NY DTF NYC-210-I 2012 free printable template

Show details

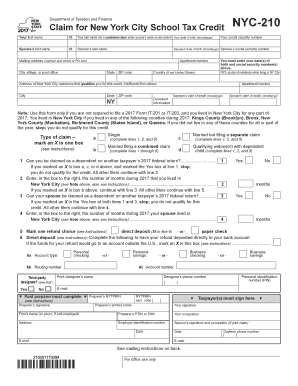

Purpose of form If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2012 use Form NYC-210 to claim your NYC school tax credit. File your Form NYC-210 as soon as you can after January 1 2013. You must file your 2012 claim no later than April 15 2016. New York State Department of Taxation and Finance Instructions for Form NYC-210 NYC-210-I Claim for New York City School Tax Credit General information Who qualifies To claim the New York City...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2012 form school tax

Edit your 2012 form school tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 form school tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 form school tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012 form school tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF NYC-210-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2012 form school tax

How to fill out NY DTF NYC-210-I

01

Obtain a copy of the NY DTF NYC-210-I form from the New York State Department of Taxation and Finance website.

02

Ensure you are eligible for filling out this form; it is typically for individuals who have claimed NYC tax credits.

03

Fill in your personal information at the top of the form, including your name, address, and taxpayer identification number.

04

Follow each section of the form step by step, providing the necessary information regarding your NYC income and tax credits.

05

Review your entries for accuracy, ensuring all figures and calculations are correct.

06

Sign and date the form before submitting it either electronically or by mail, as instructed.

Who needs NY DTF NYC-210-I?

01

Individuals who reside in or earn income in New York City and are eligible for specific tax credits or exemptions.

02

Taxpayers seeking to claim refunds or adjustments related to their NYC income taxes.

03

Any individual who has received a notice from the New York State tax authority regarding this form.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 8917 for 2012?

Use Form 8917 to figure and take the deduction for tuition and fees expenses paid in 2012. This deduction is based on adjusted qualified education expenses paid to an eligible postsecondary educational institution. See Qualified Education Expenses, later, for more information.

How do I get the full $2500 American Opportunity Credit?

To be eligible for AOTC, the student must: Be pursuing a degree or other recognized education credential. Be enrolled at least half time for at least one academic period* beginning in the tax year. Not have finished the first four years of higher education at the beginning of the tax year.

Is the maximum American Opportunity Tax Credit $2500 per student per year?

American Opportunity Tax Credit Qualifying Expenses Amount$2,500 tax credit per student (100% first $2,000, 25% second $2,000) 40% refundable (up to $1,000)Eligible ExpensesTuition, Fees, Course MaterialsEligible StudentsEnrolled at least half-time, seeking a degree or certificate, no felony drug convictions2 more rows

What is American Opportunity Credit up to $2,500 per student?

The American Opportunity Tax Credit (AOTC) is a tax credit for qualified education expenses associated with the first four years of a student's postsecondary education. The maximum annual credit is $2,500 per eligible student.

How do I claim education credit without 1098-T?

For most taxpayers, you need to receive Form 1098-T in order to claim the American Opportunity Credit or Lifetime Learning Credit. What if I don't have a 1098-T? If you don't have a 1098-T but you know the amount of tuition paid to the college you can enter that amount on the Additional Tuition Expenses screen.

What is the education tax credit for 2012?

You may be able to take a credit of up to $2,500 for adjusted qualified education expenses (defined later) paid for each student who qualifies for the American opportunity credit. This credit equals 100% of the first $2,000 and 25% of the next $2,000 of adjusted qualified expenses paid for each eligible student.

How do I claim education credit on Form 1040?

Where do I put the amount of my education tax credit on my tax return? A15. To claim the American opportunity credit complete Form 8863 and submitting it with your Form 1040 or 1040-SR. Enter the nonrefundable part of the credit on Schedule 3 (Form 1040 or 1040-SR), line 3.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2012 form school tax directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 2012 form school tax along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get 2012 form school tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 2012 form school tax in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out 2012 form school tax using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 2012 form school tax and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NY DTF NYC-210-I?

NY DTF NYC-210-I is a form used by certain taxpayers in New York to report their income and claim a credit for taxes paid on personal income.

Who is required to file NY DTF NYC-210-I?

Taxpayers who are claiming a credit for taxes paid to other jurisdictions must file NY DTF NYC-210-I.

How to fill out NY DTF NYC-210-I?

To fill out NY DTF NYC-210-I, you should gather your income information, details of taxes paid to other jurisdictions, and complete the form following the provided instructions, ensuring to calculate any credits accurately.

What is the purpose of NY DTF NYC-210-I?

The purpose of NY DTF NYC-210-I is to allow taxpayers to claim a credit for taxes they have paid to other states or localities while filing their New York personal income tax.

What information must be reported on NY DTF NYC-210-I?

The form requires reporting your personal identification details, income earned, taxes paid to other jurisdictions, and calculations for any refundable or nonrefundable credits.

Fill out your 2012 form school tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Form School Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.