NY DTF CT-248 2021 free printable template

Show details

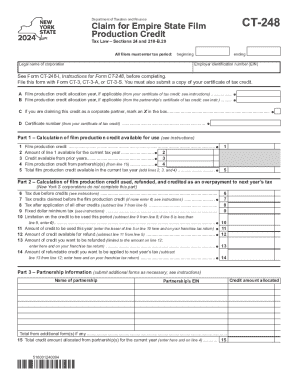

CT248Department of Taxation and FinanceClaim for Empire State Film Production Credit Tax Law Sections 24 and 210B.20All filers must enter tax period:Legal name of corporationbeginningending Employer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF CT-248

Edit your NY DTF CT-248 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF CT-248 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF CT-248 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DTF CT-248. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-248 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF CT-248

How to fill out NY DTF CT-248

01

Obtain a copy of the NY DTF CT-248 form from the New York State Department of Taxation and Finance website.

02

Provide your taxpayer information at the top of the form, including your name, address, and tax identification number.

03

Fill in the appropriate tax year for which you are filing the form.

04

Indicate the type of entity for which the form is being filed (e.g., corporation, partnership, etc.).

05

Complete the income and deduction sections accurately, detailing your entity’s financial activities.

06

Calculate the credits and payments applicable to your situation.

07

Review the form for accuracy, ensuring all calculations are correct.

08

Sign and date the form where indicated.

09

Submit the completed form to the appropriate address as outlined in the instructions.

Who needs NY DTF CT-248?

01

Businesses and entities operating in New York that are seeking to report certain types of income and expenses.

02

Taxpayers who need to claim specific tax credits or deductions for their filings.

03

Corporations, partnerships, and non-profit organizations may need to use the NY DTF CT-248 if they meet the requirements outlined by the New York State Department of Taxation and Finance.

Fill

form

: Try Risk Free

People Also Ask about

What is the New York City Film Production tax credit?

The film tax credit program provides a refundable credit against New York State taxes equal to 25 percent of eligible production costs, such as most of the crew salaries and equipment rental costs, with thresholds for production budgets for both shoots in New York City and outside of the five boroughs.

How do I know if I received the Empire State Child Credit?

Locate the amount on line 63 (Empire State child credit) of your 2021 return. If line 63 is blank, you did not claim this credit and are not eligible for an Empire State child credit payment. Look for the amount on line 19a of your return.

Who claims Empire state Child Credit?

Who is eligible? Filing StatusNY Recomputed Federal Adjusted Gross IncomeMarried filing a joint return$110,000 or lessSingle, or head of household, or qualifying surviving spouse$75,000 or lessMarried filing separately$55,000 or less Mar 24, 2023

What is the Empire State Production credit?

You are entitled to this refundable credit if you or your business: paid or incurred qualified production costs in producing a qualified film or television show in New York State, and. has an allocation certificate issued by the New York State Governor's Office of Motion Picture & Television Development.

Who claims advance Child Tax Credit?

Nearly all families with children qualify. Families will get the full amount of the Child Tax Credit if they make less than $150,000 (two parents) or $112,500 (single parent). There is no minimum income, so families who had little or no income in the past two years and have not filed taxes are eligible.

How do I know if I got the Empire State child credit?

Locate the amount on line 63 (Empire State child credit) of your 2021 return. If line 63 is blank, you did not claim this credit and are not eligible for an Empire State child credit payment. Look for the amount on line 19a of your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF CT-248 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your NY DTF CT-248 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send NY DTF CT-248 to be eSigned by others?

Once you are ready to share your NY DTF CT-248, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the NY DTF CT-248 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your NY DTF CT-248 in seconds.

What is NY DTF CT-248?

NY DTF CT-248 is a form used by certain taxpayers to report and document various tax credits and exemptions as part of their tax filings in the state of New York.

Who is required to file NY DTF CT-248?

Taxpayers who claim certain tax credits and exemptions in New York State, specifically those related to corporation taxes, are required to file NY DTF CT-248.

How to fill out NY DTF CT-248?

To fill out NY DTF CT-248, someone must provide details about the taxpayer's business, the specific credits being claimed, and any relevant financial data. It's essential to follow the guidelines provided in the form instructions carefully.

What is the purpose of NY DTF CT-248?

The purpose of NY DTF CT-248 is to allow taxpayers to claim eligible credits and exemptions, ensuring correct tax calculations and compliance with New York State tax laws.

What information must be reported on NY DTF CT-248?

Information that must be reported on NY DTF CT-248 includes the taxpayer's identification details, the type of credit being claimed, the amount of the credit, and any other relevant financial information required by the form.

Fill out your NY DTF CT-248 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF CT-248 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.