NY DTF NYC-210-I 2021 free printable template

Show details

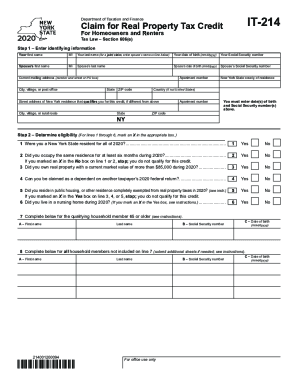

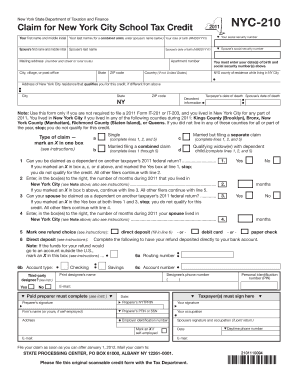

Department of Taxation and FinanceInstructions for Form NYC210NYC210IClaim for New York City School Tax Credit

Did you know? You may choose direct deposit of all or part

of your New York State personal

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nyc 210 form 2021

Edit your nyc 210 form 2021 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyc 210 form 2021 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nyc 210 form 2021 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nyc 210 form 2021. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF NYC-210-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nyc 210 form 2021

How to fill out NY DTF NYC-210-I

01

Gather all necessary documents, including your income information and tax forms.

02

Download the NY DTF NYC-210-I form from the New York State Department of Taxation and Finance website.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Report your total income for the year in the appropriate section.

05

Enter any deductions or credits that apply to you.

06

Calculate your total tax liability based on the provided guidelines.

07

Review the completed form for accuracy.

08

Submit the form along with any required attachments to the appropriate tax authority.

Who needs NY DTF NYC-210-I?

01

Individuals who earned income in New York City and need to report their tax liability.

02

Residents and non-residents who have to file taxes related to their income earned in NYC.

03

Taxpayers looking to claim deductions or credits available for New York City taxes.

Instructions and Help about nyc 210 form 2021

Fill

form

: Try Risk Free

People Also Ask about

What is form IT-203 New York?

New York Resident, Nonresident, and Part-Year Resident Itemized Deductions. Used by nonresident and part-year resident (Form IT-203) filers who need to report other New York State or New York City taxes, and tax credits other than those reported directly on Form IT-203.

Who can claim NYC 208?

The New York City enhanced real property tax credit may be available to New York City residents who have household gross income of less than $200,000, and pay real property taxes or rent for their residences, or both. The credit can be as much as $500.

What is a NYC 210 tax form?

Form NYC-210, Claim for New York City School Tax Credit.

Who is eligible for NYC enhanced real property tax credit?

New York City residents who have gross household income less than $200,000 and own or rent their residence may qualify for a refundable tax credit on their New York State income tax.

What is form IT-201 used for?

Form IT-201 is the standard New York income tax return for state residents. Nonresidents and part-time residents must use must use Form IT-203 instead. Form IT-201 requires you to list multiple forms of income, such as wages, interest, or alimony .

Do I qualify for NYC school tax credit?

To be eligible, you must have: qualified for a 2022 STAR credit or exemption, had income that was less than or equal to $250,000 for the 2020 income tax year, and. a school tax liability for the 2022-2023 school year that is more than your 2022 STAR benefit.

What is tax form NYC-210?

Form NYC-210, Claim for New York City School Tax Credit.

Who gets the NYC school tax credit?

You can use the check to pay your school taxes. You can receive the STAR credit if you own your home and it's your primary residence and the combined income of the owners and the owners' spouses is $500,000 or less. STAR exemption: a reduction on your school tax bill.

On what line of the IT-201 is the taxable income?

Net taxable income is the income reported on line 37 of your 2015 IT-201 Tax Form.

Who is eligible for the NYC School tax credit?

New York City school tax credit (fixed amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had income of $250,000 or less.

How do I claim my NYC school tax credit?

How to claim the credit. If you file a New York State personal income tax return, claim this credit on your return by filing Form NYC-208 with your return. If you are not required to file a New York State income tax return, you may still claim this credit.

How much is the NYC school tax credit Rate Reduction amount?

NYC school tax credit - rate reduction amount Calculation of NYC school tax credit (rate reduction amount) for single and married filing separatelyIf city taxable income is: over but not overThe credit is:$ 0 $ 12,000 12,000 500,000.171% of taxable income $ 21 plus .228% of the excess over $12,000 Mar 3, 2021

Who is eligible for the NYS Property Tax Relief credit?

You may be eligible for STAR if your home is your primary residence, you own it, and your income is less than $500,000. To confirm your eligibility, you must register for the STAR credit.

What is NY it 201 form?

Form IT-201, Resident Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nyc 210 form 2021 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your nyc 210 form 2021 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send nyc 210 form 2021 for eSignature?

When your nyc 210 form 2021 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out nyc 210 form 2021 on an Android device?

On Android, use the pdfFiller mobile app to finish your nyc 210 form 2021. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is NY DTF NYC-210-I?

NY DTF NYC-210-I is a form used by taxpayers in New York to report the New York City Unincorporated Business Tax.

Who is required to file NY DTF NYC-210-I?

Individuals and entities engaged in unincorporated business activities in New York City, and whose gross income exceeds the filing threshold, are required to file NY DTF NYC-210-I.

How to fill out NY DTF NYC-210-I?

To fill out NY DTF NYC-210-I, start by providing your identifying information, including your name and address. Then, report your unincorporated business income and various deductions, and calculate your tax liability as per the instructions on the form.

What is the purpose of NY DTF NYC-210-I?

The purpose of NY DTF NYC-210-I is to assess and collect taxes on income earned from unincorporated business activities within New York City.

What information must be reported on NY DTF NYC-210-I?

The information required includes the taxpayer's name, address, tax identification number, details of unincorporated business income, any relevant deductions, and calculations for the tax owed.

Fill out your nyc 210 form 2021 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyc 210 Form 2021 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.