NY DTF CT-248 2015 free printable template

Show details

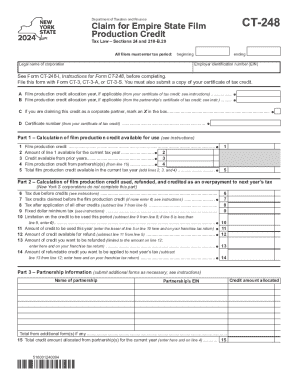

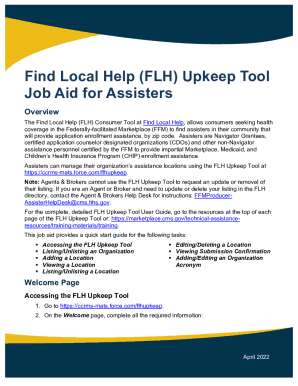

20 All filers must enter tax period Legal name of corporation beginning ending Employer identification number EIN See Form CT-248-I Instructions for Form CT-248 before completing. CT-248 Department of Taxation and Finance Claim for Empire State Film Production Credit Tax Law Article 1 Section 24 and Article 9-A Section 210-B. Attach to Form CT-3 CT-3-A or CT-3-S* You must also attach a copy of your certificate of tax credit. A Film production credit allocation year if applicable from your...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF CT-248

Edit your NY DTF CT-248 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF CT-248 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF CT-248 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY DTF CT-248. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-248 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF CT-248

How to fill out NY DTF CT-248

01

Obtain Form CT-248 from the New York Department of Taxation and Finance website or through your tax office.

02

Fill in your personal information, including your name, address, and identification number.

03

Indicate the tax year for which you are filing the CT-248.

04

Provide details regarding your income and any deductions you wish to claim.

05

Calculate your total taxable income and the corresponding taxes due.

06

Review the instructions for any additional forms or schedules that may need to be included.

07

Sign and date the form, ensuring that all information is accurate and complete.

08

Submit the completed CT-248 by mailing it to the address specified in the instructions or filing it electronically if applicable.

Who needs NY DTF CT-248?

01

Individuals or businesses that are required to report their income and taxes owed to New York State.

02

Taxpayers claiming certain tax credits or exemptions on their filings.

03

Anyone participating in specific business activities that require disclosure under New York law.

Fill

form

: Try Risk Free

People Also Ask about

What is the New York City Film Production tax credit?

The film tax credit program provides a refundable credit against New York State taxes equal to 25 percent of eligible production costs, such as most of the crew salaries and equipment rental costs, with thresholds for production budgets for both shoots in New York City and outside of the five boroughs.

How do I know if I received the Empire State Child Credit?

Locate the amount on line 63 (Empire State child credit) of your 2021 return. If line 63 is blank, you did not claim this credit and are not eligible for an Empire State child credit payment. Look for the amount on line 19a of your return.

Who claims Empire state Child Credit?

Who is eligible? Filing StatusNY Recomputed Federal Adjusted Gross IncomeMarried filing a joint return$110,000 or lessSingle, or head of household, or qualifying surviving spouse$75,000 or lessMarried filing separately$55,000 or less Mar 24, 2023

What is the Empire State Production credit?

You are entitled to this refundable credit if you or your business: paid or incurred qualified production costs in producing a qualified film or television show in New York State, and. has an allocation certificate issued by the New York State Governor's Office of Motion Picture & Television Development.

Who claims advance Child Tax Credit?

Nearly all families with children qualify. Families will get the full amount of the Child Tax Credit if they make less than $150,000 (two parents) or $112,500 (single parent). There is no minimum income, so families who had little or no income in the past two years and have not filed taxes are eligible.

How do I know if I got the Empire State child credit?

Locate the amount on line 63 (Empire State child credit) of your 2021 return. If line 63 is blank, you did not claim this credit and are not eligible for an Empire State child credit payment. Look for the amount on line 19a of your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY DTF CT-248 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NY DTF CT-248 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send NY DTF CT-248 for eSignature?

NY DTF CT-248 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the NY DTF CT-248 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your NY DTF CT-248 in seconds.

What is NY DTF CT-248?

NY DTF CT-248 is a form used by taxpayers in New York State to report income from a partnership or an S corporation and to claim a credit for taxes paid to other jurisdictions.

Who is required to file NY DTF CT-248?

Taxpayers who receive income from a partnership or S corporation that operates in New York and who want to claim a credit for taxes paid to other states must file NY DTF CT-248.

How to fill out NY DTF CT-248?

To fill out NY DTF CT-248, taxpayers need to provide their personal and entity information, details of income received, and any applicable tax credits for taxes paid to other jurisdictions as indicated on the form.

What is the purpose of NY DTF CT-248?

The purpose of NY DTF CT-248 is to ensure the proper reporting of income earned from partnerships or S corporations and to allow taxpayers to claim appropriate credits for taxes paid to other states.

What information must be reported on NY DTF CT-248?

The information that must be reported on NY DTF CT-248 includes the taxpayer's identification information, partnership or S corporation details, total income received, and the amount of taxes paid to other jurisdictions.

Fill out your NY DTF CT-248 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF CT-248 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.