IRS 1099-R 2022 free printable template

Show details

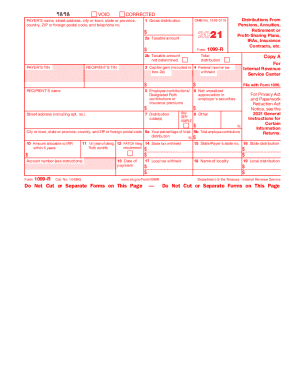

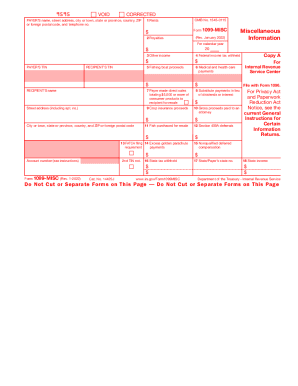

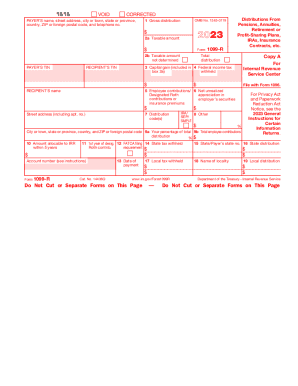

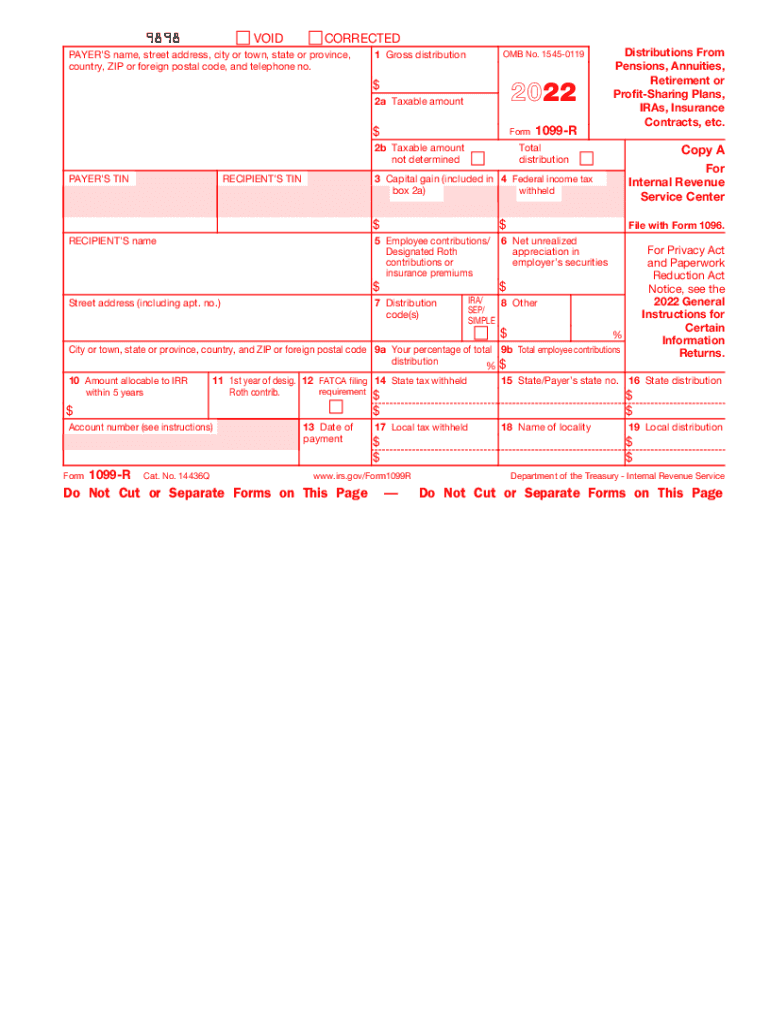

721 U.S. Civil Service Retirement Benefits Pub. 939 General Rule for Pensions and Annuities Pub. 969 HSAs and Other Tax-Favored Health Plans For Payer Copy D To complete Form 1099-R use The 2018 Instructions for Forms 1099-R and 5498. 1220. The IRS does not provide a fill-in form option for Copy A. Need help If you have questions about reporting on Form 1099-R call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. Code s Street address...including apt. no. Copy A File with Form 1096. 5 Employee contributions/ RECIPIENT S name 1099-R Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. IRA/ SEP/ SIMPLE 8 Other City or town state or province country and ZIP or foreign postal code 9a Your percentage of total 10 Amount allocable to IRR within 5 years 11 1st year of desig. 14 State distribution 15 Local tax withheld 16 Name of locality 17 Local distribution www.irs.gov/Form1099R Do Not Cut or Separate...Forms on This Page 9b Total employee contributions Department of the Treasury - Internal Revenue Service State City or Local Tax Department Copy 1 CORRECTED if checked This information is being furnished to the IRS. Report this income on your federal tax return. If this form shows tax withheld in box 4 attach this copy to your return. Copy B Generally distributions from retirement plans IRAs qualified plans section 403 b plans and governmental section 457 b plans insurance contracts etc. are...reported to recipients on Form 1099-R. Qualified plans and section 403 b plans. Attention Copy A of this form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not. Do not print and file copy A downloaded from this website a penalty may be imposed for filing with the IRS information return forms that can t be scanned*...See part O in the current General Instructions for Certain Information Returns available at www*irs*gov/form1099 for more information about penalties. Please note that Copy B and other copies of this form which appear in black may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. To order official IRS information returns which include a scannable Copy A for filing with the IRS and all other applicable copies of the form visit www....IRS*gov/orderforms. Click on Employer and Information Returns and we ll mail you the forms you request and their instructions as well as any publications you may order. Electronically FIRE system visit www. IRS*gov/FIRE or the IRS Affordable Care Act See IRS Publications 1141 1167 and 1179 for more information about printing these tax forms. VOID CORRECTED OMB No* 1545-0119 1 Gross distribution PAYER S name street address city or town state or province country ZIP or foreign postal code and...phone no. 2a Taxable amount Form not determined PAYER S TIN Total distribution 3 Capital gain included in box 2a RECIPIENT S TIN 4 Federal income tax withheld Internal Revenue Service Center 6 Net unrealized appreciation in employer s securities Designated Roth contributions or insurance premiums For Privacy Act and Paperwork Reduction Act Notice see the 2018 General Certain Information Returns.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-R

How to edit IRS 1099-R

How to fill out IRS 1099-R

Instructions and Help about IRS 1099-R

How to edit IRS 1099-R

To edit IRS Form 1099-R, begin by obtaining a blank copy of the form. You can use tools such as pdfFiller to make edits directly. Enter the necessary information into the designated fields, ensuring compatibility with IRS guidelines. After making the required changes, print the revised form for submission or storage.

How to fill out IRS 1099-R

Follow these steps to fill out IRS Form 1099-R:

01

Obtain Form 1099-R from the IRS website or other authorized sources.

02

Indicate the payer’s name, address, and taxpayer identification number (TIN) in the appropriate sections.

03

Provide recipient information, including the recipient's name, address, and TIN.

04

Complete Box 1 with the gross distribution amount and Box 2a with the taxable amount.

05

Fill out other relevant boxes, such as federal income tax withheld and distribution codes.

About IRS 1099-R 2022 previous version

What is IRS 1099-R?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-R 2022 previous version

What is IRS 1099-R?

IRS Form 1099-R is a tax document used to report distributions from pensions, annuities, retirement plans, and other financial instruments. This form is essential for both the payer and the recipient, ensuring proper reporting of income for tax purposes. Recipients must include this information when filing their annual tax returns.

What is the purpose of this form?

The primary purpose of IRS Form 1099-R is to provide the IRS with details about distributions made from retirement accounts or other sources. By receiving this form, taxpayers are notified of the income they must report for the tax year. Additionally, it helps verify reported income during audits or tax assessments.

Who needs the form?

Payers are required to issue IRS Form 1099-R to any recipient who receives taxable distributions from retirement plans, such as traditional IRAs, pensions, or annuities. This includes distributions made due to retirement, disability, or other qualifying events. Recipients who have received such distributions should receive their copy by January 31 of the year following the distribution.

When am I exempt from filling out this form?

You may be exempt from receiving or issuing Form 1099-R if certain criteria are met. For example, if the distribution is made directly to a qualified charity, it may not require reporting. Other exemptions can include distributions below a certain threshold, or in cases where the payer is not required by IRS regulations to issue the form.

Components of the form

IRS Form 1099-R is divided into several boxes, each designated for specific information:

01

Box 1: Gross distribution amount.

02

Box 2a: Taxable amount of the distribution.

03

Box 4: Federal income tax withheld.

04

Box 7: Distribution code indicating the type of distribution.

Each box must be filled accurately to avoid discrepancies with the IRS. Familiarizing yourself with these components is crucial for correct reporting.

What are the penalties for not issuing the form?

Payers who fail to issue IRS Form 1099-R may face penalties imposed by the IRS. The penalty varies depending on how late the form is filed and can range from $50 to $270 per form, with a maximum that may apply. Additionally, failure to provide accurate information can lead to further penalties and complications during tax audits.

What information do you need when you file the form?

When filing IRS Form 1099-R, you need the recipient's personal information, including their name, address, and TIN. You also need to gather details about the distribution amount, tax withheld, and the type of distribution being reported. Ensuring that all information is accurate and complete is essential to comply with IRS requirements.

Is the form accompanied by other forms?

IRS Form 1099-R may need to be filed along with other forms, depending on the specifics of the distribution and the recipient's tax situation. For instance, if you are reporting a rollover or a transfer, additional documentation may be necessary to provide a comprehensive picture of the taxpayer's financial activity.

Where do I send the form?

IRS Form 1099-R must be sent to the IRS by mail or electronically, depending on the total number of forms filed. If mailing, use the appropriate IRS address for your location. Recipients should also receive their copy of the form by the end of January following the tax year in which the distribution occurred.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

i love pdf filler but there are times when it won't save like now and I have to redo my whole document.

Great tool. Much more professional than filling forms by hand and then scanning.

See what our users say