Michigan returns, Michigan will accept the federal signature (PIN).

Who has to pay Michigan state income tax?

Every wage-earning person that lives or works in Michigan pays a flat 4.25% for Michigan state income tax. View more information about Michigan tax rates. In addition, 24 Michigan cities charge their own local income taxes on top of the state income tax rate.

Who is exempt from Michigan income tax?

An additional personal exemption is available if you are the parent of a stillborn child in 2021. The state also provides a $2,800 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MI S-1040 - Saginaw City directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your MI S-1040 - Saginaw City and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit MI S-1040 - Saginaw City in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your MI S-1040 - Saginaw City, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit MI S-1040 - Saginaw City on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute MI S-1040 - Saginaw City from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is MI S-1040 - Saginaw City?

MI S-1040 is the individual income tax form used by residents of Saginaw City, Michigan, to report their income and calculate their local income tax obligations.

Who is required to file MI S-1040 - Saginaw City?

Residents of Saginaw City who earn taxable income are required to file MI S-1040, regardless of whether they owe tax or are due a refund.

How to fill out MI S-1040 - Saginaw City?

To fill out MI S-1040, taxpayers must provide personal information, report total income, and calculate the local tax due based on the provided instructions and tax tables.

What is the purpose of MI S-1040 - Saginaw City?

The purpose of MI S-1040 is to assess and collect local income taxes from residents of Saginaw City, ensuring compliance with local tax laws.

What information must be reported on MI S-1040 - Saginaw City?

MI S-1040 requires taxpayers to report their names, addresses, Social Security numbers, total income, deductions, and tax credits to calculate the local tax liability.

Fill out your MI S-1040 - Saginaw City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI S-1040 - Saginaw City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.